Insight Focus

- Recent rally in PTA and MEG Futures falters as polyester productions cuts hit demand.

- Facing record low spreads Chinese PET resin producers begin shutdowns.

- PET resin producers to face low margin environment in 2024.

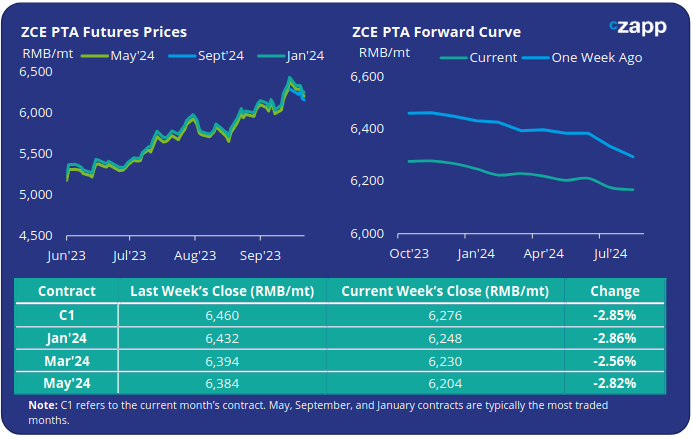

PTA Futures and Forward Curve

PTA futures experienced sizable declines last week with main contract months falling by over 2.8% by Friday’s close. Having broached USD95/bbl mid-week, crude oil prices also eased back marginally by Friday.

According to ING and Standard Chartered, oil prices may briefly cross USD100/bbl in the fourth quarter before falling back to low 90s.

However, PTA market fundamentals paint a weaker picture.

Despite Yisheng lowering operating rates at its PTA plants (totalling over 6MMt total capacity), the PTA spot market remaining amply supplied.

Other PTA plants that had previously been down have gradually restarted, more than compensating for Yisheng’s lower production, resulting in inventory buildup. At the same time, polyester operating rates are beginning to ease.

Bottle grade resin producers are cutting rates due to low profitability and growing stock levels; whilst the fibre market remains in peak season, polyester production is expected to tail-off during the later part of the year, pressuring PTA fundamentals further.

By Friday, the Jan’24 contract was at a RMB 22/tonne discount to the current month, with the forward curve moving into slight backwardated through H1’24.

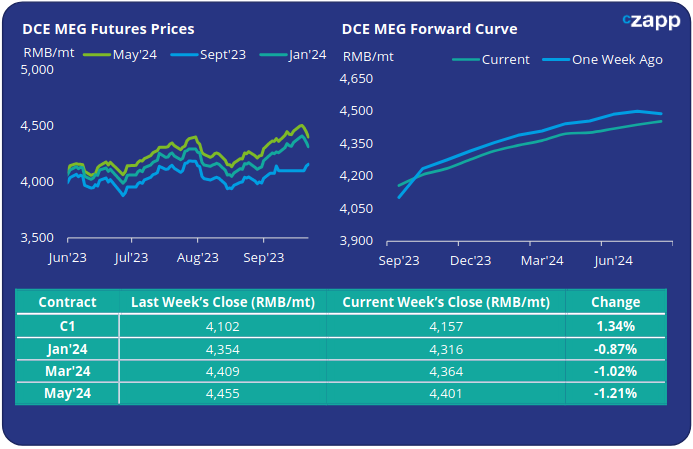

MEG Futures and Forward Curve

After hitting a four-month high, the recent rally in MEG Futures eased last week amid profit taking and slowing demand from polyester production.

Although main East China port inventories experienced another consecutive weekly decline, falling by around 2.8% to 1,030k tonnes, levels remain significantly elevated versus the same ‘peak season’ period in previous years.

Buyers are also concerned the Asian games due to start on the 23rd Sept, and the upcoming Golden Week holiday on the 1st Oct, will further reduce polyester production, denting MEG demand.

The MEG forward curve remains in contango over the next 12-months. Although by Friday, the premium held by the Jan’24 contract over the current month contract had narrowed to RMB 124/tonne.

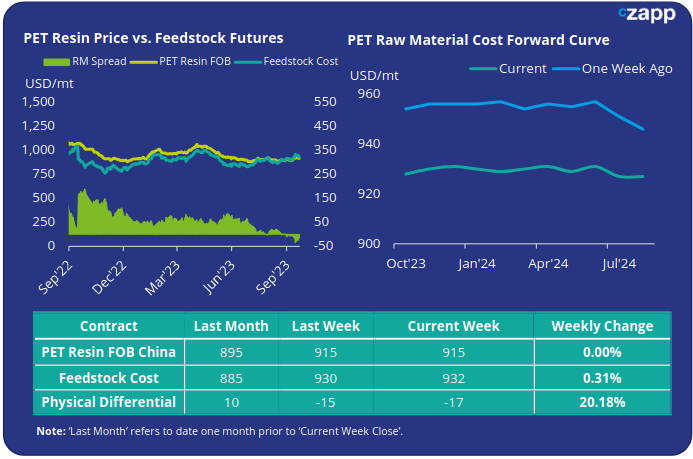

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices softened very slightly towards the end of last week, following an easing in raw materials costs. Prices averaged USD 915/tonne on Friday, down just USD 5/tonne from the previous week.

The weekly PET resin physical differential kept firmly in negative territory last week, losing a further USD 5/tonne to average negative USD 21/tonne for the week. By Friday the daily spread was showing little movement at minus USD 17/tonne.

The raw material cost forward curve remains almost completely flat through H1’24, with the most liquid contract months of January and May broadly on par with current levels.

Concluding Thoughts

With the physical differential for PET resin exports remaining in negative territory operating rates have begun to move down sharply, with producers hutting lines and moving into maintenance.

However, given over 4 million tonnes of new capacity has been added this year already (and with more to come in Q4) the scale of production cuts is unlikely to be large enough to mitigate the current oversupply.

Inventory buildup is likely to persist through to late-November, when domestic Chinese beverage production exits its traditional turnaround period, and export demand is revived ahead of the Christmas and New Year season.

Having reached record lows, PET resin export margins are expected to see a partial recovery through into H1’24. However, profitability is not expected to normalize, and will remain constrained by the supply glut created by the recent wave of new capacity.

Given the flat raw material forward curve, and limited downside to operating margins buyers are likely to seize the opportunity to lock in fixed prices for 2024.

Current market indications are for Chinese export prices to range between USD940-960/tonne in H1’24.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.