Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

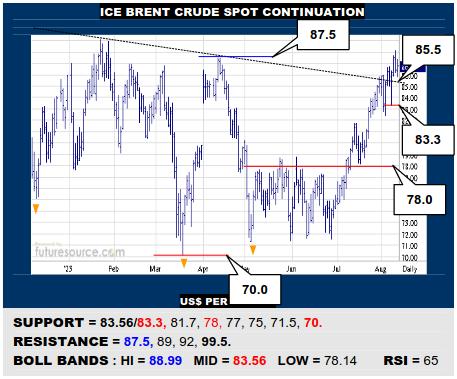

ICE BRENT CRUDE OIL SPOT

Brent has provisionally exited a major inverse H&S but since the Dollar still looks lively, the base here needs enhancing with a clean escape over 87.5. Success would expose a path to the century mark and be a massive tonic for the B-Berg but meantime always keep an eye on the 83.3 latest trough that just hosted the mid band as a pivot back to 78.

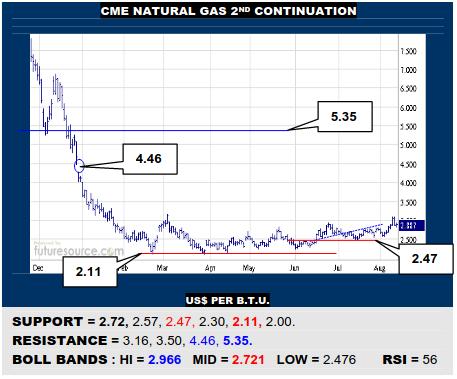

NYMEX NATURAL GAS 2ND CONTINUATION

A fleeting stab at the 3’s five months after the last one is something of a concern for the broader claim of a saucer shaped base here in Nat Gas. This makes it vital to curb the dip aboard the mid band (2.72) to keep looking north towards the 4’s. Breaking the mid band would otherwise douse the flame and point back to testing 2.47.

COMEX GOLD 2ND CONTINUATION

Breaking the 1930’s gives ’23 a H&S vibe in Gold, even if the right shoulder looks rather stunted. Must press on beneath 1900 while the Dollar invades the 103’s to verify this toppier landscape to warn of much deeper reach towards 1730. Alternatively needing to fight back over the mid band (1953) to dilute the top impression and steady the footing.

LME COPPER 3-MONTHS

Copper crested shy of the prior H&S neckline (now 8950) as Aug began and has broken the summer uptrend this week. Duly looking fragile and vulnerable if the Dollar proceeded into the 103’s, then wary of a new delve towards 7850. Only clawing back over the ex-trend and mid band (8500/8523) would start to restore grip and access the 8900’s.

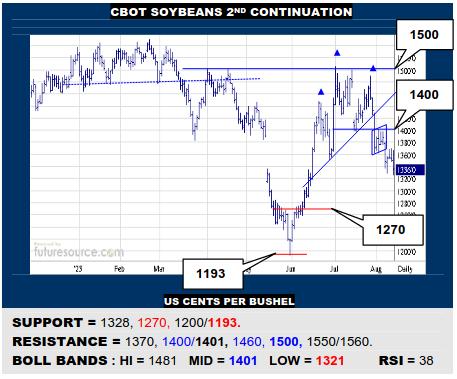

CBOT SOYBEANS 2ND CONTINUATION

Having built a steeply raked H&S in Jun-Jly, Beans have stepped down from one bear flag and look at risk of stepping down from another if 1328 gave way, the next buffering not until 1270. Otherwise the market must at least react back over 1370 to stem the leak and 1400, where the mid band is arriving, marks a more definitive turn back upwards.

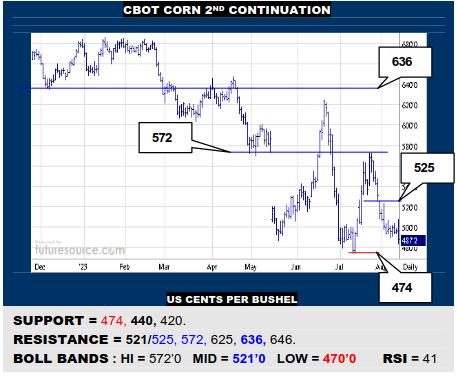

CBOT CORN 2ND CONTINUATION

Another congestion zone like early Jly is opening up and infers a key crossroads for Corn. If it could still dodge the 474 trough and rebound over the mid band (521) and 525 resistance, it would lay a groundwork for a new May-Aug inverse H&S base. Twitchy moments meantime and pressing below 474 would instead point on south to the 440-420 area.

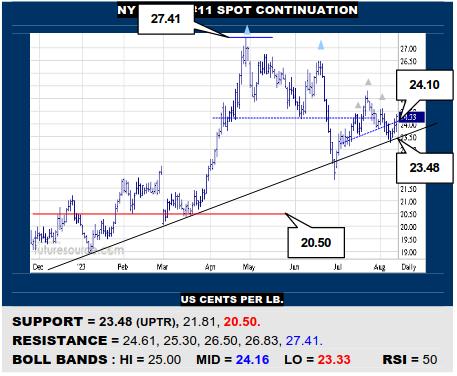

NY SUGAR #11 SPOT CONTINUATION

Rescued by the ’23 uptrend this week, Sugar has veered back up to gnaw away a nearby H&S and the mid band and suggest drawing a 3-month correction to an end while starting a next interim leg higher. A vibe of guarded promise then but stay wary if the Dollar invaded the 103’s, then still leery of straying back to the uptrend here (23.48) again.

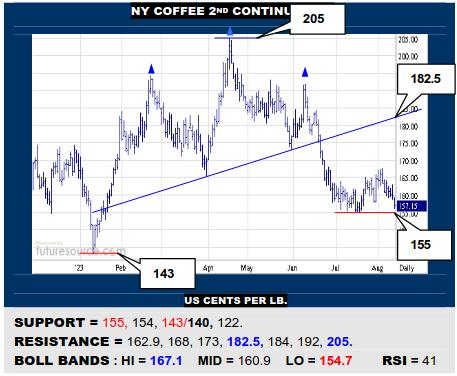

NY COFFEE 2ND CONTINUATION

Efforts to tame the Aug dip this week failed to take and Coffee has slid on towards the 155 support again. Hence Q3 really just looks like a correction following the Q2 crash and breaking 155 would resume the decline towards better weekly support at 140. Only closing over 163 would also vault the mid band and light a path to 173, if not 182.5.

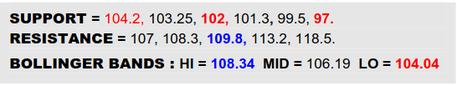

BLOOMBERG COMMODITY INDEX

A broader chart span just serves to emphasize the 109.8 divide even more as the key hurdle the B-Berg needs to overcome to really harness the turn already initiated in summer and secure ’23 as an inverse H&S. Success would then open the door to first the 118’s and in due course the mid 120’s. The problem of course is that now the Dollar has come back to life in the past month to hamper Crude in particular at a key time when it is on the verge of securing a big inverse H&S of its own. The resulting struggle is far from resolved but, due to several ex-downtrends here, would opt to watch the base neckline (102) as the critical defence that must endure to keep the commodity index propped up.

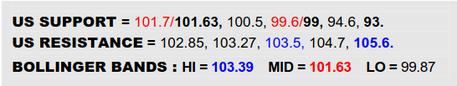

US DOLLAR INDEX

Briefly in Jly new Dollar lows seemed to offer the B-Berg the keys to the city but things changed rapidly as it narrowly missed a long term Fib retracement (99) and hustled back up, inferring a false breakdown instead. The Bollinger corridor is reacting by veering higher but, having shown poise in the 101’s lately, the greenback now needs to take its next step into the 103’s to start chasing the upper band and reaffirm its turn north with an eye to 105.6 as a next target in the recovery. If that occurs, it will spell trouble for the B-Berg. However, if denied a 103’s transition, mind the 101.7 ledge about to host the mid band as a vital pivot to undercut currency and offer the B-Berg those keys a second time.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.