Insight Focus

- The shipping industry is in a race to decarbonise as new regulations are rolled out.

- Some container carriers have made huge investments in new technologies.

- Czapp takes a look at the companies that are leading the pack.

We ranked the top container carriers in terms of their efforts to decarbonize using metrics including net zero commitments, investments in new technologies and new vessel order books. Here are our top six… and the results may surprise you.

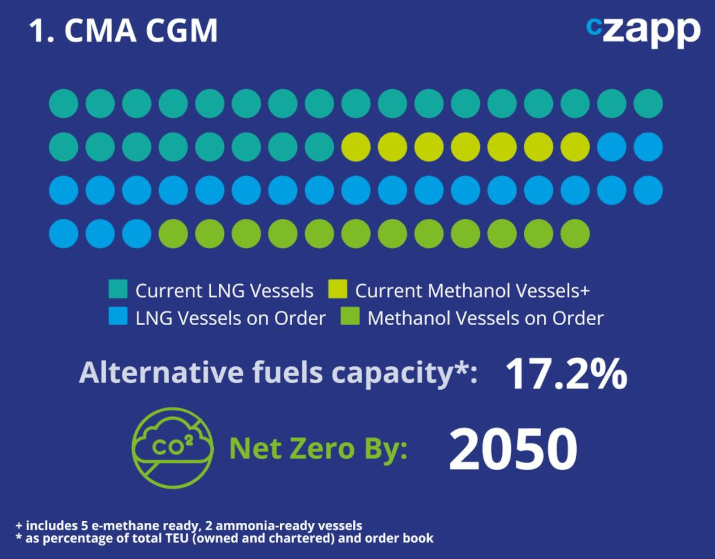

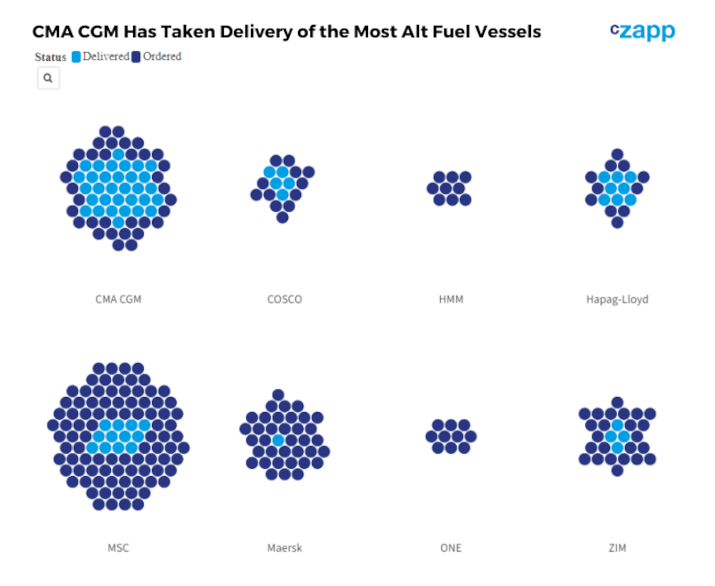

Although CMA CGM is the third-largest carrier globally by capacity, it got off the ground quickly when it came to adopting new fuels. Already, it has 25 LNG-ready vessels in its fleet, having taken its first delivery in 2020. Although it has not taken delivery of any methanol vessels yet, it placed its first order for a fleet of six 15,000 TEU ships in 2022 and has since ordered a further seven. The first vessel will be delivered at the end of 2025, with the remainder scheduled for 2026.

While not the biggest adopter of methanol (that honour goes to Maersk), CMA CGM is not far behind, with 12 ships in its orderbook set to be delivered by 2026. Notably, it also owns five e-methane ready and two ammonia-ready ships. In addition, it is also diversifying its alternative fuel ambitions with a hefty orderbook of LNG-enabled and dual-fuel vessels.

With a goal of achieving 10% alt fuels by 2023, the carrier has smashed this target at over 17% of its current fleet and order book. CMA CGM has also pledged USD 1.5 billion through its Fund for Energies to accelerate the energy transition.

MSC, the world’s largest carrier, is playing catch up but is betting big on LNG. The shipping giant took delivery of its first dual-fuel LNG vessel – the 14,280 TEU MSC Washington – last year. The carrier currently has about 150,000 TEU of LNG-enabled vessels in its fleet.

Although the alternative fuel penetration in the pipeline looks low at just 12% of total capacity, that’s mainly because MSC owns and charters so much. In fact, its order book of LNG vessels surpasses 1.1 million TEU, with over 177,000 TEU due for delivery in the second half of 2023 alone.

It looks like MSC is putting all its eggs in the LNG basket but it says it is looking at a “multi-pronged approach” that considers several different energy types, including synthetic LNG, green methanol and ammonia. In 2021, it joined The Methanol Institute, which actively explores the use of methanol for shipping.

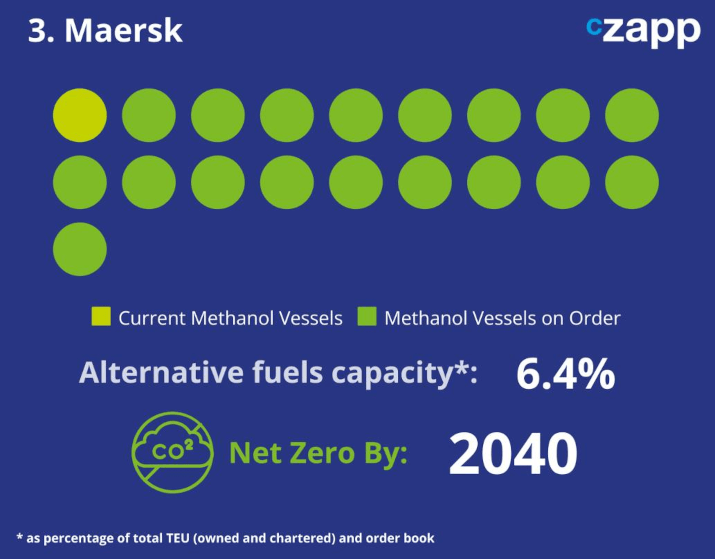

Maersk is shunning transition fuel LNG completely and moving straight to methanol. But because of the expense involved, the scale of the investment perhaps doesn’t look quite as high as that of MSC. While LNG technology is readily available and scalable, methanol is in its infancy and therefore will take longer to adopt.

But that hasn’t put Maersk off. With a lofty goal of reaching net zero by 2040 – 10 years ahead of other ocean carriers – it also aims to transport a minimum of 25% of ocean cargo using green fuels by 2030. It is investing millions of dollars into R&D, which has recently paid off, and it is on track for the launch of a newbuild 2,100 TEU dual-engine methanol-LSFO vessel later in 2023.

The Hyundai-made Laura Maersk will leave the Korean dockyard to complete her maiden voyage to Copenhagen at a speed of 17.4 knots. This will mark the first sailing of a methanol-powered container ship globally as the company plans to roll out eight larger 12,000 TEU vessels in 2024 and 10 in 2025.

Hapag-Lloyd is another believer in LNG as a future fuel having ordered 12 massive 24,000 TEU box carriers by 2025. The first vessel in the order, the Berlin Express, was delivered just last month. The shipper also retrofitted the 15,000 TEU Brussels Express vessel at a cost of USD 35 million in 2020.

With a much smaller fleet than that of MSC or Maersk, Hapag-Lloyd’s efforts may look like they are dwarfed by the larger carriers. But because of the huge size of the 12 new ships, and the likelihood that it will continue to retrofit existing vessels, almost 20% of its TEU capacity will consist of alternative fuels after its LNG vessels have been delivered.

In addition, it has made a commitment to becoming carbon neutral by 2045 – five years ahead of some of the bigger carriers. In 2021, Hapag-Lloyd committed to reducing CO2 equivalent intensity of the entire fleet by 30% by 2030 based on a 2019 baseline. It is also allowing customers to participate in the transition with its Ship Green platform, which allows charterers to choose to reduce well to wake emissions on their leg by 25%, 50% or 100% by switching to biodiesel.

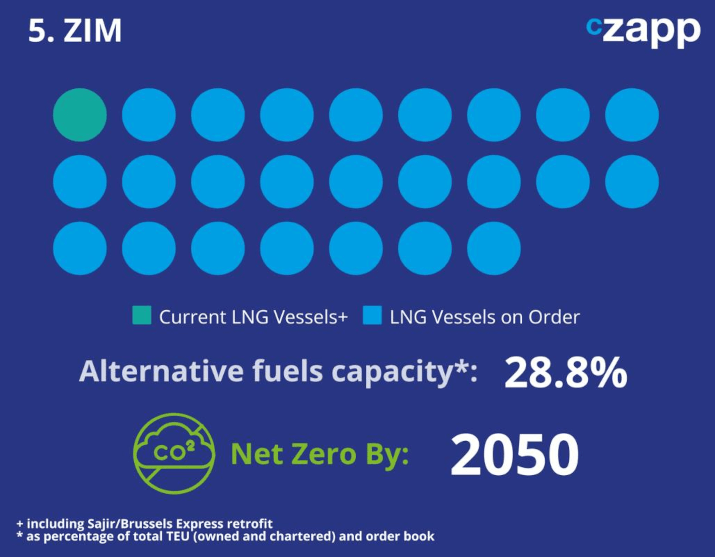

Although ZIM is a smaller shipper, ranked in 10th position in terms of TEU capacity, it is expanding its LNG-enabled fleet through charter agreements. This year has been busy for ZIM, after its charter partner Seaspan Corporation took delivery of the 15,000 TEU ZIM Sammy Ofer in February.

Since then, three more vessels in the 10-ship order have been delivered – the ZIM Mount Everest in April, the ZIM Mount Blanc in May and the ZIM Mount Denali just last month. The ZIM Mount Rainier is set to be delivered this month, while the remaining five vessels on the order will be delivered by January.

At the same time, Seaspan Corp has ordered 15 smaller container carriers with an 8,000 TEU capacity, while Eastern Pacific Shipping placed an order for a further three for its own charter agreement with ZIM. After the final vessel has been delivered in March 2025, almost 29% of ZIM’s owned and chartered fleet will use alternative fuels.

COSCO was one of the pioneers of LNG dual fuel shipping, having taken delivery of the 15,000 TEU COSCO Shipping Himalayas as early as 2017. With the delivery of four more carriers, it now has about 75,000 TEU of LNG dual fuel capacity. Since then, there has been a lull in activity for China’s flagship carrier, but this changed recently.

The world’s fourth largest shipping company now has 12 total 24,000-TEU methanol-enabled vessels in its pipeline due for delivery between 2026 and 2028. With these and the existing LNG vessels, just under 8% of COSCO’s current fleet and orderbook runs on alternative fuels. Although this number looks small, just like with MSC and Maersk, the fleet is much larger than that of other carriers so conversion is bound to take longer.

It seems COSCO has been more focused on retrofitting technology. Last May, COSCO, alongside GTT and Alwena Shipping, proposed a concept for retrofitting container vessels with LNG technology that will allow them to be compliant until 2045. At the end of last year the shipper also bought magnet shaft generator systems from ABB for 10 vessels, which promises to save fuel by 17% when delivered in 2025. But COSCO’s net zero pledges are the least ambitious as it commits to neutrality by 2060.

Concluding Thoughts

- While some shipping carriers are plunging all their efforts into decarbonisation, some have yet to act.

- However, it is imperative that the larger carriers get a jump start as they have larger fleets to make compliant.

- As new regulations come down the pike, the alternative fuels race is certainly gathering steam.