Insight Focus

- This year’s high season for containers has been particularly lacklustre amid high interest rates, weak demand and a glut of new vessels.

- Carriers are now responding by blanking more sailings in a bid to restrict supply and strengthen prices.

- Importers and exporters are likely to encounter issues with capacity on certain routes in the next few months.

Operators Try to Level Out Supply

Since September 4 Maersk has announced over 22 blank sailings, mainly from Asia, citing low demand in the period around Golden Week. The company also made some vessel substitutions, including changing the 11,000 TEU Guthorn Maersk to the 8,450 TEU Maersk Singapore.

Likewise, MSC blanked several sailings and downsized the 14,000 MSC Genova traveling to the US East Coast and Gulf to the 4,900 TEU MSC Ornella.

And at the beginning of September, Hapag-Lloyd announced several blank sailings on its Transpacific and Asia-Europe routes.

Source: Drewry

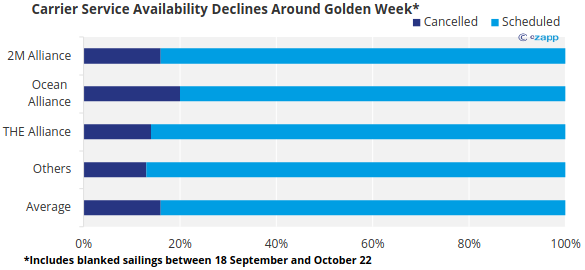

According to Drewry, 104 sailings have been cancelled out of a total 665 scheduled journeys over the five-week period around Golden Week. In 2023, China’s Golden Week takes place between Sunday, 1 October and Saturday, 7 October.

Despite low demand, blanked sailings may be problematic for some as they may be unable to find space on regular routes. This will be especially problematic for those that require a regular product flow.

Blank Sailings Explained

Blanking is the practice of removing certain sailings from key routes to level out supply and demand. It used to happen under extraordinary circumstances, but it is now becoming a tool for the shipping industry to manage supply and demand fluctuations.

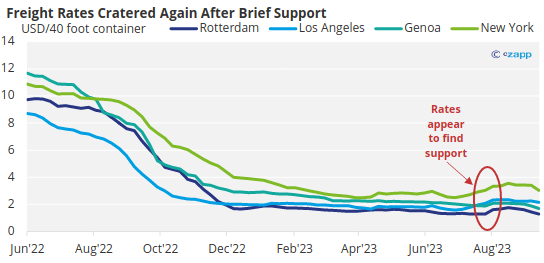

Pulling extra demand can help support freight rates. The industry especially needs rate stability right now after rates appeared to dip again after a brief period of support.

Source: Drewry

This rate volatility has been caused by several factors, including inventory destocking, low demand, new vessels coming online and a weakening in the Chinese economy.

Low Season Approaches

Container operators moving to blank routes is understandable given that rates are under such pressure ahead of a period that tends to see a dip in activity.

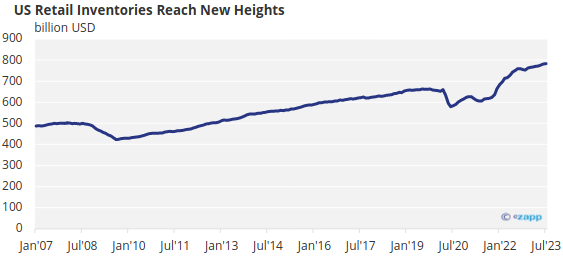

After Golden Week, the next pockets of demand tend to be Christmas and Thanksgiving in Western markets, but right now, inventories are already high.

Source: St Louis Fed

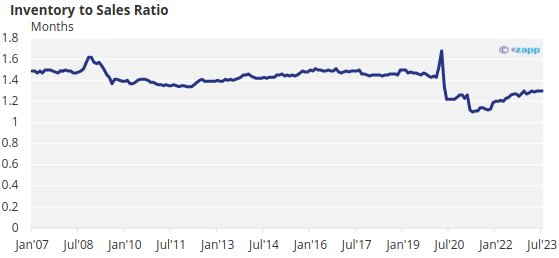

The amount of inventory relative to sales is also creeping up to standard pre-pandemic levels of around 1.5 months as lower demand kicks in.

Source: St. Louis Fed

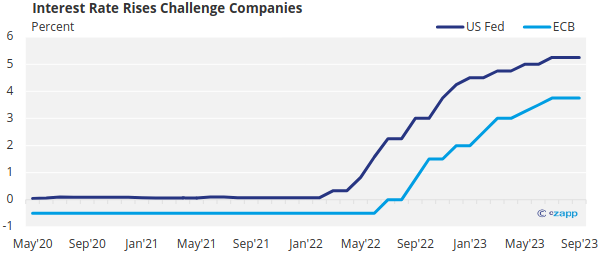

And due to higher interest rates and higher inflation impacting costs, it is becoming more expensive for companies to hold inventories. This means it is unlikely they will restock more than they need to hold.

Source: ECB, US Federal Reserve

This would mean that shipping lines would need to wait even longer for a high demand period, perhaps until Chinese Lunar New Year in February next year. This may be the first instance of an uptick in consumer demand in China after a lacklustre year.

More Blank Sailings to Be Expected

Given that there are no strong demand fundamentals that support the freight market, it should be expected that container operators will take matters into their own hands by blanking more sailings.

If this continues, there are concerns that it will result in low availability out of Europe in November and December, which would push freight rates up.

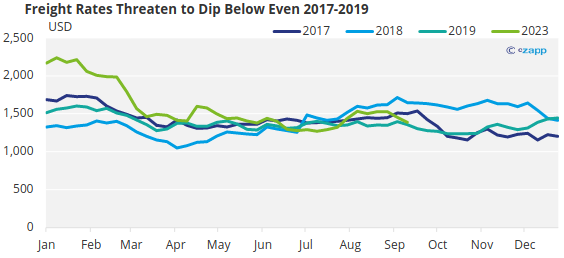

Already, the percentage of blanked capacity on Asia-North Europe routes has reached almost 20% — higher than levels seen between 2017 and 2019. At this point, freight rates were on par with today’s rates.

Source: Freightos

There are question marks around the sustainability of this practice, though. If there is no significant uptick in demand to bolster fundamentals, it is likely to just create a temporary uptick in rates like we saw over the summer. It is worth noting that prices are now even lower.

In the meantime, brokers should keep a close eye on the pace of blanked sailings to ensure operations are not disrupted. And if container carriers are successful in their efforts, rates are likely to experience a long-awaited boost.

If you’d like to minimize shipping risk for your business, contact our team.