Insight Focus

- Europe’s heatwave and tourism boost consumer demand; resin buyers cautious to restock.

- Despite weak macro environment, non-Chinese imports surged in May to record levels.

- European PET resin margins to remain challenged through H2.

European PET Producers Pin Hopes of Heatwave Boost

European PET resin producers continue to suffer from an extremely weak market, with domestic resin demand a “disaster”.

Despite signs of improvement at the beginning of the month, activity dissipated rapidly as buyers and traders instead headed away for holiday.

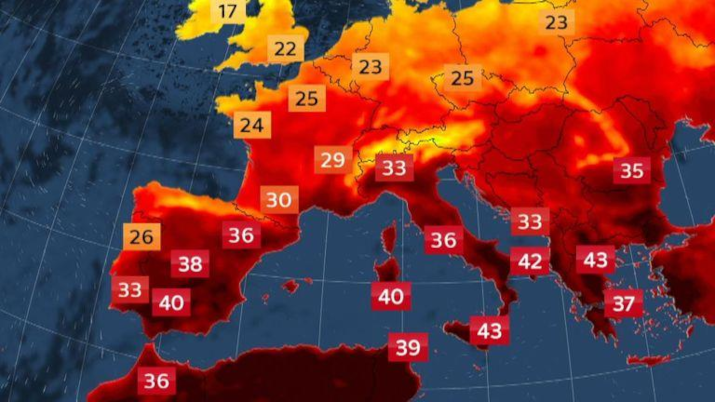

The current heatwave that is setting record high temperatures in Southern Europe, and a strong recovery in European tourists numbers this summer, holds out a glimmer of hope for a late season demand boost.

Recent data showing levels in Italy are now 5% above pre-COVID 2019 levels.

However, any downstream improvement has been slow to make its way back up the chain. Preform demand is reported to be only marginally better, and relatively unnoticeable at the producer level.

As the market enters the quieter holiday season, off-peak is now firmly on the horizon.

Customers are cautiously refraining from restocking, preferring instead to buy hand-to-mouth, despite any sales uplift resulting from the hot weather.

Unless the hot weather sustains, generating a demand rally in the last days of the summer, producers which are already under margin pressure may be forced to decrease production.

Imports Continue to Flood into Europe; Vietnam, Turkey, and Egypt Displace Chinese

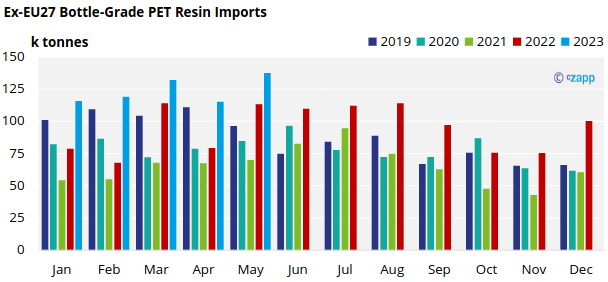

On the flip side, extra-regional imports of bottle-grade PET resin (HS 390761) showed no signs of slowing into the early part of the summer.

Imports from outside the EU27 block reached over 137k tonnes in May, increasing 21% on the same month a year earlier, and up nearly 37% year-to-date versus 2022.

This comes despite a slowdown in Chinese exports headed to Europe since the EC’s anti-dumping notice against Chinese resin back in March.

Instead, displaced Chinese resin has been substituted by volume from Vietnam, Turkey, and Egypt. Indorama, Europe’s largest PET resin producer, also has assets in both Egypt and Turkey.

So far, the EU27 block recorded around 620k tonnes of PET resin imports in the first 5-months of the year.

If the trend continues, 2023 looks set to for another record year for imports, easily surpassing previous record years in 2019 and 2022.

European PET Spot Prices Consolidate Ahead of Potential Rise

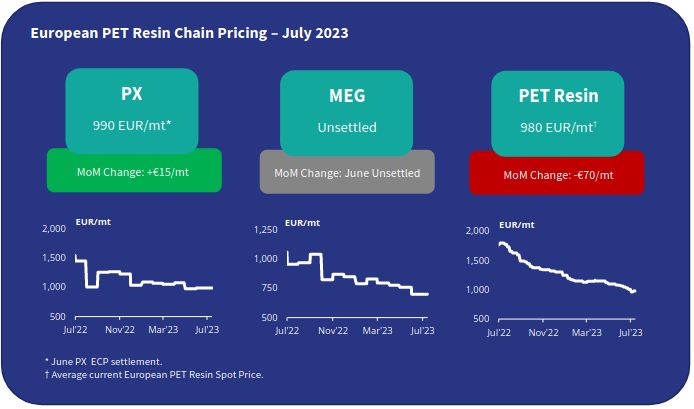

The current market price range is assessed at EUR 960 to EUR 1000/tonne, with an average price of EUR 980/tonne, down EUR 70/tonne versus mid-June.

As always, depending on volume and location, prices varied, with some offers hitting as low as EUR 930-950/tonne early July in Northwest Europe.

Having hit what could be a near-term market bottom, prices look to be regaining slight upward momentum, moving closer to the EUR 1000/tonne mark.

Producers are now trying to increase prices; deals as high as EUR 1015/tonne were reported in Northern Europe,

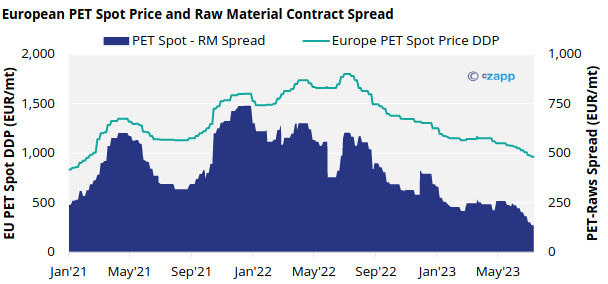

Despite the continued decline in PET resin prices over the last month, the June PX European Contract Price increased EUR 15/tonne to EUR 990/tonne squeezing the PET-raw material spread to a multi-year low.

Most producers have suffered low margins, and even losses, for the last 9-months. To see any recovery in margin over the remainder of ‘peak season’, PET resin prices need to stabilize and PX prices need to come down markedly.

Although PET prices are showing signs of an upward trend, mirroring the turnaround in Asian prices over the last week, upstream costs may also see increases limiting the ability of PET producer to recover margin in July.

Is it cheaper to import?

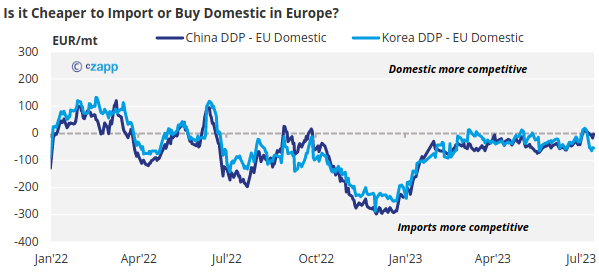

Chinese PET export prices rebounded on strengthening raw material costs last week, with current daily prices averaging USD 905/tonne, representing a slight increase of USD 5/tonne since mid-June.

Asian PET resin prices look to have reached a near-term low. Asian export margins are now close to cost level, and raw material costs show minimal downside on the futures forward curve (see latest weekly report).

Indicative import prices typically range EUR 900-930/tonne CIF customs cleared NWE, equating to EUR 980-1010/tonne DDP, based on current average Asian export prices.

Gradual erosion in the US Dollar strength over the past month, has boosted the EUR/USD exchange rate favouring imports.

That said, with the sharp decline in European domestic prices, the delivered arbitrage between Asian and European prices has closed, based on mid-prices.

At the beginning of the month European prices were cheaper than imports, showing that domestic producers had potentially overdone price reductions.

As we stand a price correction to the upside looks to be underway, which may help restore a small premium over imports for European producers.