Insight Focus

- The No.11 sugar futures has strengthened in the past week.

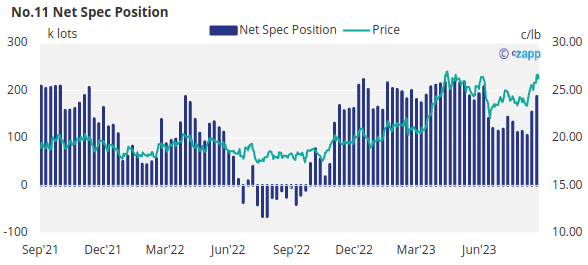

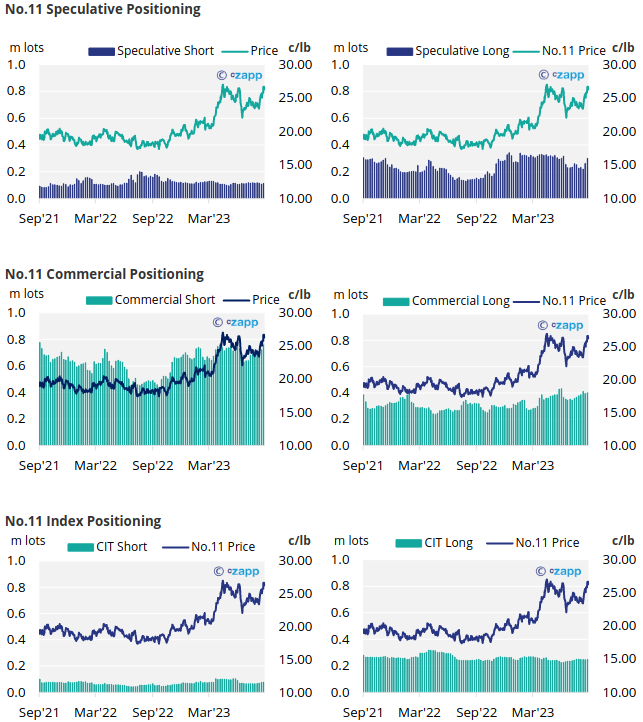

- Speculators have made a notable increase in their net spec position.

- Producers were able to further hedge into these higher prices.

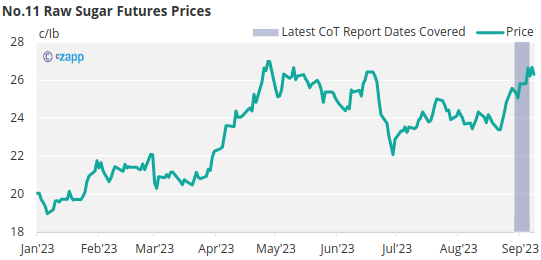

New York No.11 Raw Sugar Futures

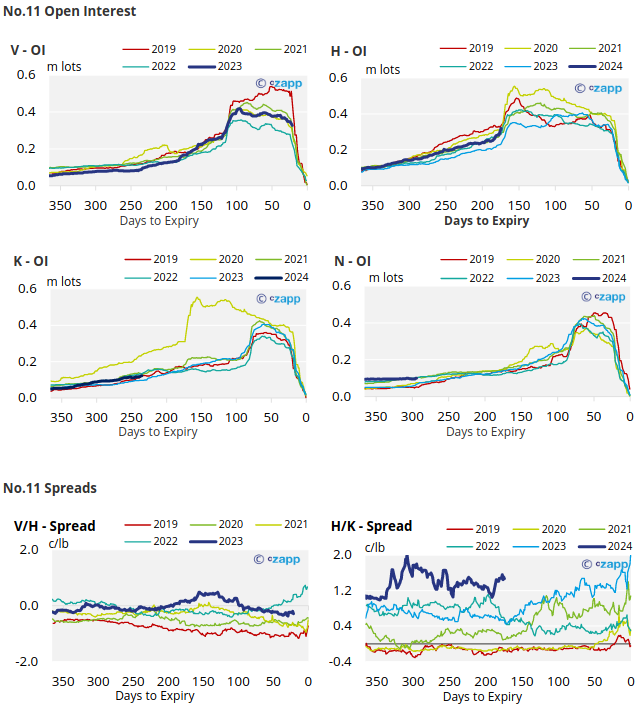

Over the past week, the No.11 sugar futures rose slightly, from a low of 25c at the start of the week to a close of 26.3c/Ib on Friday.

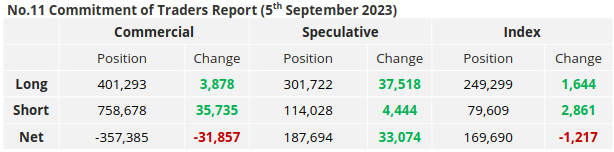

By the 5th of September (latest CoT CFTC report), the spec long position had increased by 37.5k lots, accounting for 12.4% of the total number of long positions held the previous week. With an increase in spec short position of 4.4k lots, the overall net spec position has increased by 33k lots to 187k lots.

Looking over to the commercial side, producers have increased their hedges to take advantage of these higher prices; the consumers, on the other hand, were slightly less active only adding a small number of hedges, which were most likely hand to mouth.

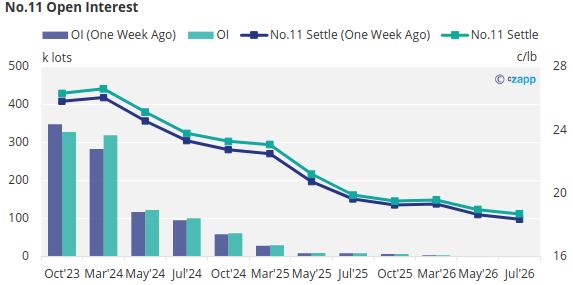

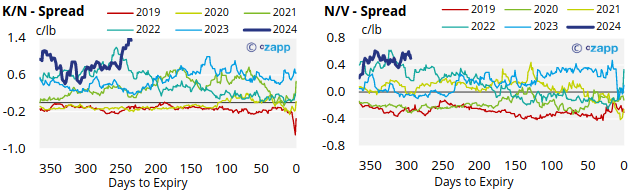

With contracts strengthening slightly across the board, the No.11 forward curve remains inverted.

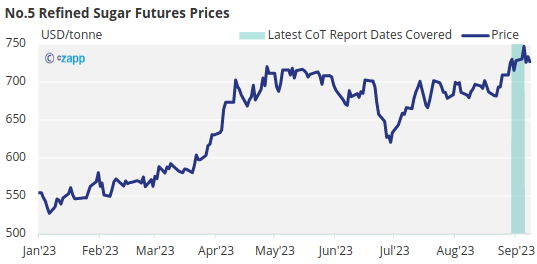

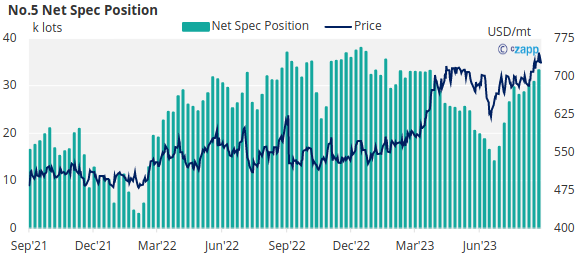

London No.5 Refined Sugar Futures

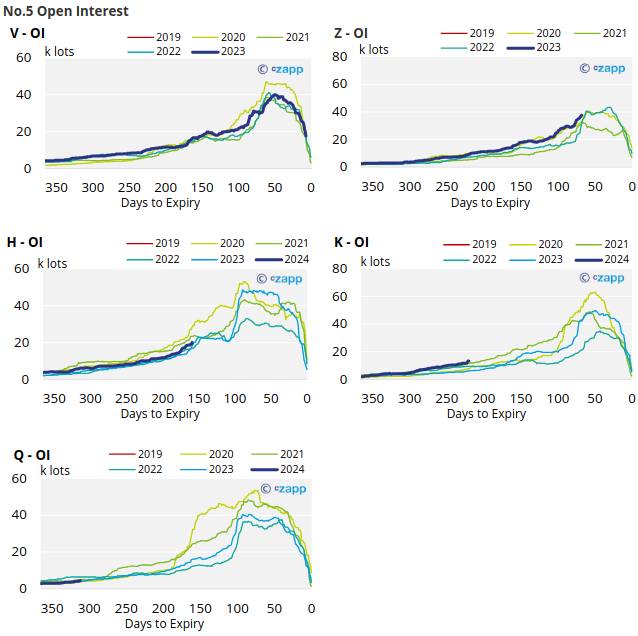

The No.5 refined sugar futures has weakened slightly over the past week, closing at 726USD/mt on Friday.

That said, speculators did add around 2.5k lots of new positions, bringing the overall net spec position to just under 33.3k lots.

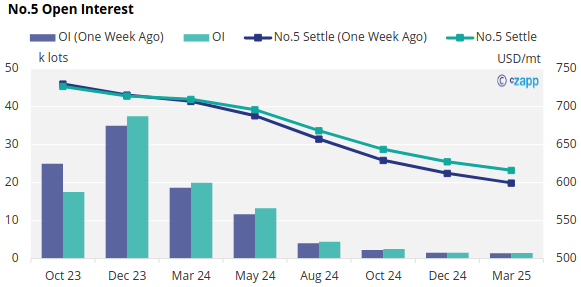

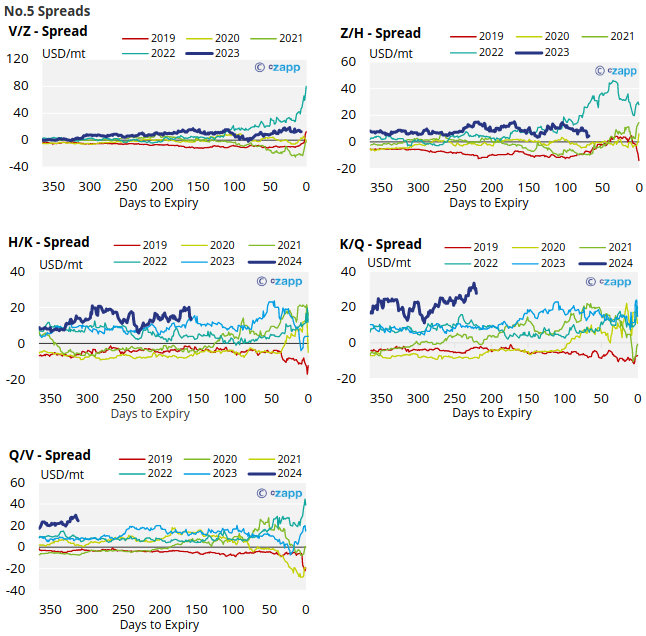

The No.5 forward curve has flattened slightly, before becoming backwardated from Mar’24 until Mar’25.

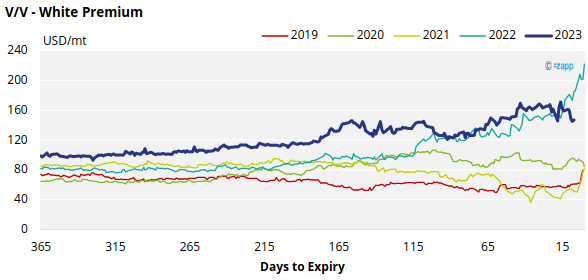

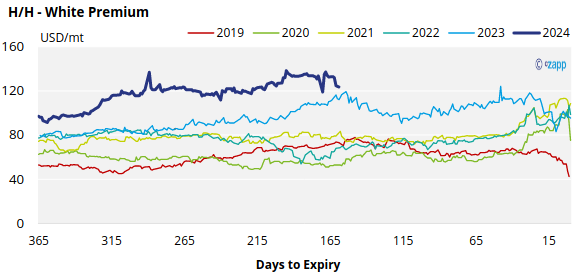

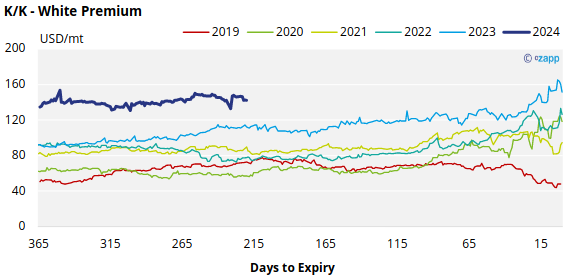

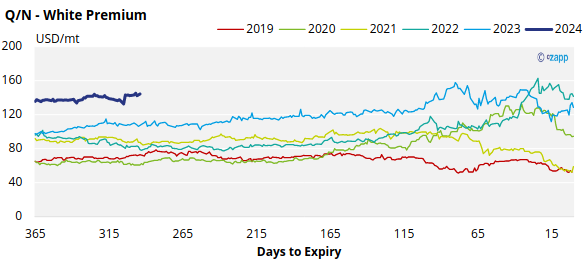

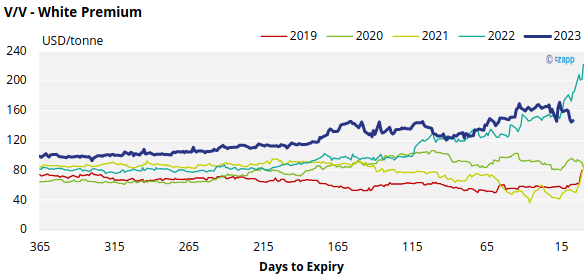

White Premium (Arbitrage)

The V/V sugar white premium has weakened now standing at 145USD/mt, down 14USD from the previous week.

We believe that many re-export refiners require at least 90-105USD/tonne over the No.11 to be profitable, which means that the spot white premium provides comfortably enough for these refiners to maximize their throughput.

At this level, higher-cost or discretionary refiners may begin to consider re-exporting in addition to serving their domestic markets.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix