Insight Focus

- Surging crude prices have driven PX and PTA prices to new monthly highs.

- Increases in PET export prices fail to keep up with highly volatile upstream costs.

- PET resin export margins once again fall to a new all-time low.

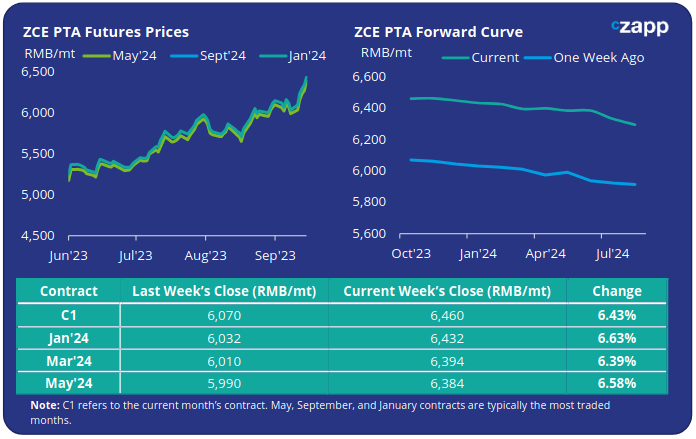

PTA Futures and Forward Curve

PTA futures have soared over the last week, up more than 6.5%, with the Jan’24 contract approaching the RMB 6,500 tonne mark. Higher upstream costs continue to be the major driving force behind these steeps rises.

Oil prices are on course for a third consecutive weekly gain, with WTI nearing USD 91/bbl and Brent trading above the USD 94/bbl mark, up over 12.5% in the last month alone.

Whilst PX-Naphtha spread remains at high levels, it has stabilised over recent weeks, keeping rangebound, averaging USD 412/tonne since the beginning of the month.

On the other hand, PTA-PX spread has continued to tumble to around USD 70/tonne, despite several unplanned maintenance issues. Most unplanned PTA production cuts have been short in duration and been outstripped by increasing production and plant restarts.

Although, polyester operating rates remain high, an easing of PTA production into Q4 and any impact during the Asian Games period could weaker supply/demand fundamentals further.

It should also be noted that PX futures have also now launched on the ZCE.

By Friday, the Jan’24 contract was at a RMB 28/tonne premium to the current month, with the forward curve moving into slight backwardated through H1’24.

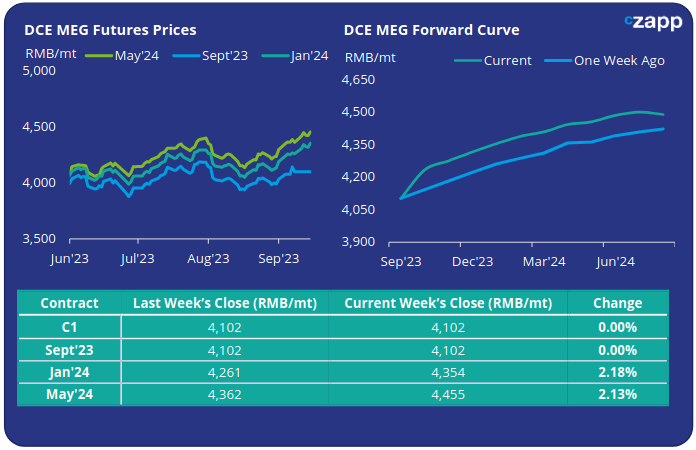

MEG Futures and Forward Curve

MEG futures also rose last week, however, gains were limited to around 2%, as weak market fundamentals weigh on sentiment.

Although main East China port inventories decreased by around 1.55% last week, levels are still above the million-tonne mark, at 1,060k tonnes, and would require sustained offtake over the coming weeks to follow any traditional peak season trend.

However, high domestic operating rates are expected to pressure port offtakes keeping fundamentals weak and constraining any potential upside to the market.

Buying sentiment was also boosted by a stronger yuan and fresh signs of economic recovery within China.

The MEG forward curve remains in contango over the next 12-months. By Friday the Jan’24 contract was holding a RMB 252/tonne premium to the current month.

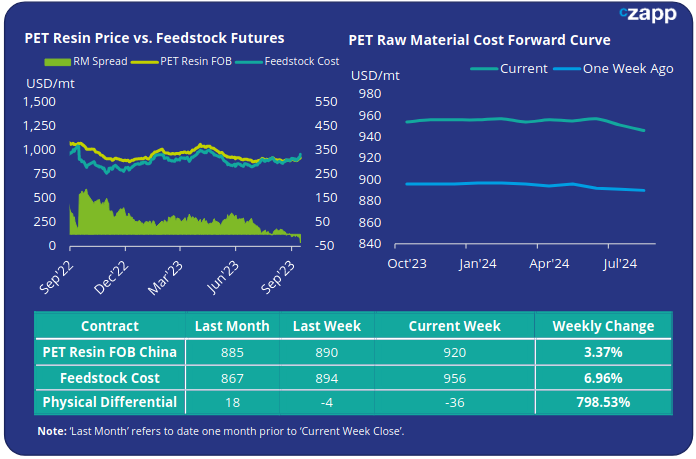

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices have regained some upward momentum over the last week following higher upstream costs, averaging USD 920/tonne on Friday, an increase of USD 30/tonne from the previous week.

However, added volatility from the crude markets, and the launch of the PX has added to the PET pricing complexities.

As a result, the weekly PET resin physical differential to future feedstock costs sank further into negative territory, losing a further USD 10/tonne to average negative USD 17/tonne for the week. By Friday the daily spread had plummeted further to minus USD 36/tonne.

Despite the volatility, the raw material cost forward curve remains almost completely flat through into H1’24. Jan’24 raw material costs on par to the current month’s contract, the next most liquid contract months of March and May were also on par with current levels.

Concluding Thoughts

On average, PET resin export prices are now up between USD 20-30/tonne over the last few weeks ago on the back of strong price movement seen in the oil and PTA futures markets.

With the physical differential once again hitting an all-time low, and added market volatility, Chinese producers increasingly reluctant to negotiate any significant downside, and in some cases only maintaining price offers for 6-hour periods.

Some Chinese PET resin producers also claim to have made very good physical sales in the past 10 days, for both domestic and export, slowing any potential inventory accumulation.

PET resin export prices may begin next week playing catch-up to these cost increases.

Whilst average operating rates have slowly eased since mid-summer, they are still above average for the period; although some producers will move into planned maintenance in the off-peak (Oct-Nov), at least 900,000 tonnes of new capacity is still due to be added this year.

As a result, the impact on operating rates and production is expected to be limited and margins to remain under considerable pressure through to Dec.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.