Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

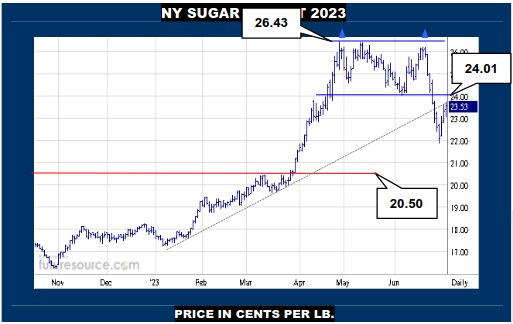

NEW YORK SUGAR #11 OCTOBER 2023

With London making gains while NY was on holiday, Raws were able to keep pushing against the ex-uptrend Wednesday (23.70). Even so, this near term upswing is hence drawing into the key terrain where the ex-trend, 24.01 double top border and gradually incoming mid band (24.39) are liable to make for a tougher test. If he market could stomp straight through anyway, then shedding the Jly contract would clearly have been a pivotal event and the 26’s would be in range again. Wary of Fund selling meantime so, if foiled near 24₵, beware a new lash down towards 20.50.

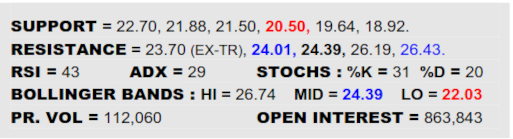

LONDON WHITES #5 OCTOBER 2023

Londons’ nearby revival was ongoing Wednesday as it comes up under the ex-uptrend (656), the double top border just beyond at 661 with the mid band easing towards it (656.6). That span is where the market must really show its colors if it is to make this bounce stick and then potentially evolve into a next mid term upside leg beyond the 730.5 spot apex set in April. Extremely cautious as the challenge to that area unfolds though because, if blunted, the overhanging top would be proven and another lash down to 600 could follow swiftly.

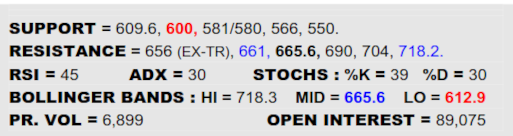

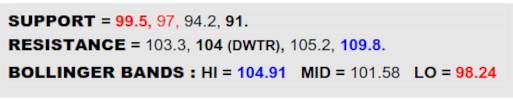

BLOOMBERG COMMODITY INDEX

Notwithstanding a delve back inside last week, the May-Jun inverse H&S base has essentially served in an underpinning role all the same and nudged the B-Berg back up. Alas, can’t make a big song and dance of this yet since the mid term downtrend (104) has to be shed to signal a more substantive groundswell that might then pique ideas of taking on that next major hurdle at 109.8 to really tilt the broader balance favorably to commodities. Too soon to count the chickens then and the 99.5 ledge that lately caught the stab into the base must remain under close watch as any swerve beneath it would suddenly rig a new nearby top to instead reassure the downtrends’ dominance.

#5 / #11 WHITE PREMIUM OCT 2023

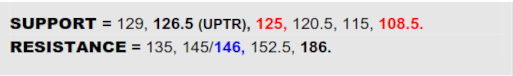

VALUE : $132.9

Skin of the teeth stuff but some brief fraying of $125 in mid Jun never became a definitive snap as the White Premium dodged a two-prong disaster of both an uptrend derailment and a double top. Instead, in the interim fortnight, it has clawed back into the 130’s and, if able to secure grip here, that recent crisis could soon fade and a third shot at the mid 140’s then be entertained. Nonetheless, with both flat price scenes very much in a state of flux beneath new Q2 tops, it would be premature to jump to that conclusion quite yet and if a second swat below $125 did occur, beware it could be much harder to retrieve the next time down and might well precipitate a further sell-off to the 108’s.

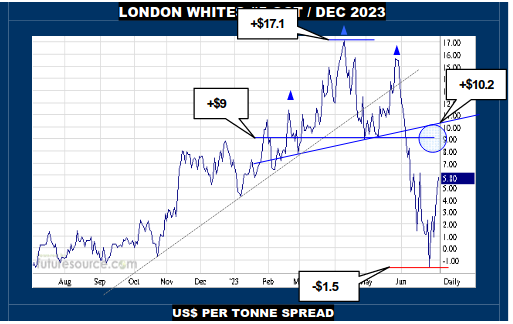

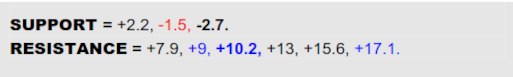

LONDON WHITES #5 OCT / DEC 2023 SWITCH

VALUE : +$5.8

“The Captain has switched on the seat belt sign.” And he hasn’t had reason to switch it off again yet either. In the wake of a H&S (or double top if you prefer) as the uptrend gave way in Q2, the Oct/Dec Whites switch tore down in one month the gains it had made over the previous seven. The quick glance at negative values comfortably exceeded a projection from either top, after which there has been a sharp reflex higher again. There wasn’t much in the way of this bounce initially but that is not the case henceforth as the upper Bollinger (+$7.9), double top rim (+$9) and H&S neckline (+$10.2) all feature in quick succession. How this area fares in sync with 661 on Oct flat price should tell the tale of having endurance or not.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.