Insight Focus

- PTA futures yo-yo on volatile crude markets, recover through week.

- PET resin export margins into loss making territory as producers maintain rates.

- Destocking in key markets holds glimmer of hope for further demand growth into 2024.

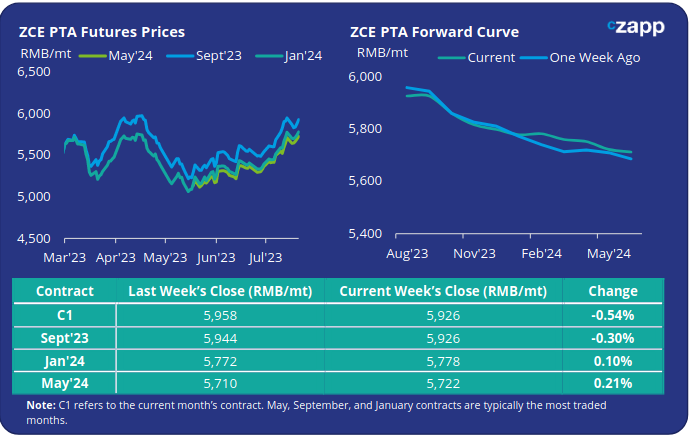

PTA Futures and Forward Curve

- PTA futures recovered strongly through the week after dipping Monday, reapproaching last Friday’s 15-month high. Since May, PTA futures have risen by around 14%; 8% since the end of June alone.

- PTA producers continue to run at relatively high operating rates, despite margins remaining low. Several plant restarts may also increase operating rates in the coming weeks, adding pressure to the supply side.

- Whilst polyester rates remain high, in the 90% range, supply and demand is relatively balanced. However, polyester demand has weakened due to the poor global macro-environment and accumulated inventory levels at textile producers.

- As a result, polyester operating rates are expected to come under pressure in Q4 and reverberated up through the chain.

- The weakening yuan and any potential deterioration in the global economy could put downward pressure on prices in the second half of the year.

- The forward curve continues to show a steady downward slope over the next 12-months. By Friday the Jan’24 contract was trading at a RMB 148/tonne discount to the current month.

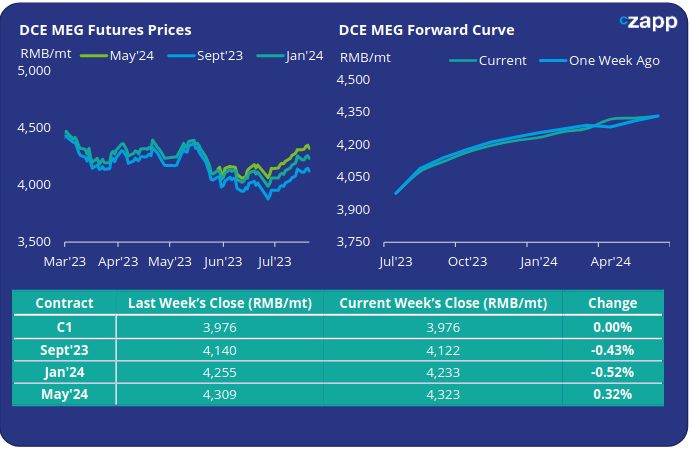

MEG Futures and Forward Curve

- MEG Futures were flat through most of last week, mute to the swings in the crude oil and commodity markets.

- Market fundamentals continued to show improvement, as some units shut for maintenance, and polyester plant operating rates reached new highs.

- This comes despite port inventories moving above the million-tonne mark once again; last week port inventories increased 1.33% last week to 1,006k tonnes.

- Future price direction will not only rely on crude’s path over the coming months but whether the high polyester operating rates can sustain in the face of slow textile offtake.

- The MEG forward curve continues to show prices steadily increasing over the next 12-months. By Friday the Sept’23 contract was holding a RMB 146/tonne premium to the current month; Jan’24 holding a RMB 257/tonne premium.

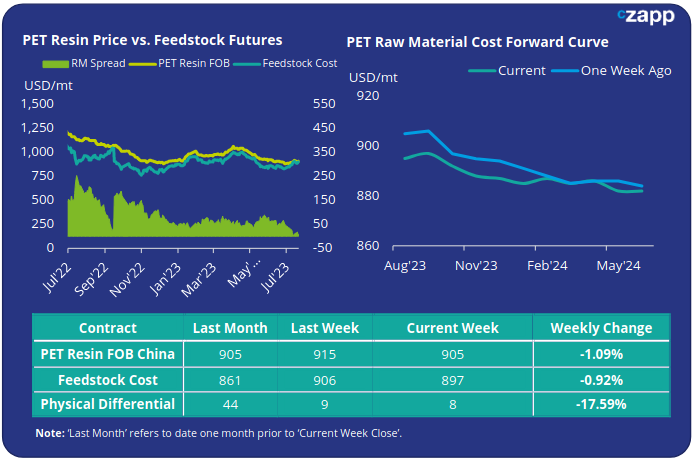

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices slipped early last week, easing USD 20/tonne to an average of USD 905/tonne by Friday.

- The weekly average PET resin physical differential to future feedstock costs stayed relatively flat versus the previous week, up less than USD 1/tonne to average USD 12/tonne for the week. By Friday the daily spread had fallen to just USD 8/tonne.

- The raw material cost forward curve shows a marginally declining cost based through the remainder of the summer and into Q1’24.

- At Friday’s close, Jan’24 raw material costs were at a USD 10/tonne discount to the current month’s contract.

Concluding Thoughts

- Chinese PET resin export margins continue to plumb new depths, off-the-back of weak demand, new capacity and strengthening upstream costs.

- Discussions are now around, how long can operating rates maintain current high levels of production whilst producers see low margins, or losses.

- However, expectations are for Chinese producers to follow typical seasonal patterns with scheduled maintenance through September and November.

- Even with new capacity coming on-stream inventory levels at producers are far from excessive.

- And whilst export volumes have steadily declined in recent months, reaching a little over 309k tonnes in June, destocking in key marking, including Latin America may support future demand.

- In the meantime, export margins are expected to remain close to cost level through to December, with prices closely tracking raw material movement.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.