Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

Still waiting to resolve the contest between the ’23 uptrend and the recent Q3 H&S before taking focus off the continuation chart of NY. The trend was fraying Tuesday but just about hung in there (23.40), the lower Bollinger now acting as rear guard (23.36). If it still gave way such that the H&S could claim victory, be increasingly wary of a spec long exodus with initial reach down to the 21.80’s and potentially later to the bigger 20.50 platform. Otherwise needing to reflex off the trend and over the mid band (24.19) to pluck a white rabbit from the hat.

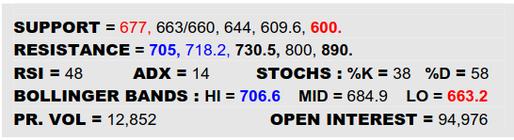

LONDON WHITES #5 OCTOBER 2023

As NY’s uptrend creaked, so too did the immediate 677 trough in London Tuesday. If this pivot gave way on a close basis, a small new double top would resolve and there appears to be plenty of open air underneath on back towards the better weekly brace at 600. A distinctly tottery scene then that is a stark contrast with the markets’ mode a week ago. Needing to hold on aboard 677 and witness Raws pivoting back into the 24’s to wrangle through this stumble and still have a shot at redemption by busting loose over 705.

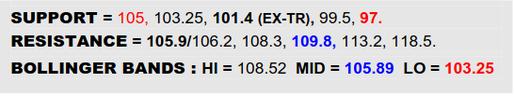

BLOOMBERG COMMODITY INDEX

As the 105 support ledge for the B-Berg was being stressed again Tuesday, a slew of components including Sugar, Coffee, Beans, Gold and Base Metals were creaking. Fortunately Brent gathered back a dip without hurting its $82.5 mid band so a tenuous balance was just about preserved but with the Dollar still eying the 103’s hungrily, the feeling of vulnerability is palpable. Temporarily using that Brent mid band as a confirming tripwire if 105 were gnawed away here, in which case wary of peeling on back to the ex-downtrend (101.4) before next trying to find an outcrop to grab onto. Must otherwise power clear of 106.2 to pop the overhead mid band here and suggest pulling out of a crisis.

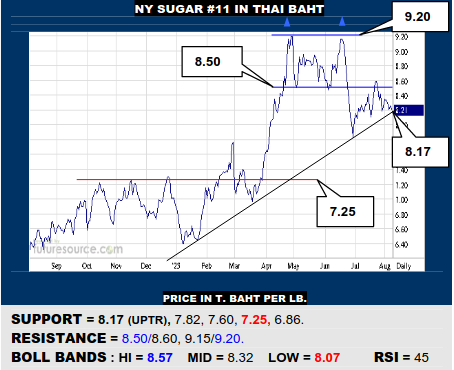

NY SUGAR #11 IN THAI BAHT

Back on the Asia circuit, Baht priced Raws have been largely refused by the 8.50+ double top and a distinctly H&S-like shape is emerging in Q3 that has the uptrend front and center (8.17). If the trend snapped to finish the H&S, beware a next leg down towards 7.25. Must cling to the trend and bust across those 8.50’s to otherwise spark new zest.

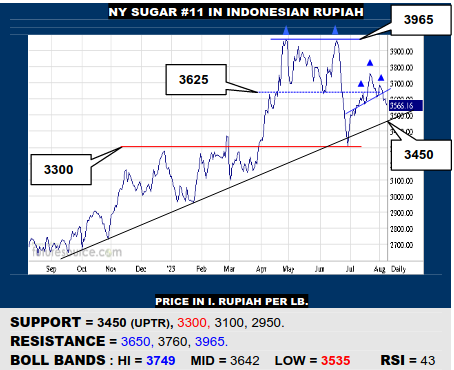

NY SUGAR #11 IN INDONESIAN RUPIAH

A more complete nearby H&S in Rupiah Raws that emphasizes the prior Q2 dual top but a little more leeway to the uptrend here (3450). That marks the final tipping point beneath which a retrieval would be very hard to do, setting the stage to exit the 3K’s. Alternatively needing to hack back up over 3760 to dispel the tops and open the door north.

NY SUGAR #11 IN CHINESE YUAN

A small but well marked H&S in Yuan Raws too and an uptrend in quite close attendance (1.67) that is thus very much on alert. If the trend gave way, the toppiness of mid-year simply could no longer be ignored and fallout to the 1.40’s would be catered for. Otherwise the trend must hang tough and trip an escape over 1.80 to save the day.

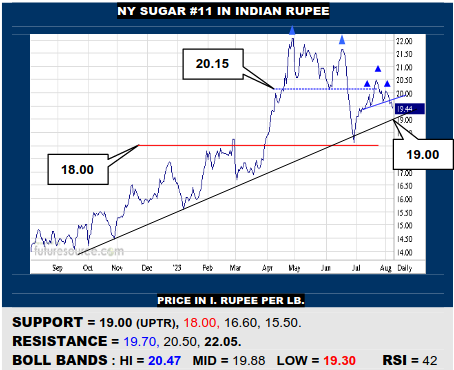

NY SUGAR #11 IN INDIAN RUPEE

A textbook small H&S for Rupee Raws similarly places the lengthy uptrend on battle stations (19.00). Breaking through would polarize the successive tops and warn of a market poised to press back below 18.00, the mid 15’s looking the next likely rendezvous. To shake off all the cobwebs will meantime demand a breakout over 20.50.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.