New York Fed Insight Focus

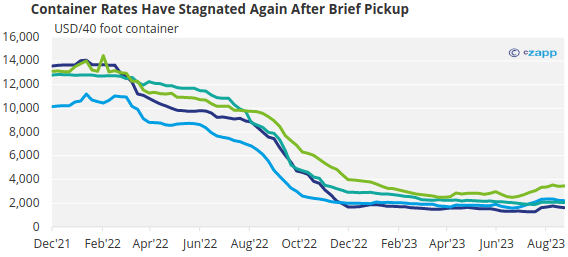

- Earlier this summer, there was a glimmer of hope for container markets as rates looked like they might rebound.

- But optimism was short lived amid no signs of stimulus coming from the Chinese government.

- In the meantime, shipping companies have some solutions they can employ to manage capacity.

Freight Market Feels Weakness

Lacklustre spending in China has impacted negatively on freight markets. A short boost in container rates in August coinciding with the usual “peak season” proved short lived as prices began to struggle again.

Source: Drewry World Container Index

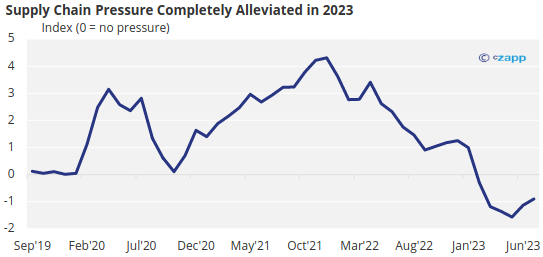

Supply chain pressures have entirely eased, according to the New York Fed’s Global Supply Chain Pressure Index.

Source: New York Fed

Port congestion and other supply chain issues were partly responsible for the rise in freight rates in 2020 and 2021.

Support From High Employment, Retail Sales

But some sticking points remain. Labour issues at North American ports plagued the shipping industry over the past year, while structural and weather issues at the Panama Canal and Mississippi River are also adding to headaches.

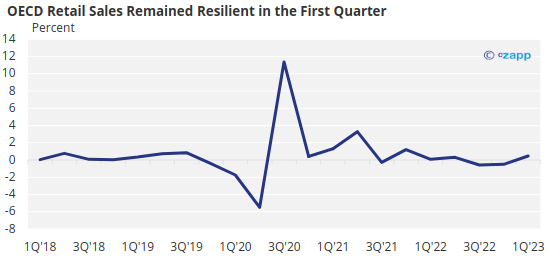

And across the OECD, retail sales seem to have bounced back in the first quarter of 2023 after a contraction in the final quarters of 2022.

Source: St Louis Fed

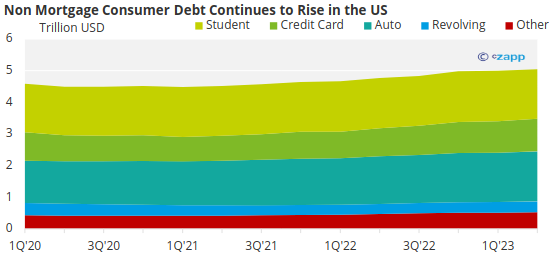

And in the US, people continue to consume, even borrowing more to do so.

Source: New York Fed

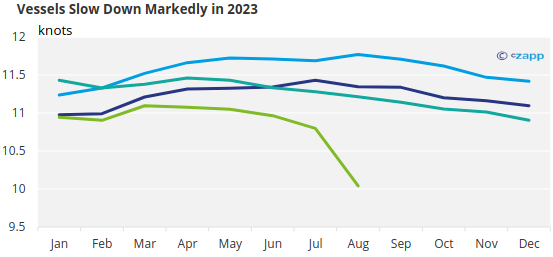

More support for the freight markets could be found in slower vessel speeds. In 2023, ships have been travelling much slower due to shipowner efforts to limit emissions and moderate supply.

Source: AXS Marine

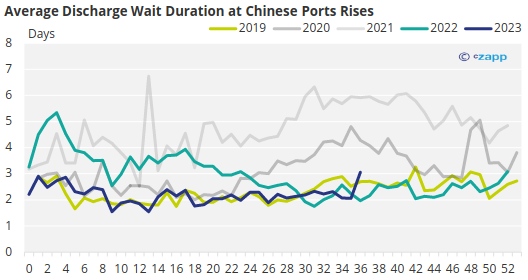

Shipping firms will likely continue to limit capacity for the rest of 2023, with measures that include blanking sailings and laying up ships at ports. Slower imports into Asia are also creating some bottlenecks as inventories are high due to a slowdown in purchasing volume.

Source: AXS Marine

China Weighs Heavily on Markets

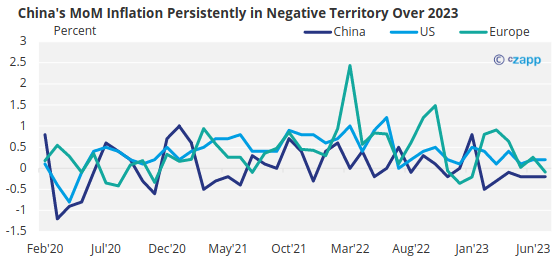

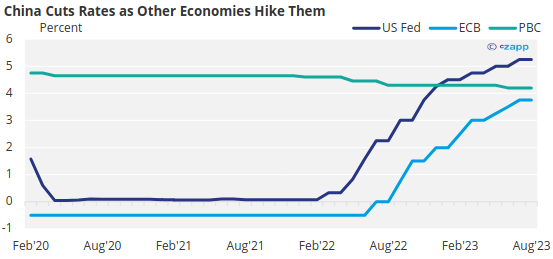

While economies in Europe and the Americas have been struggling to contain rampant inflation, China has the opposite problem. It is experiencing deflation as consumer spending lags after long and strict Covid lockdowns.

Source: BLS, St Louis Fed

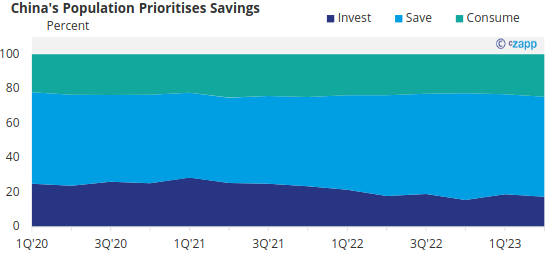

Savings are growing in China as consumers remain wary of making expensive purchases. This is a huge problem for container markets, which have a huge dependency on Chinese consumer appetite.

Source: PBC

Of course, this means that Chinese policymakers are taking the opposite approach to central banks in the west. Instead of raising interest rates to cool the economy, it has made some rate cuts to try to stimulate spending.

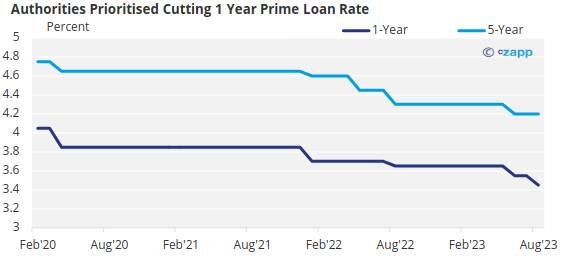

The People’s Bank of China has prioritized cutting its one-year prime loan rate, which is mainly used as a benchmark for business borrowing.

Source: PBC

However, critics say more attention should be paid to the five-year rate, which is used as a benchmark for mortgages – and therefore more closely linked with consumer spending.

Concluding Thoughts

- Despite some encouraging indicators including retail sales and employment, freight markets continue to lack support.

- But a more meaningful boost would be felt from a kickstart to consumer appetite in China.

- This will presumably only be possible with a government stimulus targeting consumers.

- Meanwhile, the US and European central banks continue to try to limit consumption in an attempt to cool down inflation.

- As shipping firms feel the brunt of these economic policies, they will continue to employ supply chain management practices such as slow steaming and blanking voyages.