Insight Focus

- North Africa has a diet rich in grains but most countries are not self-sufficient in production.

- For these countries, the rising cost of food is creating a bigger impact than in developed countries.

- Rising US interest rates and a strong US dollar are both pushing grain affordability further out of the reach of countries like Egypt.

North Africa Depends on Food Imports

Food prices are rising. While this is a problem for everyone in the world, the developing world is feeling the pinch much more. This is because there tends to be much lower levels of food security, less developed food production and storage infrastructure and higher levels of imports.

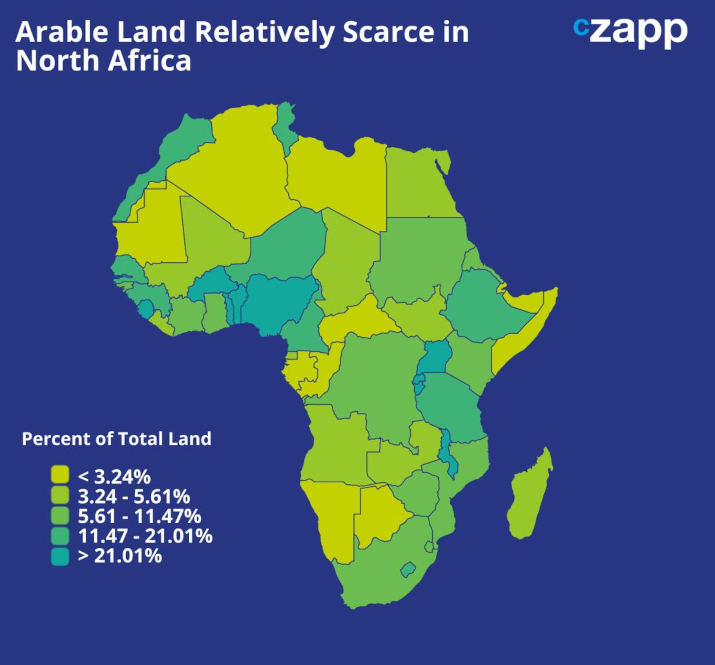

Although about 40% of Africa’s total land area is arable land, this is distributed unevenly. Most African countries have very few hectares of arable land per person.

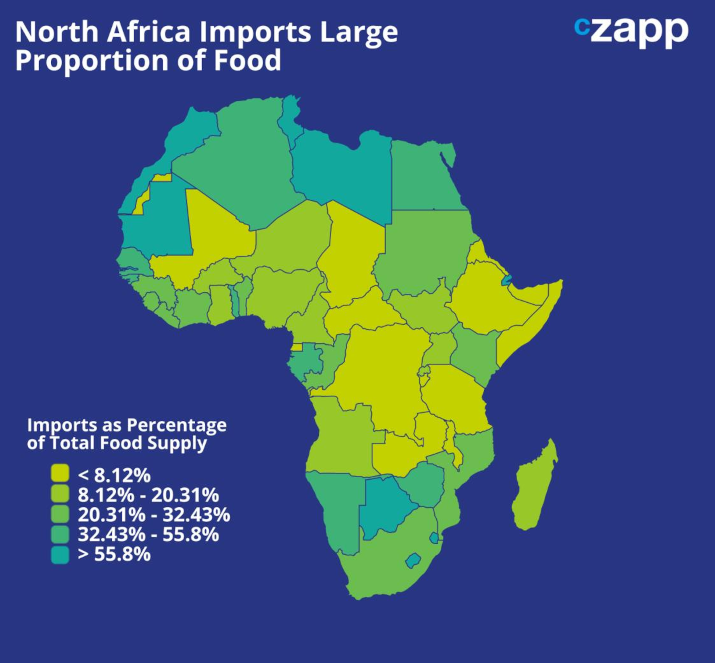

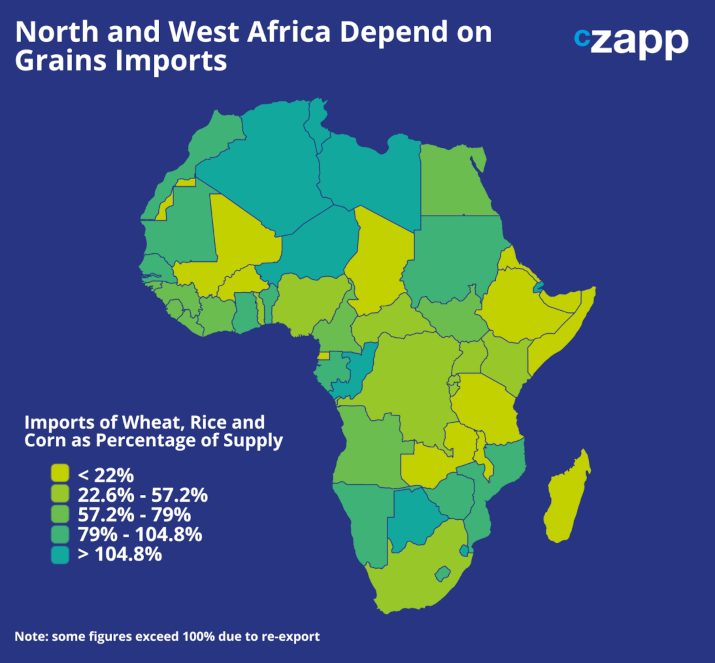

As a result, many countries depend on food imports. In North Africa in particular, food imports represent a significant volume of overall food supply.

This dependence on food imports means these countries are at the mercy of international food prices, which have continued to rise.

Source: World Bank

High Grains Prices Cause Pain

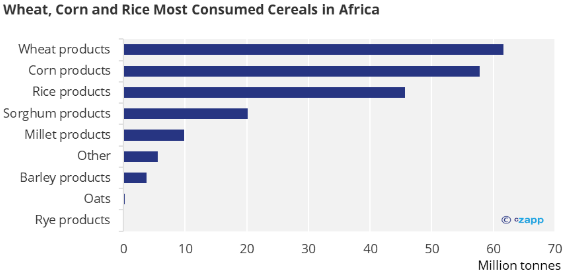

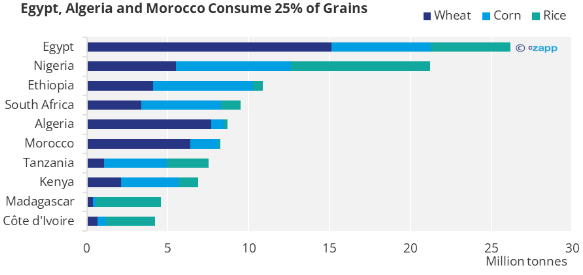

Grains are a staple of the African diet. In fact, in 2020, the continent consumed over 204 million tonnes of grain products.

Source: FAOSTAT

Egypt, Algeria and Morocco consumed a total of 43 million tons of wheat, corn and rice. This accounts for about a quarter of grain consumption across Africa.

Source: FAOSTAT

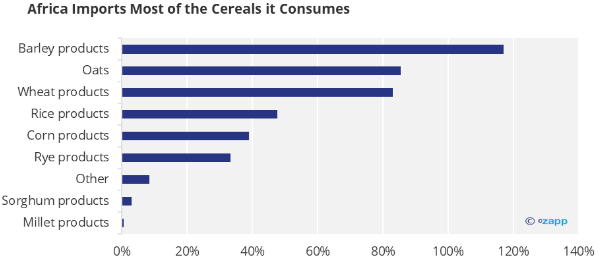

And much of the grain consumed in Africa is imported.

Source: FAOSTAT

North Africa is particularly dependent on grain imports.

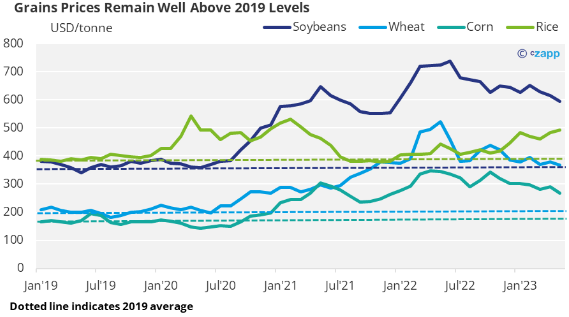

When it comes to grains, there have been significant supply issues in the past few years. Since Ukraine is a major producer, the war has wiped out a huge amount of grains from the global market, pushing prices up.

And although a grain corridor has been agreed between Russia and Ukraine, there are doubts that the deal will be renewed amid rising tensions between the countries.

Russia – also a major producer – is trying to bolster grain prices and recently withdrew a winning offer in an Egyptian wheat tender because Russia’s agriculture ministry decided the price was too low at USD 229 per ton. Global prices for hard red wheat are USD 367 per tonne and soft red wheat prices are USD 260 per tonne, according to World Bank data.

Economic Turbulence Adds to Headache

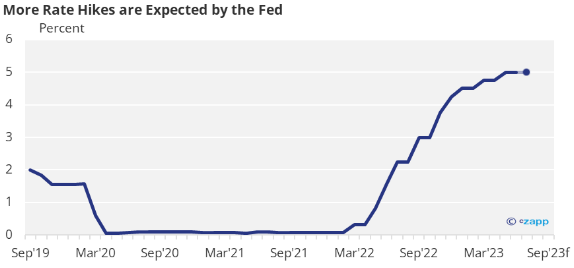

Food, like most commodities, is traded in US dollars. The dollar is strong right now because it is seen as a safe haven amid economic uncertainty. Higher interest rates can increase a currency’s value, and the Fed has hiked rates several times over the past year.

Source: US Federal Reserve

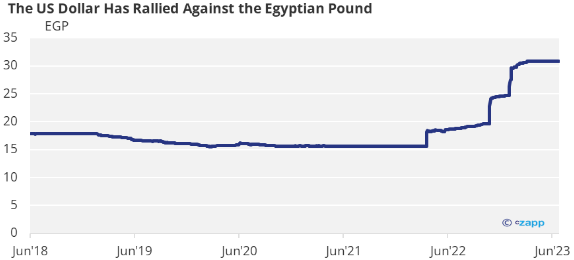

But developing countries are particularly susceptible to fluctuating exchange rates. Let’s look at Egypt’s exchange rates, for instance. As of June 2023, USD 1 now costs around EGP 30, having practically doubled since 2020.

Source: Central Bank of Egypt

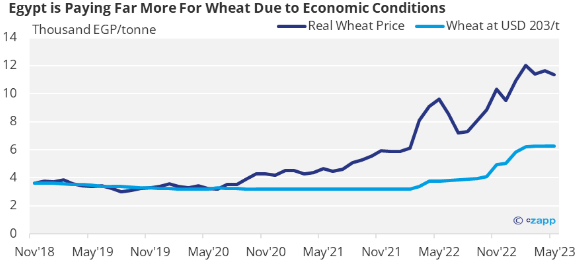

Even without taking into account exchange rates, Egypt’s wheat bill would have doubled since the beginning of the pandemic to EGP 6,277 per tonne due to rising global costs. This can be seen in the light blue line below.

Source: Central Bank of Egypt, World Bank

But when we also throw in exchange rates, the price paid in the Egyptian national currency to import wheat skyrockets to EGP 11,340 per tonne in May 2023. We can see this in the dark blue line above.

Implications Reach Beyond Food

The only way to avoid the fluctuations of the international grains market is to become self-sufficient in production. However, the head of Egypt’s Agriculture and Water Resources Committee Abdel-Salam el-Gabaly said earlier this year that this wouldn’t be possible, given land constraints.

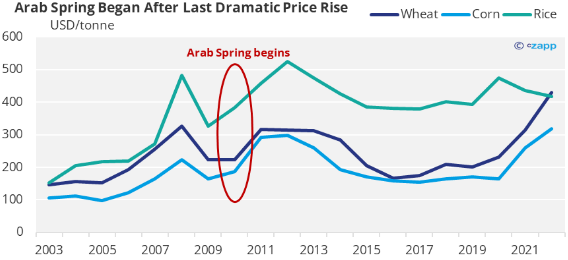

Wheat procurement remains one of the most important policies in Egypt. The last time food prices rose so dramatically, huge protests spread across North Africa that lasted for about two years. These protests led to the overthrow of rulers of Tunisia, Egypt, Libya and Yemen.

Source: World Bank

Given the reliance on food imports in North Africa, if food prices continue to rise at unprecedented rates, there are several implications for the region.

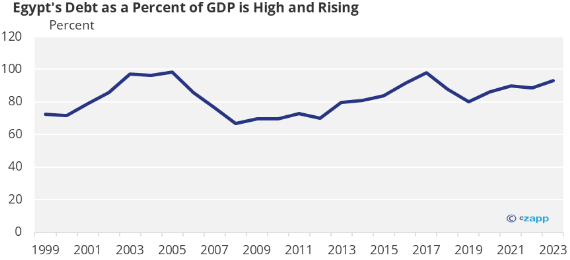

North African countries, like much of the developing world, lack the economic buffers to protect themselves from volatile interest rates. They are also paying higher interest rates on loans and bonds.

Source: IMF

This means wheat imports could be pushed beyond the affordability even of national governments – a huge threat to geopolitical stability.

Concluding Thoughts

- Because of the reach of the US dollar, US monetary policy has far reaching effects outside of the country.

- Given that food commodities are traded in dollars, they are susceptible to price fluctuations.

- Devaluation of currencies in developing countries, such as Egypt, is exacerbating the issues they face with food procurement.

- The last time North African food prices rose, mass protests broke out, which led to huge political unrest.