Insight Focus

- UK carbon allowance price falls 50% since March.

- UK carbon price now around half of the equivalent EU emissions scheme.

- Exporters from the UK to EU may face climate surcharge in the future.

A sharp fall in the cost of UK carbon allowances raises the prospect that UK industrial exporters may have to pay a climate surcharge to send their products to the European Union, when the 27-nation bloc launches its Carbon Border Adjustment Mechanism.

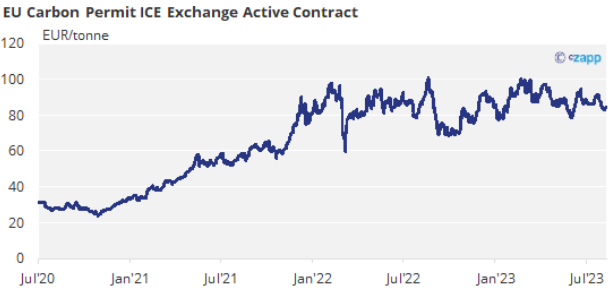

UK carbon allowance (UKA) prices have fallen by more than 50% since March this year, and are currently hovering at around £40/tonne, or 54% of the cost of equivalent EU emissions allowances (EUAs).

Air first glance, this might be seen as good news for British industry, giving them a slim cost advantage over trading partners in Europe, who are still paying in excess of €80/tonne for their emissions.

But the reasons behind the price collapse, and the implications of it going forward, should be considered seriously.

In the early summer the UK government published its response to a public consultation on reforms to the UK Emissions Trading System, seeking views on how to reform its carbon market in line with the goal of reaching net zero by the middle of the century.

The document listed a raft of proposals to tighten the overall limit on greenhouse gas emissions, but crucially, offered short-term support to sectors covered by the market. These included setting an overall cap on emissions between 2021 and 2030 of 936 million tonnes of CO2 equivalent.

Despite the indicated cap falling at the very upper end of a proposed range of 887-936 million tonnes, the reduction represents a cut of 31% from the original decade-long limit.

To help soften the impact of the reduction, the government proposed to distribute more than 53 million allowances over the 2024-2027 period, and to increase industry’s free allocation of allowances to 40% of the annual cap from 37%.

These and other proposed reforms may be seen by industry as helpful in watering down the impact a 31% cut in supply, but the UK’s emissions market, which buys and sells permits daily and sets the price, was less convinced.

Prices declined steadily from an all-time high of £99.00/tonne in August 2022 to a record low of £39.58 last week, and have lost more than 50% since March.

Emission traders point to the proposed measures to weaken the impact of the tighter cap, and, crucially, the lack of any mechanism to shore up the market in the event that allowance supply balloons, as it did in the European market for many years.

The sharp drop in price also raises the spectre of UK exporters having to pay a climate levy to ship their products into the EU, after the Union passed legislation to set up a Carbon Border Adjustment Mechanism (CBAM) earlier this year.

The CBAM seeks to establish a level playing field between European manufacturers, who are exposed to the cost of carbon, and foreign exporters who are not. Maintaining a level playing field between exporters to Europe and domestic producers lowers the risk of carbon “leakage”, in which producers are forced to relocate their output offshore to jurisdictions where there is no cost of carbon.

The EU legislation states: “The CBAM seeks to … [ensure] equivalent carbon pricing for imports and domestic products…the CBAM should ensure that imported products are subject to a regulatory system that applies carbon costs equivalent to those borne under the EU ETS, resulting in a carbon price that is equivalent for imports and domestic products.”

The key element is that the CBAM would ensure that exports to the EU pay the same climate charge as domestic products. For a long time this levy was assumed to be targeted at major international industrial powers like China and India, but the plunge in UK Allowance prices raises the possibility that cross-Channel exports too would be subject to the charge.

The EU legislation places emphasis on ensuring that costs are kept equivalent, though it’s not clear whether EU regulators would be able to judge the parameters of an emissions trading system to be equivalent, as distinct from the price it generated at any specific time.

The legislation also provides for periodic assessment of third countries’ emissions pricing mechanisms to judge whether the CBAM levy should continue to be imposed.

All of this leads to uncertainty regarding the costs that British exporters to Europe may or may not face when the CBAM comes into force in 2026. With UK carbon allowances now standing just above half the price of EU permits, exporters could be required to pay double the prevailing market price of carbon to access the European market.