Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

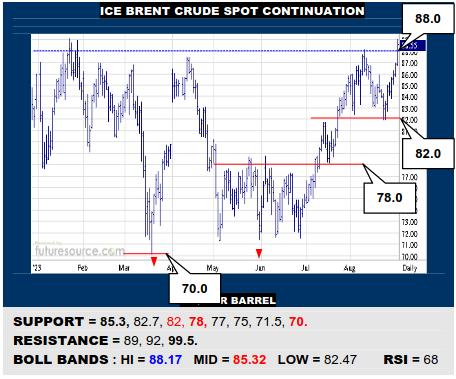

ICE BRENT CRUDE OIL SPOT

Though previously denied at 88, Brents’ Aug dip was promptly pulled together by the lower Bollinger band and it is back needling over that 88 frontier. A clean escape would merge 9 months into a major inverse H&S to take aim at triple digits. Only a sudden swerve back under the mid band (85.3) would otherwise warn of more frothy ranging instead.

NYMEX NATURAL GAS 2ND CONTINUATION

Holding the 2.47 support and nearby lower Bollinger, Nat Gas enjoyed a contango effect and jolted north to 7-month highs to revive ‘23’s candidacy as a saucer base. The Nov contract must cross the 3.26’s to underscore this however and pave the way into the 4’s whereas falling back out of the 3’s would mean another failed getaway attempt.

COMEX GOLD 2ND CONTINUATION

Quickly retrieving a dunk into the 1800’s, Gold has fought back to pierce 1940 and fray the neckline of its ’23 H&S top. Alas, it needs to secure escape over 1940 to proceed to 1990 and a reviving Dollar won’t make that easy so beware any twist back under the 1937 gap low could divert to the mid band instead (1919) and so reassert the H&S control.

LME COPPER 3-MONTHS

The Dollars’ quick gathering and resumed jabbing at the 104’s robbed Copper of initial Friday gains that thus implies a new 8600 candidate point on a ’23 downtrend. If the market could still bust through there, it would raise the sights to the 9K top neckline. Meantime watch the mid band though (8365) as a tripwire back to a vital 8120 support shelf.

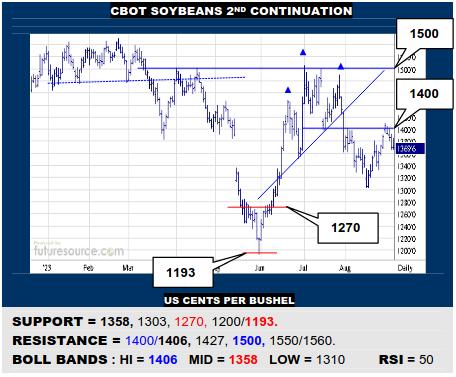

CBOT SOYBEANS 2ND CONTINUATION

A brief rattle of the 1400 resistance was quelled and Beans have tailed off back towards the mid band (1358). If it can hold, perhaps another run at 1400 could pop the door to try for the main 1500 crossing. However, if the mid band snapped, beware summer becoming increasingly toppy and a delve through 1300 could point all the way on down to 1193.

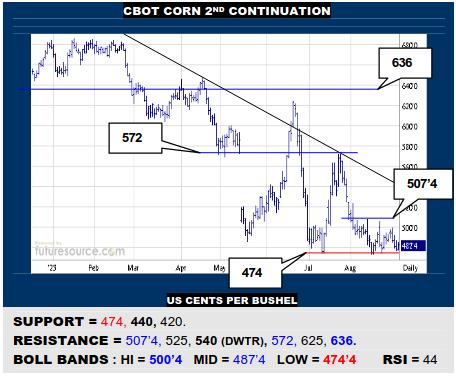

CBOT CORN 2ND CONTINUATION

Minor Aug swells in Corn have faltered shy of the 507’4 resistance and only piercing that would claim a more reliable base that could fuel a dice with the ’23 downtrend (540). It feels a fragile footing on 474 meanwhile and if that Q3 prop were to surrender, do then make room for a further leg south into broader monthly support spanning 440 to 420.

NY SUGAR #11 SPOT CONTINUATION

In the wake of busting free from a 4-month inverse H&S base, Sugar has undertaken a few days’ consolidation in the 25’s. This looks hopeful given its flaggish vibe so a resumption higher over 25.90 would dial in focus on the 27.41 high. Only reeling back under the base neckline and mid band convergence (24.35/24.28) would undo this positive scene.

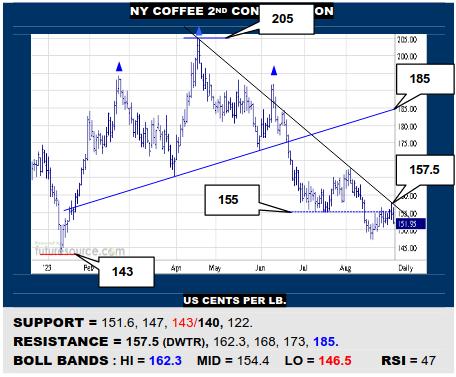

NY COFFEE 2ND CONTINUATION

A jab over 155 was deflated as the Dollar regained ground from its mid band hold and Coffee posted an outside day Thursday to start applying pressure again Friday. Duly eying 151.6 as a tripwire from an Aug bear flag that could lead on down to the 140 weekly defenses. Otherwise needing to close over 157.5 to suggest a livelier downtrend escape.

BLOOMBERG COMMODITY INDEX

A good Q3 to date for the B-Berg as a Jly downtrend and inverse H&S escape rally was followed by a mild mannered setback that stayed well clear of the base neckline before getting back on the horse a week ago. This has the commodity index chasing its upper Bollinger band into the 107’s towards the major crossing marked by the 108.3 to 109.8 span. Getting by there would be a big step, expanding the inverse H&S to a wider textbook design and lifting sights to the 120’s and Brent is poised to help if it can cement an $88 escape to secure its own big base. Alas, if the Dollar vaulted 104.5 instead, it could reinforce the overhead wall so watch 105 here as a stumbling block back into murkier waters.

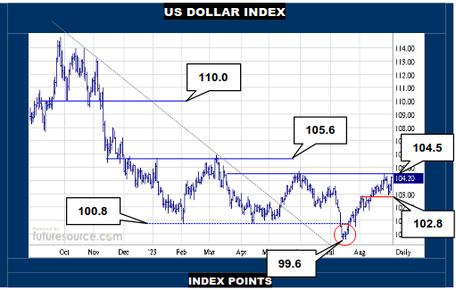

US DOLLAR INDEX

The UK holiday caused the Dollar to stumble in the 104’s but a dip back to the mid band this week (now 103.28) has been well mopped up. While able to balance on that, it would be premature to preempt failure here and indeed the mid 104’s have grown in stature as a next key hurdle, release from which could well punch the ticket out across a next 105.6 threshold. If able to scale that full 104.5-105.6 span, it would mark a major recovery from a near miss of a long term Fibonacci figure at 99, therein highlighting a prior false breakdown and granting a passport to 110. Only ripping away the mid band and the 102.8 rear guard would be a serious stumble that could finally unlock 109.8 for the B-Berg.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.