Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

‘Just when you thought it was safe to go back in the water…’ Though not finding instant traction, the Dollars’ lunge at the 103’s undermined NY’s stab at the recent H&S and led to an inside day Monday. So, while gathering in aboard the uptrend last week, it would be premature it seems to conclude that the trendline was ironclad and it must remain under watch (23.50). If the Dollar was promptly swatted back under 101.8, so the trend should still have good opportunity to survive. If the Dollar reached for 105.6 though, beware a trend failure here and drop towards 20.50.

LONDON WHITES #5 OCTOBER 2023

London got a glimpse of the low 700’s Monday but with Raws twitchy due to Dollar gains, the 705 hurdle was a bridge too far and some modest losses occurred. This preserves a tense stand-off between 705 overhead and 677 underneath. It feels as if the outcome of this range will be more broadly influential in determining events in the latter part of the year. Still content to call a useful inverse H&S if 705 was overcome, paving the way to 800. Routine creaks and groans meanwhile and loss of 677 alongside NY’s uptrend would warn of a dive to 600 instead.

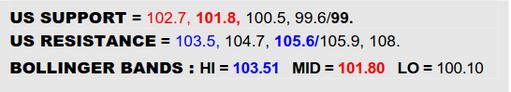

US DOLLAR INDEX

Having successfully consolidated the prior rally back up from the 99’s with some early Aug congestion, the Dollar kicked off this week probing on into the 103’s. This is initially suggesting departure from a new bull flag and soon adding conquest of 103.5 would reassure that assessment to train focus on the next bigger crossroads at 105.6, in which case the B-Berg could well be ditched from the 104’s to jeopardize its generally inverse H&S feel of ’23. The situation could only turn more pro-commodity again if this Dollar flurry was very swiftly contained at 103.5 and it was swatted away back under the 101.8 underside of the flag that is just now hosting the mid band.

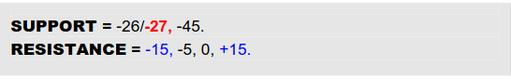

NY SUGAR #11 OCT 23 / MCH 24 SWITCH

VALUE : -22

Certainly no instant verve in Oct/Mch to accompany the recent flat price uptrend hold but it has been dabbing the brake just clear of the -26/-27 lows of last year, which is serving to wriggle free of the hefty summer downtrend. Even so, to put some meat on the bones of this trend escape will still require a follow-up break of the -15 resistance to more convincingly steer out of the decline and present a better lit path back to positive values. Meantime, just shuffling around in the shadow of -15 wouldn’t be especially reassuring and, if the flat price uptrend ultimately succumbed, beware a break of -27 and pressing on to -45.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.