Insight Focus

- Another negative week for Wheat on higher quarterly stocks.

- USDA reported Corn stocks at 5% below what the market was expecting, at 1.36 billion bushels.

- US is expected to have warm and dry weather, Brazil is expected to receive rains.

Forecast

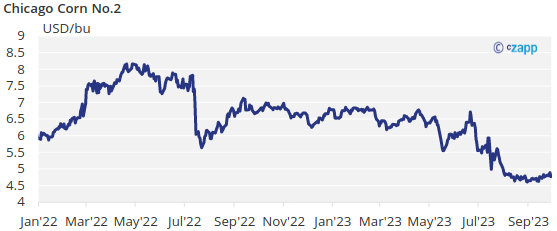

The average price for Chicago Corn during the 2022/2023 (September/August) crop was USD 6.3 per bushel vs. a range of USD 6 to 6.5 per bushel we had forecasted.

Our forecast for the new 2023/2024 crop for Chicago Corn is in a range of USD 3.9 to 4.15 per bushel. The average price since 1 September is running at USD 4.74 per bushel.

Market Commentary

Another negative week for Wheat mostly on higher quarterly stocks than expected and higher production, while Corn showed tighter stocks.

We had the USDA quarterly stocks report last Friday with Corn stocks reported at 1.36 billion bushels as of 1 September with is almost 5% below what the market was expecting and 1.1% lower than last year. Chicago traded higher since the beginning of the week but lost all gains on Friday pulled down by Wheat and Soybeans which saw higher supply than expected.

The European Commission lowered again their Corn production forecast for 2023/2024 by 1.86 million tonnes to 60,07 million tonnes or 3% below their previous forecast. This is still above last year’s production of 52.3 million tonnes.

US Corn is 15% harvested vs. 11% last year and vs. 13% of the five-year average. Conditions improved 2 pts to 53% good or excellent vs. 52% last year. Corn area under drought increased by another 4 points and is now 58%. French Corn is 81% in good or excellent condition flat week on week and vs. 42% last year. Harvesting is 11% complete very much delayed vs. last year’s 48%. Russian Corn is 14% harvested. Ukrainian Corn is 4% harvested.

In Brazil, Safrinha Corn is 98,2% harvested, virtually completed, and first Corn crop is 18.3% planted vs. 19,3% last year.

On the Wheat front, prices fell with more vessels booked out of Ukraine but mostly by the end of the week after the USDA quarterly stocks report.

US Wheat stocks as of 1 September were 1.78 billion bushel basically flat year on year and a bit higher than the 1.77 billion bushel the market was expecting. Wheat production for 2023 was reported at 1.81 billion bushels vs. 1.73 billion bushels expected as per the latest WASDE.

The European commission lowered their Wheat production forecast by 774 million tonnes to 126.3 million tonnes marginally lower vs. their previous forecast.

US spring Wheat is 96% harvested in par with last year. The area of US Wheat under drought was unchanged at 47%. Winter Wheat is now 26% planted vs. 30% last year and 29% of the five-year average. Russian Wheat is 84.5% harvested. Winter wheat planting in Ukraine is 24% complete.

On the weather front, the US is expected to have warm and dry weather this week while Brazil is expected to receive rains. Europe had a warmer than normal second half of September and warm and dry weather are forecast for this week too.

In the Black Sea – despite Russia having attacked grain infrastructure at the beginning of last week –as much as 15 vessels are rumoured to have been fixed by China somehow easing worries around logistical disruptions out of Ukraine.

The quarterly stock report from the USDA showed lower Corn stocks as we had anticipated last week, which are some 100 million bushels below the carry out showed in the September WASDE so we will see this lower stocks in the October WASDE next week. This lower stock value takes the stock to use ratio to 9.5% vs. 10.6% but then if the harvest that has already started delivers 15.1 billion bushels as of the last WASDE, the 15.4% stock to use ratio justifies prices making a visit below USD 4 per bushel.

Whilst the condition of the US Corn crop is not ideal, it is not much different from last year, thus no reason to expect further damage to yields which had been already downgraded in the August and September WASDE. All the growth is coming from higher acreage. Prices should tend to ease as new crop Corn starts to hit the market.

Another negative week for Wheat mostly on higher quarterly stocks than expected and higher production, while Corn showed tighter stocks. This lower stocks takes the stock to use ratio to 9,5% vs. 10,6% but then if the harvest that has already started delivers 15,1 bill bu as of the last WASDE, the 15,4% stock to use ratio justifies a visit below 4 USD/bu. Prices should tend to ease as new crop Corn starts to hit the market. The average price for Chicago Corn during the 22/23 (Sep/Aug) crop was 6,3 USD/bu vs. a range of 6 to 6,5 USD/bu we had forecasted. Our forecast for the new 23/24 crop for Chicago Corn is in a range of 3,9 to 4,15 USD/bu. The average price since Sep 1 is running at 4,74 USD/bu.