Insight Focus

- The United States has announced a second TRQ allocation for this year.

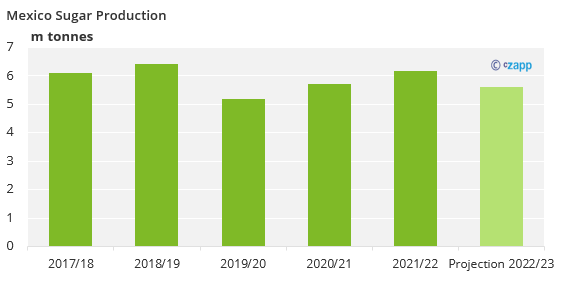

- We now project Mexico to produce around 5.6m tonnes of sugar.

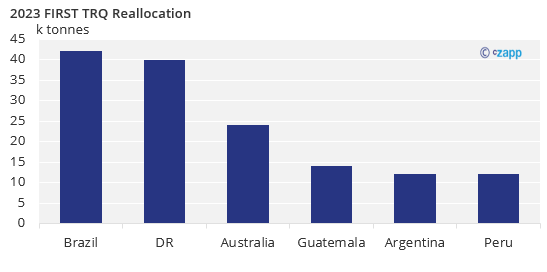

- Brazil, DR, and Guatemala may be winners from this move.

The United States has announced a second reallocation of the amount of raw sugar it will allow to be imported under its zero duty Tariff Rate Quota (TRQ) program for this year. A total of 125k tonnes will be reallocated. The United States has only announced how much sugar will be reallocated but not to whom.

What is the TRQ Program?

The United States allows 1.117m tonnes of sugar to enter under the TRQ Program annually. The TRQ Program allows raw sugar with a polarization below 99.49 to enter the United States with a no tariff. Most sugar-producing countries receive an allocation from the 1.117m quota. Usually, Brazil and the Dominican Republic receive the highest allocation. When Mexico (United States’ largest sugar supplier) or other countries fail to supply sufficient sugar to the USA, un-used TRQ can be re-allocated to other countries.

Mexico’s Poor Cane Crop

Mexico is a major cane-growing country. Most of Mexico’s surplus sugar flows into the US duty-free, with American corn syrups going the other way. In 2022/23, America believes it will need 1.26m tonnes of Mexican sugar to arrive. However, this year’s Mexican cane harvest is proving tricky.

In March, I wrote about Mexico’s poor sugar production. At the beginning of the season, we estimated Mexico would produce around 6.05m tonnes of sugar this year. Optimism behind this figure has dwindled. We now think Mexico has produced approximately 5.6m tonnes of sugar. This harvest would be the second smallest in the past six seasons..

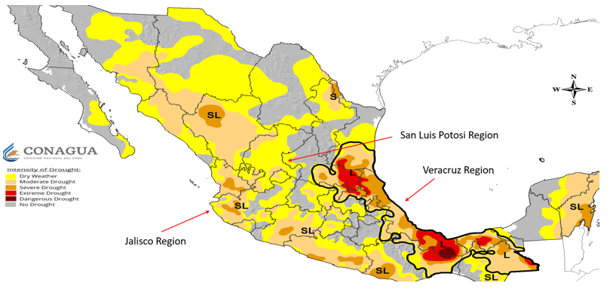

Weather was dry in the Mexican cane regions of Veracruz and San Luis Potosi through the middle of 2022, which limited cane development.

Source: CONAGUA

Around 60% of the cane isn’t irrigated and so was exposed to the full force of the dry weather

Who Benefits from a TRQ Reallocation?

The countries that benefit from a TRQ allocation this year are the same countries that fulfilled their quota consistently in the past few years and received a reallocation during the last occurrence. Brazil and the Dominican Republic are the countries that benefited the most from the previous reallocation. Both countries were allocated an additional 40k tonnes of raw sugar. Countries that usually receive reallocation, too, are Australia, Guatemala, and Peru.

TRQ reallocation effect on world market

The world sugar market is currently facing a production deficit. We now forecast global production at 178.3 m tonnes and global consumption at 179 m tonnes for

2023/24, leaving an 800k tonnes deficit. The TRQ reallocation means more sugar will divert towards the US market, meaning even less sugar is available for

world markets.