Insight Focus

- Global wheat price volatility remains scarily high.

- The risks associated with wheat price volatility can be huge.

- Making the best decisions for your individual business can be critical for success.

Introduction

Wheat price volatility has been crazy since Russia’s invasion of the Ukraine. Many businesses have been forced to pay much greater attention to wheat markets as a result.

However, it is worth noting that values, although driven to extraordinary levels in 2022, have seen significant fluctuations for a number of years as access to information has become easier.

Whether a farmer producer, livestock feed compounder, miller, baker, food & beverage provider or retailer to the end consumer, the risks have been there and are likely to remain.

An understanding of how to manage these fluctuations are vital for making the best margins whatever your place in the supply chain.

Prices over recent years

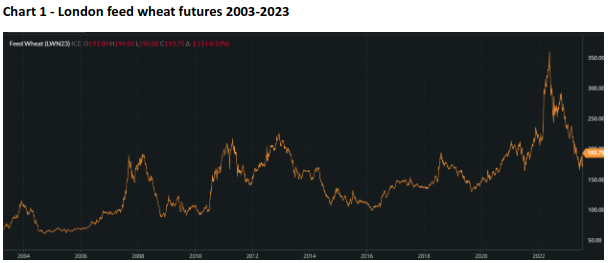

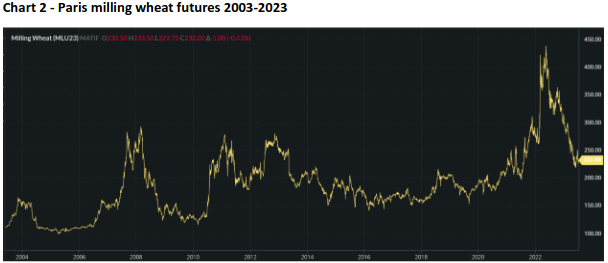

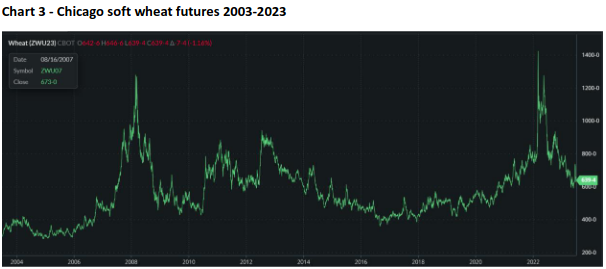

The charts below show wheat prices in London, Paris and Chicago over the last 20 years.

Source: Barchart Commodityview

Looking at the price charts above show the extraordinary movements that have been seen over the last 20 years.

In terms of significant percentage volatility out of 20 years, at least half have seen major price fluctuations.

As the World was rocked by Putin’s invasion of Ukraine, wheat markets surged and became mainstream headline news. Having been involved in the wheat trade for well over 20 years, my own experiences have reminded me that, although 2022 was unusual for the impact on values, we have experienced other seasons with incredible, unforeseen volatility.

Managing the ups and downs

Knowing how to react to crazy and often business critical price hikes or collapses, demands a calm head and discipline.

2007/08 and 2022 are perfect examples of when to take a step back and think of the bigger picture and consider simple economics.

2007/08

2007/08 saw Global wheat stocks shrink to a mere 119.36mmt (million metric tonnes) from 610.60mmt of production (Source USDA). Only to rebound for 2008/09 with 682.37mmt produced, allowing a restocking at the season end to a more comfortable 145.25mmt.

As production estimates were released around the world and stock levels became a concern, we saw a huge price hike in the latter months of 2007.

Inevitably, as farm producers across continents saw this, they planted a greater number of acres, in the hope of continuing record prices for the following 2008 harvest.

At the same time, the largest buyers realised that in the final throes of 2007, wheat was simply unaffordable for the poorest nations. Populations need to eat, but if you cannot afford it, you simply have to buy and thus consume less.

As the price graphs above show, the second half of 2007 saw incredible price rises. However, the simple prospect for an increase in supply, at the same time as the inevitable demand erosion, saw a collapse in prices during the first half of 2008, as the outlook for supply vs demand became more stable.

2022

In 2022, panic set in following the February invasion of Ukraine.

Buyers of wheat or its products were panicked by many into thinking that wheat prices were heading to the sky for eternity as Putin’s war destroyed world wheat trade. We have written articles as prices reached impressive heights, driven by these fears (See 4th May ’22 Wheat’s war-driven rally may be nearing the end). Ultimately, prices will not rise indefinitely once prices hit levels where buyers cannot continue to buy in volume.

Reports suggesting a collapse in the Black Sea grain trade and exports, still at times headlined, could be considered an overreaction at times (See 2nd November ’22 Reasons Putin does not want to stop grain corridors).

Inevitably, as we saw all those years ago in 2007 & 2008, again in 2022 we experienced, what goes up will ultimately come back down.

Conclusions

Modern technology provides us with constant, up to date wheat news from all corners of the world. ‘Sorting the wheat from the chaff’ (See 24th August ’22) can often seem a nigh on impossible task, from which to make the best business decisions.

A simple step back, to assess what is truly critical, as opposed to falling into the trap of ‘hope, fear and greed’ (See 13th July ’22 How to stay calm in a crazy wheat market), will inspire us to make measured, margin conscious decisions, at the right time for our businesses.

Whether prices are at the extreme highs or lows, if it is ‘too good to be true’ for a buyer or a seller, it probably is!