Opinion Focus

- Green hydrogen is obtained through the electrolysis of water using renewable energy.

- Rich in renewable energies, Brazil aims to invest USD 27 billion in green hydrogen.

- Much of the hydrogen could be exported, potentially to the EU.

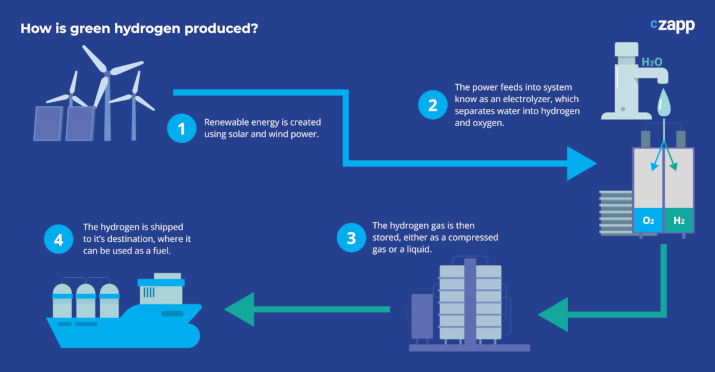

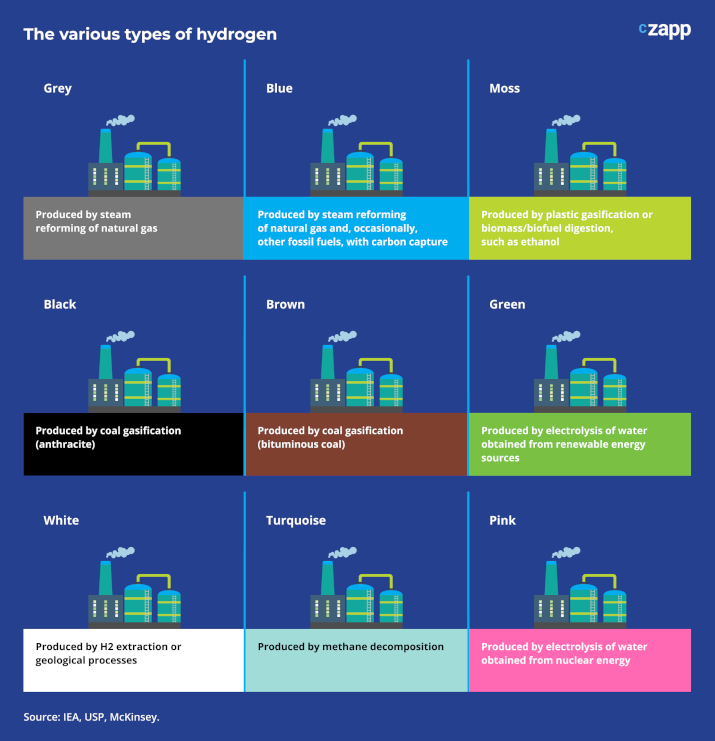

The growing interest around the world in reducing greenhouse gas emissions has led to a search for new clean fuels. One of these is green hydrogen. Its production has the advantage of not emitting pollutants, since it is obtained from the electrolysis of water carried out with renewable sources, such as solar and wind. In addition, its high calorific value provides significant energy generation, which makes it a useful fuel for decarbonization.

In addition to power generation, hydrogen can be used in the synthesis of ammonia, essential to produce fertilizers, and in various industrial processes. The gas should also play an important role in the decarbonization of the transport sector, being used as fuel in heavy vehicles, cars and even trains, although more technological advances are needed for large-scale use.

Source: DNV Hydrogen Forecast to 2050

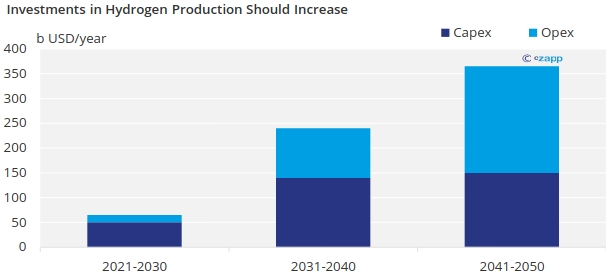

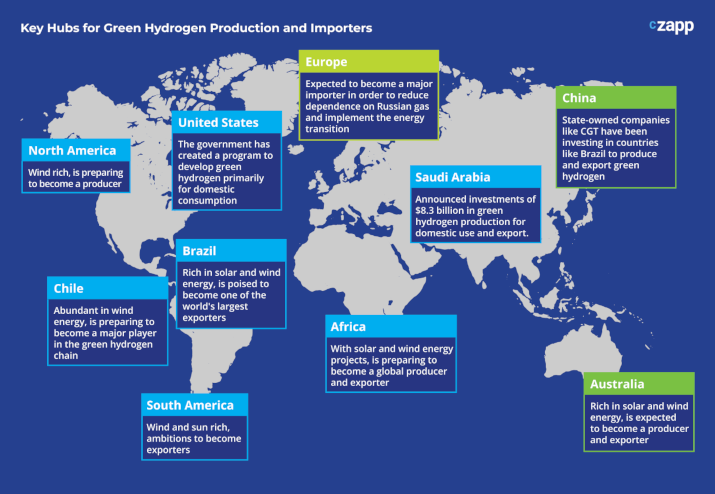

The growth perspectives of the market, which is starting to take its first steps, have been stimulating investments, with several countries competing for production and exports. Brazil, rich in solar and wind energy, is in this race.

Source: EPE

Projects for the production and export of green hydrogen in the country add up to more than USD 27 billion, according to a survey by the Economic Institute for Applied Research (Ipea). These are resources from the Brazilian government, private companies, and European countries, such as Germany and France. Petrobras and public ports are also committed to making this wheel turn faster.

Port of Suape: investments in innovation to produce green hydrogen. Publicity photo.

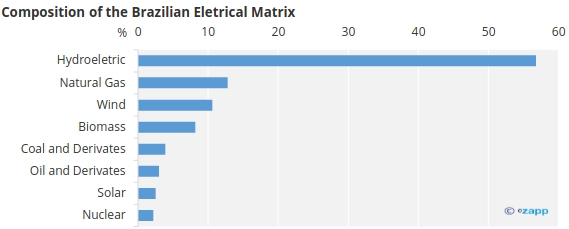

The ports of Suape, in Pernambuco, and Pecém, in Ceará, on the northeastern coast, are already attracting investment. “Brazil, where more than 70% of energy is generated cleanly, is very well-positioned to supply green hydrogen,” says Marcio Guiot, CEO of the port of Suape. “We have already started important projects and partnerships to produce and transport the product”.

Companies such as Qair, of French origin, intend to invest in the production of green hydrogen in the region of the port of Suape. At the same time, Senai (National Service for Industrial Training) is implementing an innovation center at the site, TecHUB, aimed at developing innovative technologies for the production, storage, and transport of green hydrogen.

Representatives from the port of Suape receive a visit from Czapp at the green hydrogen TecHUB. Publicity photo.

The idea is to boost the manufacture of green hydrogen to serve both the domestic market, in sectors such as fertilizers and chemical products, and the foreign market – in this case, one of the main focuses is the European Union. European countries aim to import 10 million tonnes of green hydrogen by 2030, in addition to producing another 10 million tonnes, according to the European Commission.

To meet this goal, it will be necessary to speed things up. Last year, green hydrogen was responsible for only 2% of energy consumption in the bloc, with 96% of the total hydrogen used being produced from natural gas.

The objective is to reverse the game. For this, Europe intends to invest around 9.2 billion Euros until 2030. 840 infrastructure projects and development of new technologies to produce green hydrogen should be implemented throughout the bloc. Also under discussion is the creation of a bank, the European Hydrogen Bank, to boost funding.

In Brazil, the National Development Bank (BNDES) announced the creation of a special credit line for green hydrogen projects. The maximum amount of financing reaches, for the time being, BRL 300 million.

Several countries are in the running to produce and export green hydrogen. Chile, for example, launched a government plan, in 2020, to produce the gas at competitive costs by 2030. In the Middle East, Saudi Arabia announced investments of around USD 8.3 billion in the production of the substance.

Countries like Australia also intend to become major producers. In Africa, about 3.4 million tonnes of green hydrogen are expected to be generated over the next seven years.

No wonder that 90% of the approximately 4,300 kilometers of gas pipelines available in the world to transport hydrogen are currently in Europe and North America, which have been leading the demand for gas. Market estimates indicate that 91 infrastructure projects should be completed globally by 2035, totaling 30,300 kilometers of pipelines.

Challenges

This race for decarbonization and energy transition is not without its challenges. To begin with, a significant volume of investment will be required to enable large-scale production. Preliminary studies point out that Brazil alone will need USD 200 billion, in the coming decades, to become a competitor at world level.

Globally, large-scale production should help reduce costs and reduce the final price, currently around USD 6 per kilogram (two to three times more than hydrogen obtained from fossil fuels), another important factor to boost the market. There is yet another issue. To be transported, in general, hydrogen is converted into ammonia. At this point there is an additional challenge. Due to the specific characteristics of hydrogen, gas pipelines need to have larger diameters and a higher-pressure level than the conventional one, which demands extra costs.

None of this, however, sets obstacles to the expansion of the market. In the sector’s view, these are challenges that must be overcome with gains in scale, increased demand and technological advances that positively impact production and transportation.