Insight Focus

- Europe holds auctions worth 900 million euros to import green hydrogen.

- Brazil invests in innovation hubs to promote new technologies.

- Researchers and companies launch a project to produce hydrogen from ethanol.

In recent months, Leandro Borgo, president of the Brazilian Association of Hydrogen and Green Ammonia, has spent a good part of his time in online meetings with government representatives from Germany and other European countries, as well as with Brazilian authorities. The goal is to discuss participation in sector auctions and contracting models for clean energy in Europe.

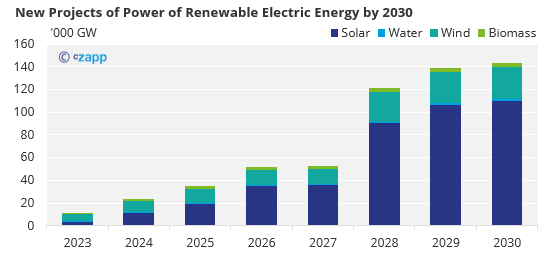

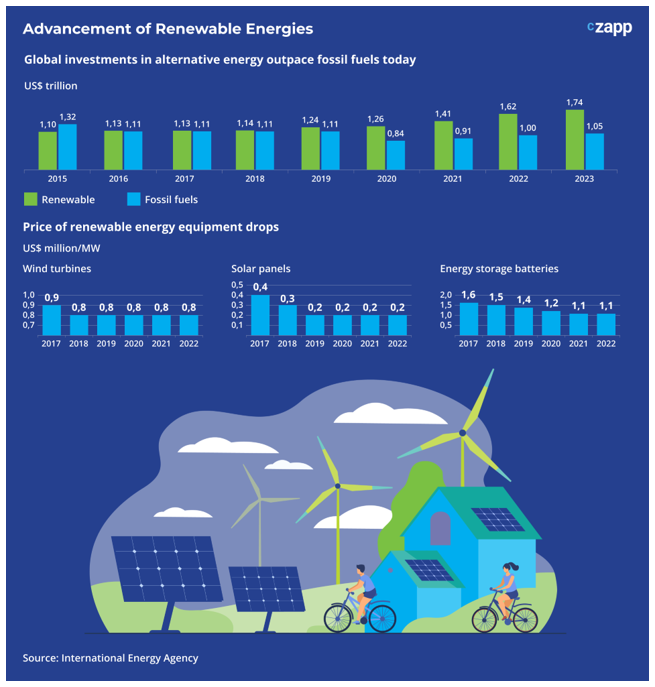

Brazil has presented itself as a player particularly interested in participating in the supply of green hydrogen, obtained from the electrolysis of water carried out with renewable sources, in which the country is rich. Brazil’s production of renewable energy will continue to grow – by 2030, the country should generate an additional amount of almost 110,000 GW of solar energy, 28,000 GW of wind and 3,500 GW of biomass.

Source: Aneel

The discussion about exporting hydrogen come at an opportune time. Germany held the first international auction to import green hydrogen in December 2022 and intends to promote others until 2033, through investments of 900 million euros. In April this year, the Netherlands announced that it will make 300 million euros available to participate in the auctions – countries such as Belgium and Austria have revealed their intention to follow in the footsteps of the Dutch government.

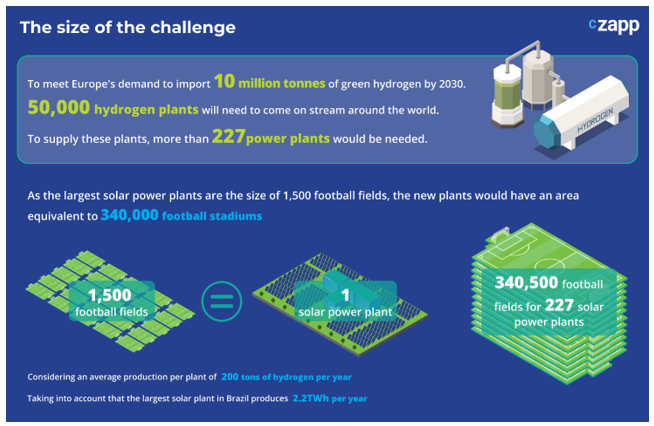

The European Union should demand the import of 10 million tonnes of green hydrogen by 2030. Since production has only started to gain momentum now and many projects still need to get off the ground, this is quite challenging. Considering the current capacity of green hydrogen plants of 200 tonnes per year, thousands of plants distributed around the world would be needed to meet this demand. Even if the import target is oversized, it will still be necessary to work hard to accelerate hydrogen production – and those who start in front can have competitive advantages.

“Europe is in fact willing to decarbonize itself, which has been opening windows of opportunity for the production of green hydrogen in Brazil, where the production of renewable energy has grown a lot in recent years”, says Borgo.

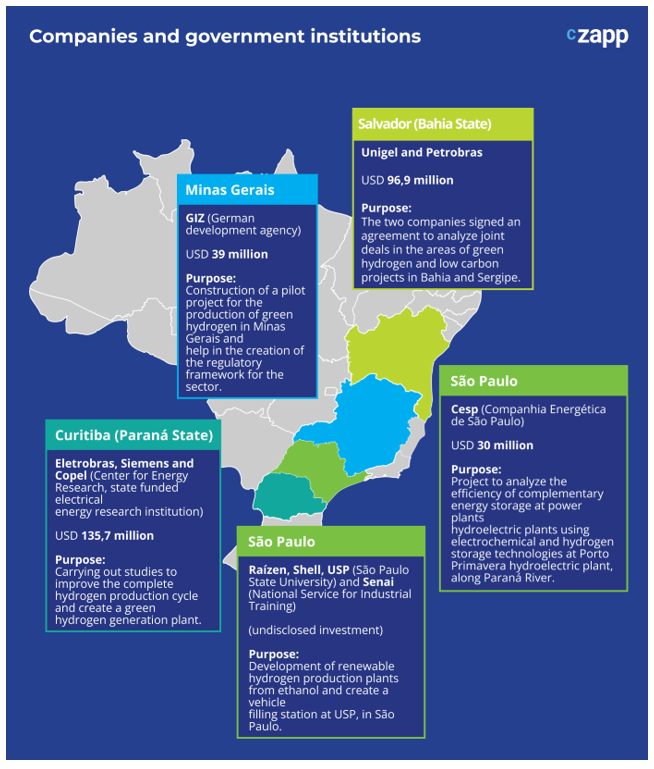

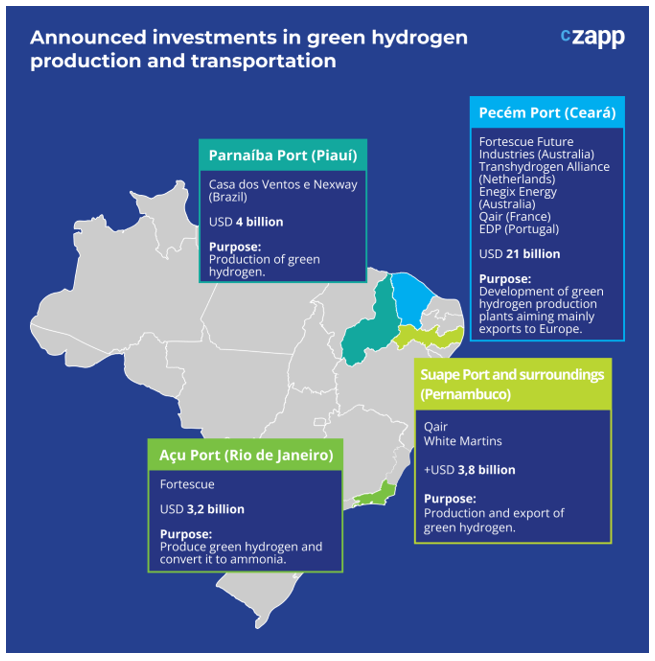

A group of players have been joining efforts to set up the green hydrogen chain in Brazil. The northeastern states, with closer access to the European continent, took the lead, with ports and companies investing in new projects. In Pernambuco, White Martins started operating a green hydrogen plant, initially to serve the local market.

Other companies, such as Unigel, intend to start production next year – Petrobras signed an agreement with the company to study the joint realization of business in green hydrogen and low carbon projects. Casa dos Ventos, a wind energy company, installed 80 turbines to supply Unigel, in Bahia. Qair, in turn, announced investments of more than BRL 3.8 billion in green hydrogen plants in the Northeast with the goal of serving the international market. Most projects, however, should take off in the coming years.

At the same time, the port of Suape is preparing to launch a green hydrogen innovation hub together with Senai and the private sector. One of the main objectives is the creation of new technologies that can help reduce production, storage, and transportation costs.

Czarnikow has just announced its participation in the project. “Our intention is to transport hydrogen, domestically and abroad. We also intend to connect green hydrogen producing plants to companies interested in buying it, helping to boost the production chain in Brazil”, says Gabriela Andri, head of energy at the company.

More progress is needed, however, for the market to consolidate. To begin with, the supply chain needs to get stronger. Although the sector already has suppliers of essential equipment, such as electrolysers, it still needs to expand the manufacture of tanks, compressors and refrigerators, for instance. “Something similar happened with the wind and solar energy sector, in which there was an expansion of the entire chain as the market was structured, with cost reduction and scale gain”, says Borgo. “The same should happen with green hydrogen.

The creation of tax incentives is also on the agenda. Entrepreneurs from the renewable energy sector recently met with Tarcísio de Freitas, governor of São Paulo, to discuss the matter. One of the main intentions is to reduce the final cost of green hydrogen — at the moment, it costs twice as much as hydrogen produced from non-renewable sources.

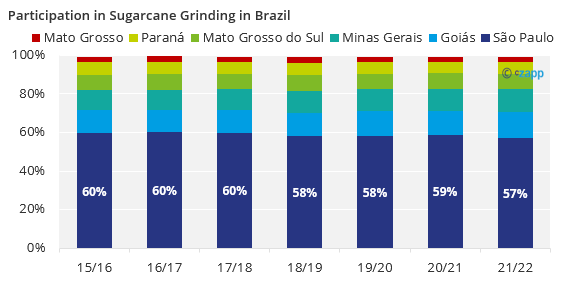

On the occasion, the generation of hydrogen through the burning of sugarcane biomass and the use of ethanol was also discussed. In São Paulo, after all, there is no shortage of sugarcane. The state is responsible for almost 60% of sugarcane production and half of ethanol generation in Brazil.

The starting point has already been given to produce hydrogen from ethanol. A consortium formed by Raízen, Shell, Hytron, Senai and USP (University of São Paulo) launched a program for the conversion of ethanol. The pilot plant is set to open in August on the university campus. The intention, at first, is to supply an experimental bus, fueled with hydrogen, which should run around USP.

In Brazil, hydrogen should be used as a source of energy for transport and a series of other purposes, such as the decarbonization of the oil and gas sector, mining and steel. To make the scenario of medium and long-term opportunities viable, however, the country will need heavy investments, on the order of BRL 200 billion by 2040, including a significant additional capacity for generating renewable energy, as indicated by a study by McKinsey. In that sense, it will be necessary to race against time.