Insight Focus

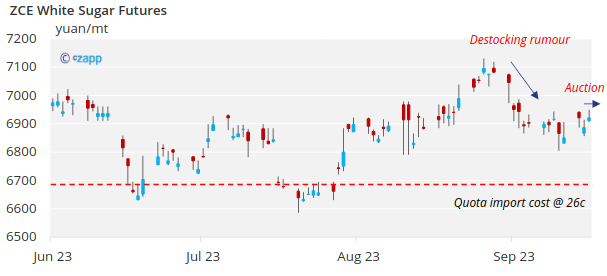

- China has held its first public sugar auction in six years.

- 126.7k tonnes of sugar were auctioned, produced by 7 refineries.

- The results were neutral and more auctions could come.

First Open Auction since 2016/17 Season

The China Reserve Exchange announced its first sugar auction in 6 years on Sept 22nd. This came after market participants were invited to register for sugar auctions earlier this month.

- The auction date took place on September 27th 2023.

- The auction volume was 126,700 tonnes.

- The auction product was white granulated sugar processed by 7 refineries.

- 26,700 tonnes of whites produced in 2017 ~ 2019, with a floor price of 6500 CNY/mt.

- 100k tonnes of white sugar produced in 2023, with a floor price of 7300 CNY/mt.

- The delivery window was mainly from 2H October to November.

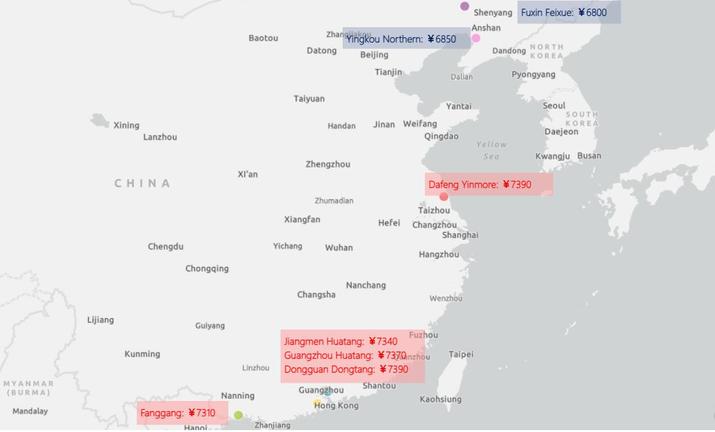

Warehouse/Refinery Location for This Auction

Source: Czapp

- The auction results were neutral.

- Rumour said that around 85% of the volume was sold.

More Auctions to Come?

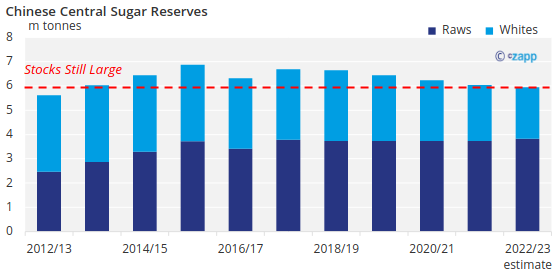

Apparently, that’s just the first batch. Thanks to the rumours that COFCO was allowed to import an extra 1m quota sugar this year, the ‘gun’ seems to be fully loaded.

We think the China Reserve Exchange may adjust the following auctions according to this result. Today’s spot price is around 7,500 yuan/ton, but the sugar auction with a floor price of 7,300 yuan is not fully sold. This may be due to the late delivery window when cane crushing in the south will also start and compete for the market.

With the uncertain impact of the auction results, funds have temporarily left the sugar market ahead of the long National Day holidays.

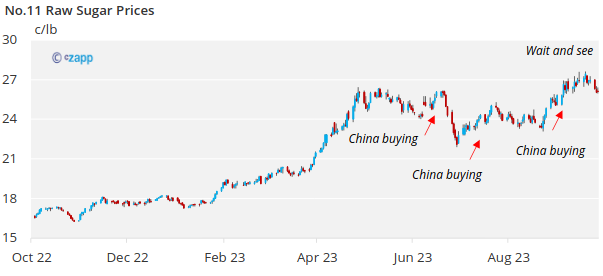

The same goes for Chinese sugar refineries. Most of China’s buying so far is quota demand (paying 15% import duty), and most AIL demand (paying 50% duty) remains uncovered. With the domestic sugar market is still looking for direction, refineries will be temporarily absent from the world market.