Insight Focus

- Chinese PET exports continue downward slide in June, H1 total exports still up versus 2022.

- The US market grew its share of Korean exports in Q2, with European sales also recovering.

- Brazil remained self-sufficient with low trade levels, Malaysian imports grew market share.

China’s Bottle-Grade PET Resin Market

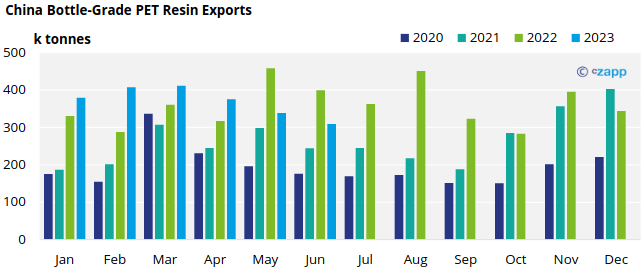

Monthly Exports

- Chinese bottle-grade PET exports (HS 39076110) totalled 309k tonnes for June, falling 9% versus the previous month and 22.5% down against June 2022.

- The latest monthly decline represents the third consecutive monthly decline in export levels since peaking in March this year.

- Algeria, a traditional sink for Chinese resin, was the largest destination market in June with around 17.3k tonnes, these levels were twice that seen a month earlier, although 17% below those recorded a year earlier.

- The UAE was the second largest destination with 16.2 k tonnes; an increase of 15% on May levels; slightly below levels seen in June 2022. The timing of the Eid holiday being the key element of seasonally across the MENA region.

- Exports to Russia slipped to 4th in the rankings, whilst June volumes represented a 25% month-on-month decrease, exports to Russia are still significantly above those seen before Russia’s war in Ukraine and pre-COVID levels.

- Looking at where volume has been lost versus 2022, Mexico, Philippines, and Algeria rank as markets with the largest year-on-year volumes decline. That said, current volumes for these markets are still significantly above where they were in 2021.

- Over the first half of 2023, exports to Mexico were still up 287% versus 2021 levels, despite slipping against record volumes in 2022.

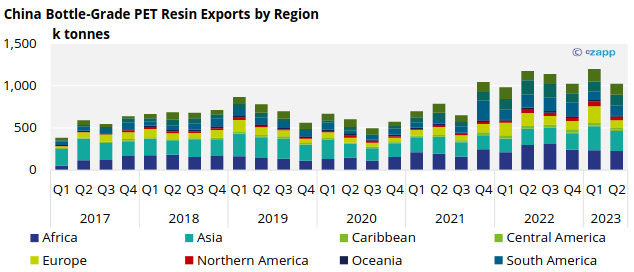

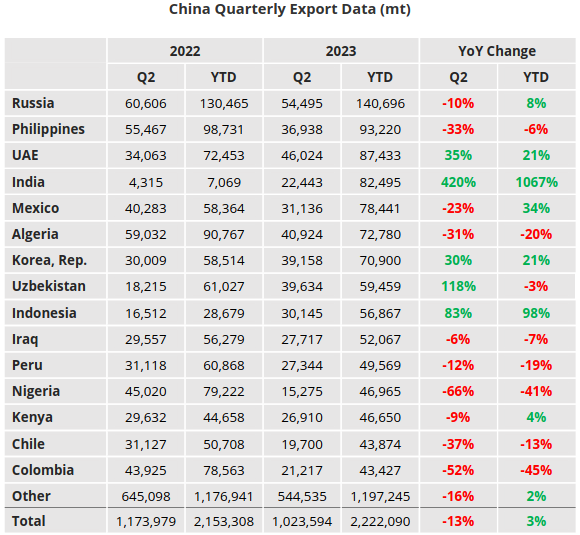

Quarterly Exports

- Looking at the latest full quarter, Chinese bottle-grade PET Resin exports totalled 1.02 million tonnes in Q2’23, down 14.6% versus the previous quarter, and down 13% from the same period a year earlier.

- Despite the slowdown in export sales in the second quarter, total year-to-date volume is still 3.2% up on 2022.

- Of the major importing regions, South America and the Middle experienced the largest quarterly gains, up 19.5% and 4.2% respectively.

- Whilst volumes to Russia & CIS, Africa, and Asia struggled to keep pace last quarter, slipping 13%, 4%, and 17% respectively versus Q1’23.

- Despite weakness in Q2 export sales, the addition of new capacity in China is expected to result in an overall increase in exports in the later part of this year and in 2024.

- New capacity is already in place from Baosheng and Sanfame, with further additions from Yishang and Billion expected in Q3’23.

South Korea’s Bottle-Grade PET Resin Market

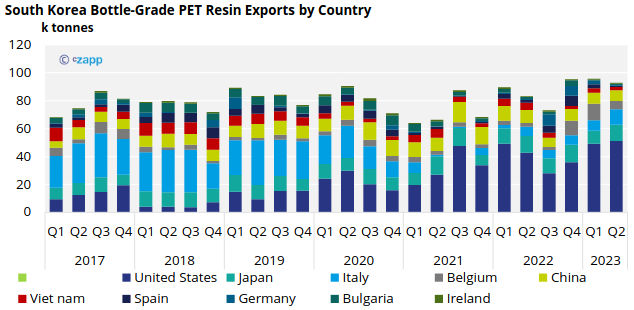

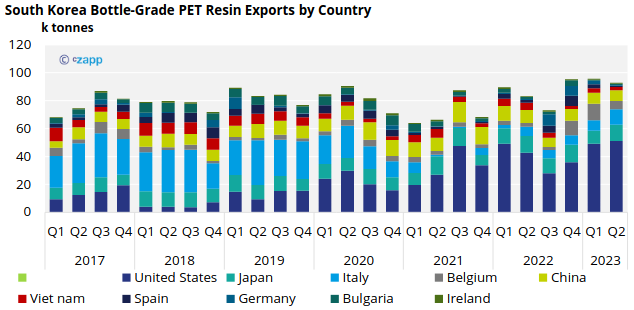

Quarterly Exports

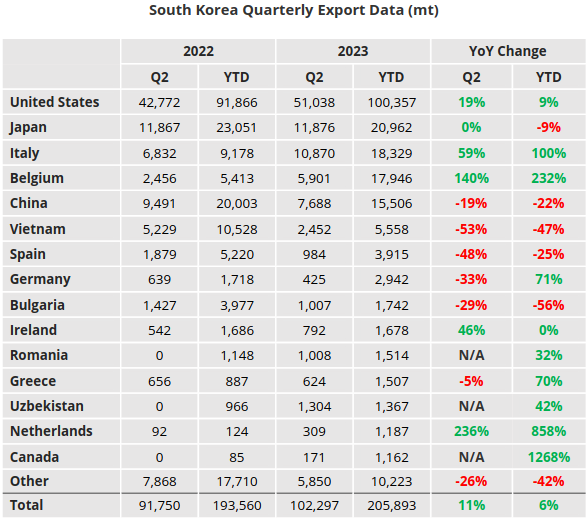

- South Korean bottle-grade PET exports slowed slightly in Q2’23, falling to 92.7k tonnes, a quarterly decrease of 1.3%; still up 11% year-on-year.

- South Korea’s largest export market remained the United States, which accounted for over 51k tonnes in Q2’23 (around 50% of total); representative of a 3.5% increase on the previous quarter and 19% up from the same quarter a year earlier.

- Japan and Italy were the next largest export destinations for Korean resin, recording 12k tonnes and just under 10k tonnes respectively.

- Exports to Italy have recovered strongly since the beginning of the year, with round 21k tonnes being sent in the first half of the year, more than twice that achieved in H1’22.

- The removal of India’s GSP trade status with the EU from Jan’23, and more recently the anti-dumping notice against Chinese imports, have opened the door to alternative origins that are now vying to fill the gap.

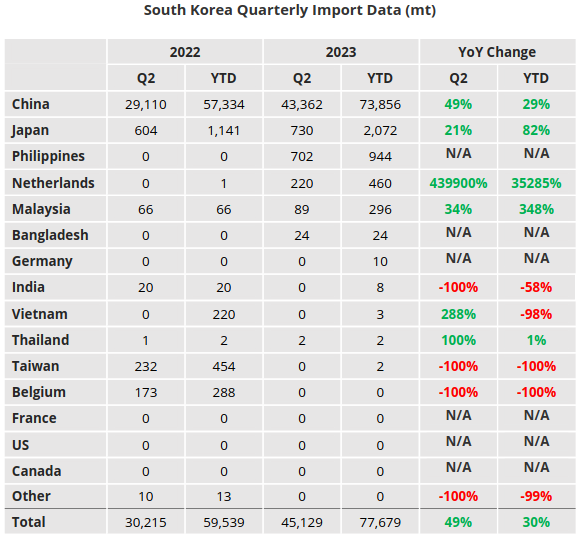

Quarterly Imports

- South Korea’s bottle-grade PET resin imports totalled over 45k tonnes in Q2’23, a marked increase on previous quarters, increasing 39% versus Q1’23 and 49% against Q2’22.

- China remained South Korea’s main resin supplier, supplying over 96% of Korea PET resin imports, equivalent to around 43k tonne in Q2’23; 74k tonnes in the first half of the year.

Brazil’s Bottle-Grade PET Resin Market

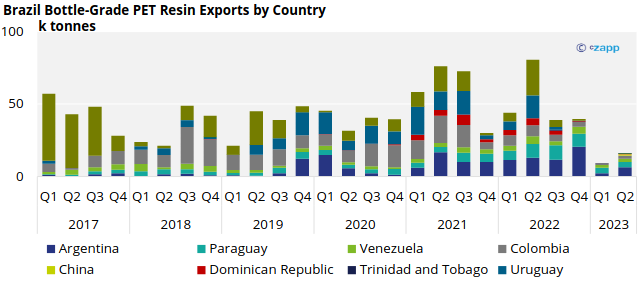

Quarterly Exports

- Brazilian PET resin exports increased to 15.8k tonnes in Q2’23, up 68% on the previous quarter’s extremely low levels, yet was still 80% down on Q2’22.

- Out if the 9 destination countries recorded, over 92% stayed within South America and the Caribbean.

- Top destinations in Q2’23 included Argentina, Paraguay, Venezuela, and Colombia.

- Argentina was the largest end market with 6.4k tonnes in the quarter, representing 40% of total exports over that period.

- Although the export volume had risen substantially versus Q1’23, exports to Argentina were still down 51% versus Q2,22.

- Paraguay was the second largest destination with 3.6k tonnes in Q2’23, followed by Venezuela with around 2.4k tonnes, all others were less than 2k tonnes.

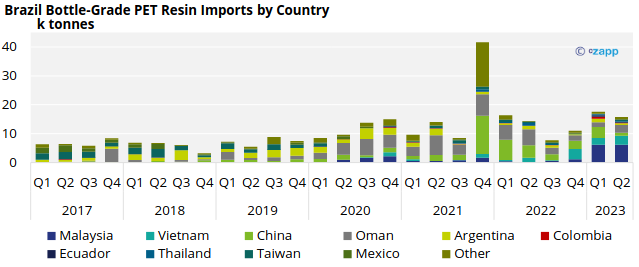

Quarterly Imports

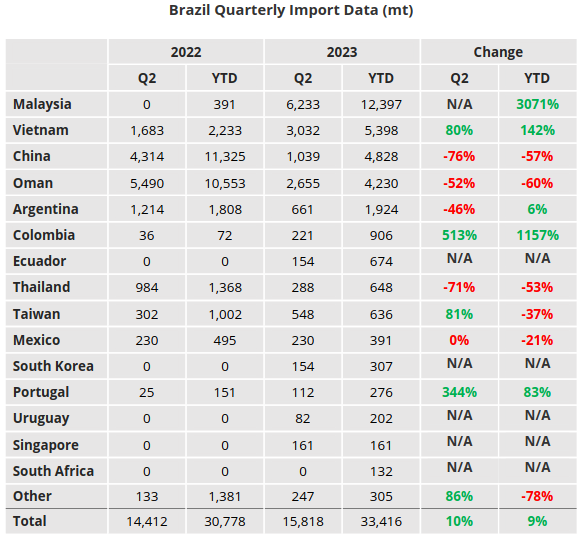

- Brazilian imports moderated into Q2’23 following the rebound since Q3’22, decreasing 10% to 15.8k tonnes, yet up 10% versus the same quarter a year earlier.

- Malaysia once again topped the list as the largest source of PET resin coming into the Brazilian market in Q2’23, followed by Vietnam, Oman, and China.

- Imports from Malaysia, which have steadily risen over the last 12-months, increased 1% on the previous quarter to 6.2k tonnes in Q2’23, from a base of zero tonnes a year earlier.

- Vietnam was the second largest import origin in Q2’23 at just over 3kt. Vietnamese imports increased 28% versus the previous quarter and were up around 80% against the same period a year earlier.

- Whilst imports from Oman have shrunk over the last 12-months, imports rose to there highest level in nearly 12-months, although they were still less than half that recorded in Q2’22.

- Those origins to have lost share over the latest quarter included, China, Argentina, and Thailand, with volumes down 73%, 48%, and 20% respectively.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com.