Insight Focus

- From rail to feeder services, trucking, warehousing and ports, there are a lot of steps in the supply chain.

- In order to gain greater control over supply chains, container operators are increasingly moving inland by snapping up terminals, ports and rail services.

- This diversification away from just ocean freight could help box carriers manage weak freight rates.

Freight Falls, Costs Rise

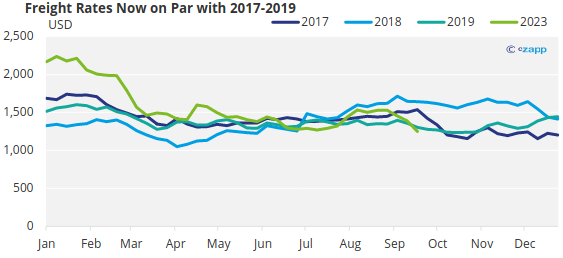

Freight rates continue to flounder. Despite efforts to blank sailings to restrict supply, it looks like rates are no closer to finding a floor.

Source: Freightos

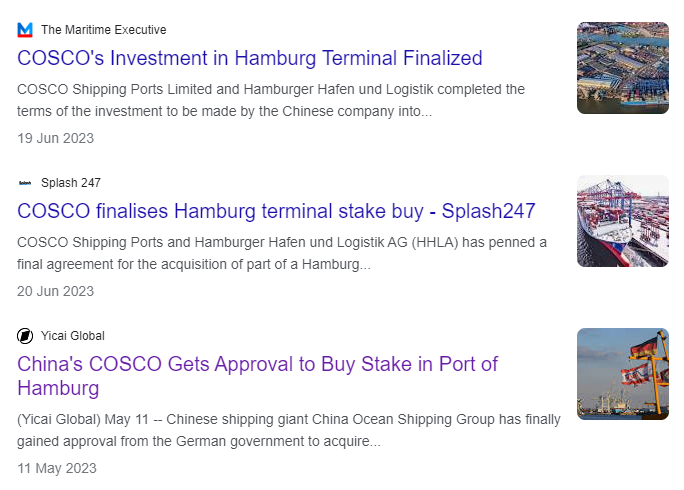

In this environment, it is wise for container operators to try to gain greater control over supply chains so that they can exercise more financial discipline and create efficiencies. Recently, despite some security concerns, Chinese shipping giant COSCO secured an almost 25% stake in a container terminal in the port of Hamburg.

But this is just the latest move over at least a decade that sees container operators gaining greater control over port and inland infrastructure.

COSCO Expands to Hamburg

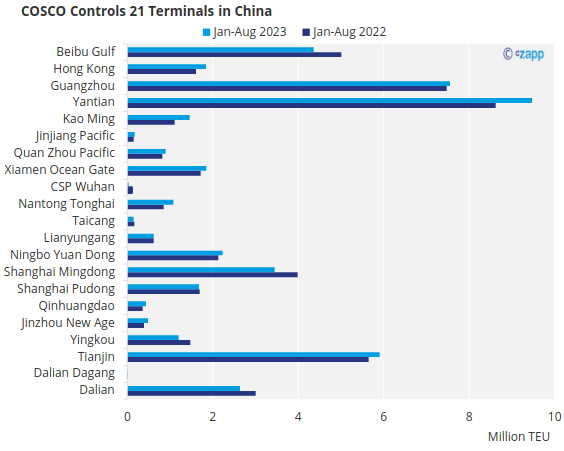

Before it acquired its 24.99% share in Hamburg’s Tollerort Terminal (CTT), COSCO had already made inroads with its port and terminal infrastructure. Within China, the shipping company has direct and indirect interests in 21 container terminals.

Source: COSCO Shipping

And outside of China, Hamburg is not the first port in which COSCO has invested. With most of its attention focused on Europe, one of its biggest successes has been the port of Piraeus in Athens, Greece.

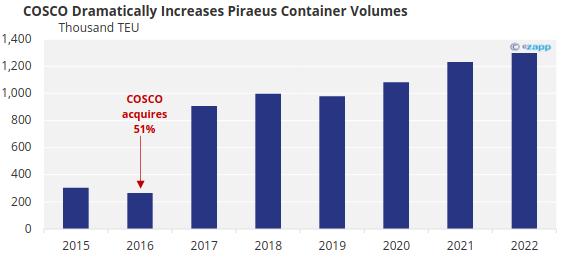

After taking a controlling 51% stake in the port in 2016, COSCO dramatically increased its performance and throughput.

Source: Piraeus Port Authority

Not only has COSCO bet on port infrastructure, but it is also looking more inland to the European rail network. Its subsidiary OceanRail Logistics, established in 2017, used COSCO’s Piraeus base to create a freight network through Eastern Europe, which in turn connects central Europe to the west with the Far East.

In 2019, OceanRail also acquired a 60% stake in Greek rail company Piraeus Europe Asia Rail Logistics (PEARL).

MSC Follows COSCO

MSC, the largest container company in the world in terms of TEU, also holds stakes in several terminals.

But recently, the company has also been eyeing the port of Hamburg but has more ambitious plans to purchase a share of the port itself. A proposed deal would see MSC control 49% of the port, while the city of Hamburg would retain the controlling share of 51%.

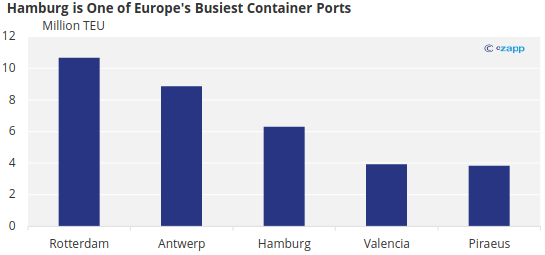

MSC, through the Terminal Investments Limited Group, already controls over 70 container terminals in 31 countries around the world. But Hamburg is Europe’s third-busiest freight port in terms of throughput.

MSC is also looking more at inland logistics. In a much-reported deal, MSC acquired multimodal logistics operator Africa Global Logistics from Bolloré late last year, giving it a competitive edge across Africa.

MSC has also expanded into air cargo with the acquisition of Italian company AlisCargo Airlines, which will be finalized next year.

CMA CGM Bet on Americas, Africa

CMA CGM operates a huge number of terminals through its Terminal Link subsidiary, created in 2001. Right now, CMA CGM holds a controlling 51% stake in the company, while China Merchants Port Holdings Company Limited holds the remaining 49%.

CMA Terminals is another subsidiary, this time fully owned by CMA CGM. It was created in 2012 and has holdings in 29 terminals globally, while Terminal Link’s network consists of 33 terminals.

Most recently, CMA CGM signed an agreement to acquire the Bayonne and New York terminals from Global Container Terminals. This came after the acquisition of the Fenix Marine Services terminal at the port of Los Angeles.

And while MSC bought Bolloré’s Africa subsidiary, CMA CGM announced this year it would purchase Bolloré itself. This followed acquisitions of logistic firm Ingram Micro Commerce & Lifecycle Services and French courier firm Colis Privé.

Not only that, but CMA CGM is expanding its rail network. It has agreed to buy GEFCO – which provides rail logistics for carmakers in France – after the company was forced to buy back the 75% of its shares owned by Russian Railways after the Ukraine invasion.

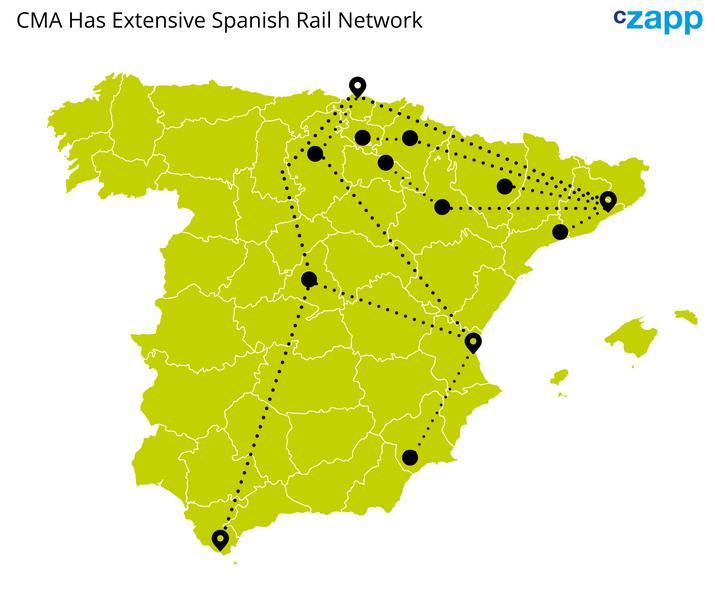

And a major rail acquisition came in the form of Spanish rail company Continental Rail in 2021, which specialized in inland intermodal container traffic. CMA CGM now has access to a wide rail network in Spain.

Maersk Divests Russian Terminals

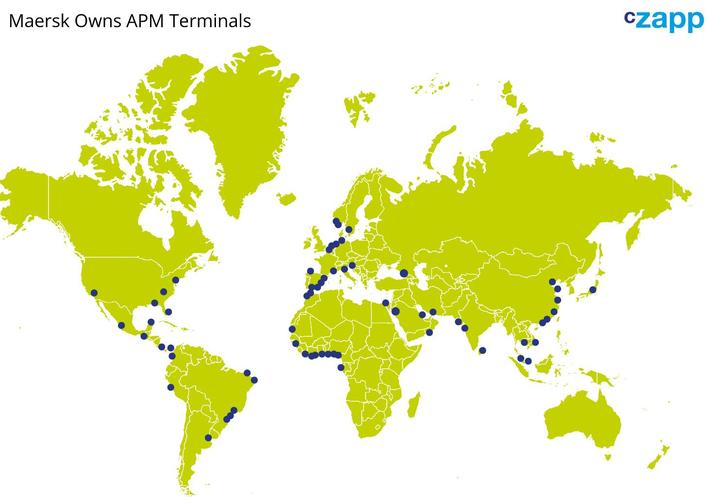

APM Terminals – an independently owned company of shipping giant Maersk since 2001 – controls 65 terminals worldwide.

But last year marked one of divestments for Maersk. It had held a 30.75% share in Russian ports company Global Ports Investment, which it sold to Delo Group as a consequence of Russia’s invasion of Ukraine.

Late last year the company also won a bid to develop a new terminal at Suape port in Brazil. It will spend $500 million on the terminal, which will have an initial capacity of 400,000 TEU. The company also signed a $500 million development deal for the Suez Canal Container Terminal.

Moving more inland, Maersk expanded its presence in Latin America this year with the opening of two new fulfilment centers – one in Colombia and one in Panama. The company said it will invest $200 million in Colombia alone to expand storage, warehousing and distribution infrastructure.

Hapag-Lloyd Looks to Chile, India

At the end of 2022, Hapag-Lloyd added 10 terminals in the Americas to its portfolio after it acquired SM SAAM along with its terminal and logistics businesses. The company now has five terminals in Chile, one in Florida, US, and one each in Ecuador, Costa Rica, Mexico and Colombia.

This year, the company is continuing to expand its terminal operations with a 39% stake in the brand-new Terminal 2 at Egypt’s Damietta port. It also signed a binding agreement to acquire 35% of India-based terminal operator J M Baxi Ports & Logistics, which operates a handful of terminals and warehouses in the country.

And reportedly, Hapag-Lloyd may be teaming up with logistics firm Keuhne Holding to go up against MSC for a stake in the port of Hamburg. Reuters reported that the companies may make a competing offer for a stake in the port.

And Hapag-Lloyd also has its eye on rail infrastructure. When it took a 30% stake in the Wilhelmshaven container terminal in 2022, it also took 50% control of the Rail Terminal Wilhelmshaven (RTW), which it has already expanded.

Concluding Thoughts

- It is clear that all the major box carriers are taking steps to move more inland.

- Greater control over supply chains should go some way to helping mitigate rate volatility.

- A more diversified business model will also place the companies on a more solid financial footing.

- But a balance should be struck — too much integration may lead to a lack of competition.

- This would likely lead to price increases for ship brokers or charterers.