Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

Having found the preceding pennant an adequate new support ledge earlier this week (23.70), NY pushed ahead deeper into the 24’s double top Thursday. This is making a similar impression when converted to several other Sugar currencies but there is a key exception, that being B. Real priced Raws that need to pop 1.20 to take an equally important next step. Nonetheless aimed for the upper Bollinger band here (25.01) and only suddenly diverting back out of the 24’s again would sound the alarm at 23.70, which has the mid band lurking close by (23.64).

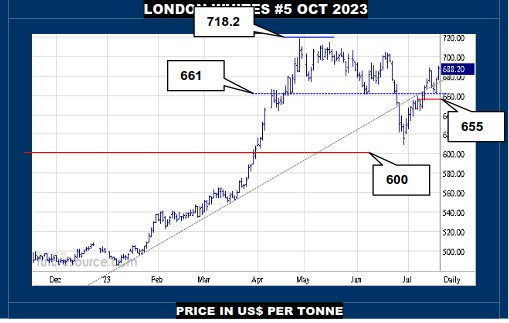

LONDON WHITES #5 OCTOBER 2023

On the heels of an outside day rebound from the low 660’s the session before, London quickly dialed in its sights on the 688 resistance Thursday. Could do with a bit more to call a clear cut breakout here but it would certainly be a useful way to finish the week if duly achieved, then hailing a flag of sorts that would point on up to the 718.2 April peak with even an eye towards the spot 730.5 apex set at that same time. Only a couple of days fumbling the ball near 688 would instead raise the anxiety level again and warn to keep minding that 662-655 span.

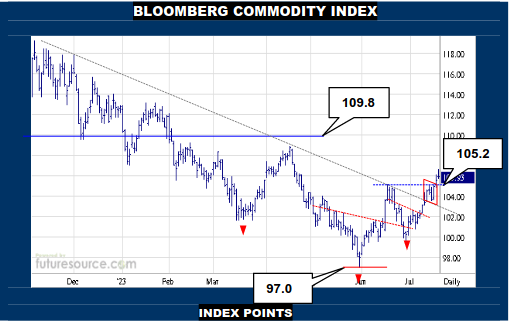

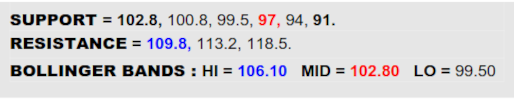

BLOOMBERG COMMODITY INDEX

The B-Berg has started Q3 very well with a downtrend breakout and follow-up flag while meantime proposing ’23 generally as an inverse H&S pattern. With Brent adjacently overhauling a tricky $78’s hurdle to improve its own basing status, what’s not to like as the commodity scene starts to simmer? The answer to that is, as usual, the Dollar. No screeching alarm in that respect yet but the greenback is probing prior 100.8 lows. If halted there, things would be all the better here and the road to 109.8 would beckon. Alas, if the Dollar vaulted 100.8 and especially if proceeding on over the 101.60’s gap, its’ retrieval would look a significant one that could steer the B-Berg back towards its mid band (102.8).

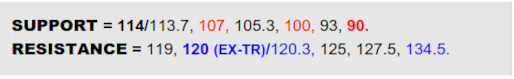

NY SUGAR #11 IN BRAZILIAN REAL

Real priced Raws have extended the recovery from a 107 Fib retracement catch at the end of Jun but still appear to face a pivotal crossroads around 120 (1.20) where the ex-uptrend is about to converge with the border of the Q2 top shape. Stride on by and the rejuvenation would look increasingly persuasive to then hone focus on the path ahead to the prior 134.5 high. Only if intercepted at 120 would there be cause for more nail biting as one would then have to entertain the chance of this being the Achilles heel of ₵/lb too. In that case, keep a very keen eye on the 114 area underneath, a rebuke from 120 that broke on below there disrupting the mid band, in which case itwould instead suppose a Jly correction had hit its crest.

BRAZILIAN REAL / US DOLLAR SPOT MONTHLY

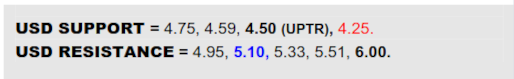

VALUE : 4.805

Going supersized overview here (monthly bars) as the Dollar continues to dab the brake just clear of a 4.75 ledge. If it can stay away from 4.75 the remainder of Jly, an inside month could occur that would help significantly allay existing concerns about the prior years’ toppy terrain in the 5’s and the consequent threat of testing the decade long uptrend situated at 4.50. So if managing to post that inside month, focus would swivel back up onto the 5.00-5.10 span as an escape hatch higher. Only if gnawing on below 4.75 next week would the pressure on the Dollar be verified and intensified to insist that the long term trend confrontation was going to happen.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.