Insight Focus

- Corn and wheat markets nervous over Black Sea grains flows.

- A Russian export terminal caught fire last Friday.

- Ukrainian corn yields are high, offsetting lower acreage.

Forecast

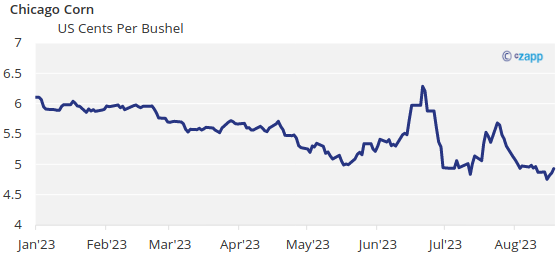

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,35 USD/bu.

Market Commentary

A second half of the week rally in Chicago prevented Corn from closing the week negative and it finally closed 1% higher week on week, but Wheat was not able to make it. Flow out of the Black Sea continues to add volatility.

Improving Corn conditions at the beginning of last week in the US pressed the market lower but dry conditions forecasted by the end of the week triggered enough buying to close the week positive. The buying was further fueled by fears around supply out of the Black Sea: Ukraine attacked Moscow and also Russian warships, and a Russian export terminal caught fire last Friday.

Looking at how production is doing, US Corn condition improved another 2 pts and is now 59% good or excellent vs. 57% last year. Corn area under drought has improved significantly and is now 42% down from 49% the previous week. French Corn is 84% in good or excellent condition or one point lower week on week and vs. 50% last year.

Ukrainian yields are expected to be very high as weather conditions have been perfect during the spring and during the summer which should help to compensate for lower area planted due to the war. Corn production is expected to be flat to last year at 28 mill ton and Wheat flat too at 21 mill ton.

In Brazil, Safrinha Corn is 72,4% harvested vs. 86,4% last year and the first Corn crop is now harvested. In Argentina, Corn is 90,2% harvested with just 14% in good or excellent condition.

In the Wheat front, the market is even more volatile than Corn with the market debating how much of the risk premium due to Black Sea disruptions needs to stay. A sizable queue of vessels both to enter and exit the Danube ports somehow indicates the trade flow is very slow but is moving.

US winter Wheat is 92% harvested above last year’s pace of 89% and within the five year average of 92%. Spring Wheat condition improve 1 point and is now 42% good or excellent vs. 64% last year. Spring Wheat is 24% harvested vs. 15% last year. The area of US winter Wheat under drought was 43% down from 45% the previous week. French spring Wheat was 76% in good or excellent condition just one point down from last week, and is 96% harvested. Russian Wheat is 50% harvested. Ukrainian Wheat is 94% harvested.

In the weather front and after four weeks of favorable weather in the US, the forecast is now for very hot and dry conditions in most growing regions during this week. Brazil saw heavy rains by the end of last week but the forecast for this week is showing dry weather with some rains expected by the middle of the week. Europe is again expecting a heat wave and dry weather in the south and even up to Germany.

The IGC published updated projections and left global Wheat production unchanged at 784 mill ton vs. 803 of the previous crop. Corn production was increased by 1 mill ton to 1,22 bill ton higher than the 1,16 bill of the last crop.

We continue to be in a market with a downtrend due to production growth across most key agricultural areas (except Argentina) but very volatile due to the weather market -normal for this time of the year- but also due to the situation in the Black Sea which is causing a disruption to Ukrainian exports although the flow is not totally blocked thus the volatility.

A second half of the week rally in Chicago prevented Corn from closing the week negative and it finally closed 1% higher week on week, but Wheat was not able to make it. Flow out of the Black Sea continues to be volatile. We continue to be in a market with a downtrend due to production growth across most key agricultural areas (except Argentina) but very volatile due to the weather market -normal for this time of the year- but also due to the situation in the Black Sea which is causing a disruption to Ukrainian exports although the flow is not totally blocked thus the volatility. No changes to our average price forecast for Chicago Corn for the 22/23 (Sep/Aug) crop in a range 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,35 USD/bu.