Insight Focus

- USDA numbers cause a wheat price collapse.

- El Nino keeps the Southern hemisphere harvest in focus.

- Interesting reports from the Black Sea.

Introduction

Global wheat prices were dealt a blow by the United States Department of Agriculture (USDA) in their surprise quarterly stocks and production numbers last week.

However, considering the weather in Argentina and Australia, together with wheat export stories around the Black Sea, market moves may remain unpredictable in the weeks ahead.

The World’s Wheat Markets

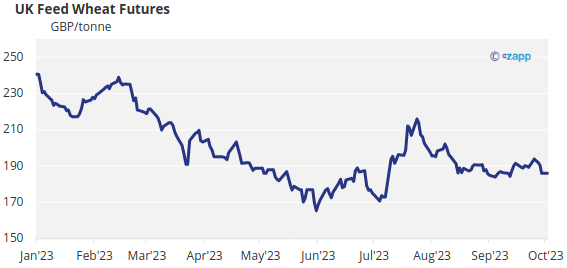

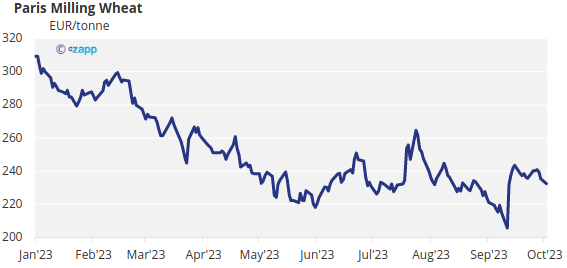

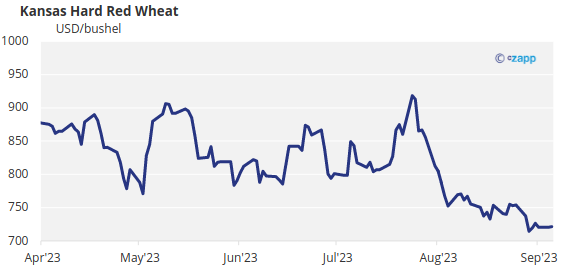

The wheat market’s most recent peak towards the end of July, has been followed by a steady decline, keeping the bear market in control; as seen in the charts below.

A recent attempt at a rally was stamped out last week following the release of the USDA report.

The United States Department of Agriculture Report

The end of September saw the end of another quarter and the publishing of the latest USDA report on US stocks and production.

Wheat stocks were 1.780 billion bushels, higher than the pre-report trade estimates of 1.772bbu.

However, more surprising were the US harvest 2023 numbers, with total wheat production pegged at 1.812bbu, above average estimates of 1.729bbu. Particularly notable were also the other spring wheat figure of 0.505bbu, way above the 0.446bbu estimates.

All of these numbers pressured the market prices as they closed for the week, month and quarter end.

Southern Hemisphere Harvests

With the Northern Hemisphere winter wheat harvests now safely in store, attention turns to the growing wheat crops in the major Southern Hemisphere exporters of Argentina and Australia.

These plants still have critical growth stages to complete prior to harvest and ongoing dryness concern in Argentina is not encouraging farmers to sell much wheat for now.

Australia is also experiencing dry conditions with El Nino weather worries. Crops, still far from maturity, are in need of rain and only time will tell how much and when it may arrive. In the meantime, production numbers are unpredictable and could rise or fall as their weather needs fluctuate.

The Black Sea

Ukraine

The resourcefulness and resilience of Ukraine is once again being shown as they ignore Russia’s withdrawal from the Black Sea grain corridor agreement.

Since Russia’s withdrawal from the agreement, on 17 July, Ukraine has been pursuing a new ‘humanitarian’ corridor for grain shipments.

As the first vessels safely navigate this route and Ukraine continues its military harassing of Russia’s Black Sea fleet, there are positive signs that grains will find their way from Ukraine to the big importers of Africa, the Middle East and Asia in the months ahead.

Conclusions

- As we head into the final quarter of 2023 weather will continue to disrupt the markets.

- Wheat crop estimates, whether from the USDA or others, will no doubt provide a few surprises to add into the mix.

- Ukraine will resolutely continue its quests to export larger and larger volumes of grain to the importers in need.

- Whatever the next story, this does not look like a settled market which will just bumble along the lows recently seen.

- Volatility for prices is almost inevitable and wheat markets will have to wait another day for balance and stability.