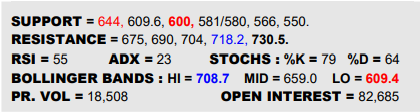

NEW YORK SUGAR #11 OCTOBER 2023

The battle raged in the low 24’s terrain Thursday as NY attacks the prior Q2 double top. Asking that rather than just the 24.01 Oct pivot, the market also hurdle the 24.23 figure set on the very same day (Jun 6) in spot continuation terms to really make headway that would dispel the obstacle and bolster the sense of greater upside freedom into the 26’s on the heels of shedding the Jly contract. The macro is doing its best to help meantime but not quite there yet so keep minding 23.10 underfoot as a likely trapdoor to undergo an abrupt new slap lower.

LONDON WHITES #5 OCTOBER 2023

London has made more of an impact back into its prior double top over 661 and tacked on further gains Thursday. This gives the impression of reach on up to the 700’s in the event of suitable compliance from NY and in that event one might even then start to look upon Q2 as a big flaggish type correction on the weekly scene that would measure into the 820’s. Bated breath watching the stateside conflict therefore but, until / unless that resolved well, always spare a thought for the 644 pivot as a reversal tripwire back towards 600 instead.

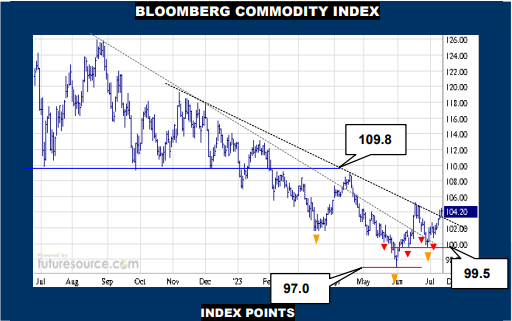

BLOOMBERG COMMODITY INDEX

A scrappy spell involving two inverse H&S patterns in the past couple of months has been reassured by the B-Berg loosening the second of its downtrends as the Dollar meanwhile probes double digits. With currency seemingly in the throws of a next interim step down headed towards 94/93, the commodity index duly looks capable of dispatching a nearby 105.2 apex and merging nearly all of ’23 into a much bigger inverse H&S to set sights on 109.8. Only if Brent’s emergence over $78 failed to endure and 105.2 warded off several challenges here would the basing credentials come into question, warranting an eye on the mid band (102.45) for more serious signs of fizzling.

NY SUGAR #11 IN BRAZILIAN REAL

As noted last week, there was a hopeful rumble to the fact that the May-Jun setback was caught precisely at a Fib retracement (107) on Real priced Raws to prompt the recent revival. Even so, there wasn’t much barring the way of the initial stage of the bounce but this is changing now as the mid band lies just overhead (115.7) as a first true test of the reaction. Push by it and it would suggest further gains to the 120 area to test the ex-trend (119) and initial top border (120.3). However, if blunted by the mid band here adjacent to 24.23 in ₵/lb., so the warning light would come on, then wary that the early Jly hop merely gave the market a corrective breath before a new swipe lower could break that 107 trough and infer risk on down to 90.

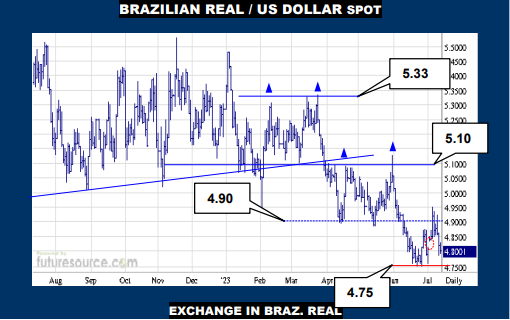

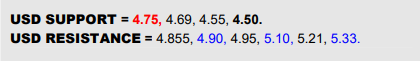

BRAZILIAN REAL / US DOLLAR SPOT

VALUE : 4.80

Though managing several jabs into the 4.90’s, the Dollar failed to find any lasting traction there and has dipped back to plug a low 4.80’s gap. Watch what happens next closely. If after filling the gap, the greenback immediately lunges into the 4.90’s again, it would be a much more encouraging sign and there would be better reason to cast off the Q2 dual top pattern and look for a further foray to try the preceding Q1 top rim at 5.10. If there was no swift response to the gap fill however, the recent bounce would look simply corrective and 4.75 would be left extremely prone as a tripwire on down into the 4.50’s to maybe

est the decade long uptrend.