Insight Focus

- Mexican sugar production impacted by lack of rainfall for second year.

- More sugar is being imported to meet local demand.

- Export to the US continue.

El Niño Effect on Mexico

2023 is an El Niño year. El Niño is a weather event that occurs in periods of 2-5 years, and happens when the surface waters in the eastern Pacific become warmer.

These changes affect each region and country differently. During El Niño, Mexico experiences more rain during the winter, followed by an arid summer. A summer drought could adversely affect cane development in Mexico as the crop needs rainfall through the middle of the year to grow and mature fully. The lack of rain has led to lower yields as more than 60% of Mexican cane is not irrigated.

Mexico Back-to-Back Poor Sugar Harvest?

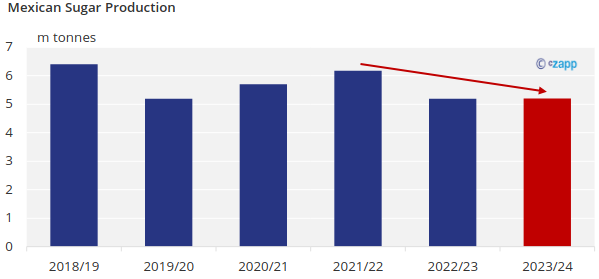

Mexico is currently experiencing a second consecutive poor cane crop due to El Niño. During the 2021-22 season, Mexico produced 6.2m tonnes of sugar. Then, last year, Mexican production decreased by almost a million tonnes to 5.2m tonnes. Any optimism for a crop recovery for the 2023-24 has dwindled. Our current forecast for the 2023-24 forecast is 5.2m tonnes.

Why is Mexico Importing Sugar?

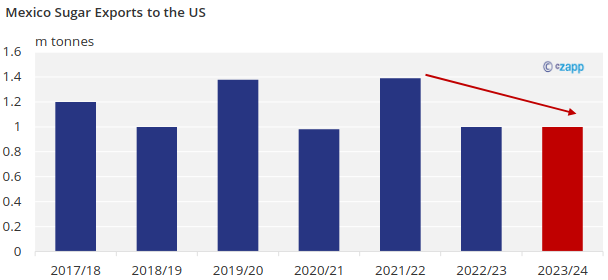

Mexico is the United States’ largest sugar trade partner. Mexico usually exports around 1.35m tonnes of sugar to the United States (70% raw vs. 30% white). Last year, Mexico could only export 1m tonnes due to the drought. We project Mexico to ship the same amount of sugar to the United States this following season.

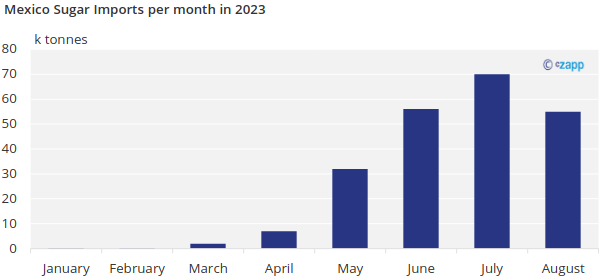

Mexico has imported sugar to satisfy its local sugar demand and still have enough sugar to export to the United States. Since January, Mexico has imported around 225k tonnes of sugar.

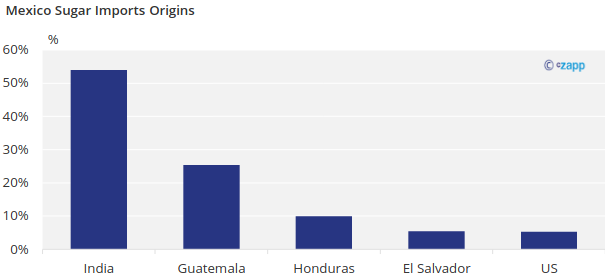

Most of the sugar that Mexico has imported came from India and Central America (primarily Guatemala).

For Mexico to continue to satisfy its local demand, export to the United States, and export to the world market under the IMMEX program, we expect it to continue importing sugar for the rest of the year. Imports for 2024 could reach 200k tonnes.