Insight Focus

- The US corn yield should be lower than the USDA forecast.

- This follows dry weather in growing regions.

- US corn condition continues to fall.

Forecast

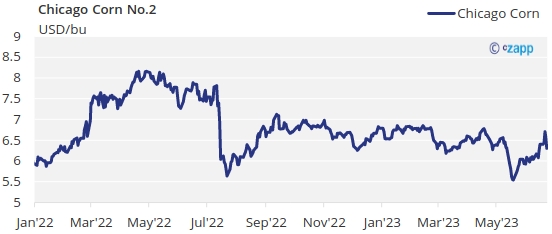

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,55 USD/bu.

Market Commentary

Negative week after an initial drought related rally but a rain related sell off by the end of the week for Corn in Chicago. Wheat closed the week positive in all geographies. US Corn yield should be lower than USDA’s forecast.

Chicago started last week rallying all the way up to 6,7 USD/bu last Wednesday to correct all the way down to 6,29 USD/bu where it closed the week.

It was all around weather again and the speculation of how much lower will the new crop be vs. the USDA estimate of a record yield. The reality is that the size of area under drought is big and in our opinion the record yield of 181,4 bpa the USDA is projecting is not anymore an option.

US Corn condition fell for a fourth week in a row last week by 6 points to just 55% good or excellent vs. 70% last year. 65% of Corn area is under drought conditions higher than the 57% of the previous week.

In Brazil, Safrinha Corn is 5,3% harvested making a big weekly advance but still slower than the 11,1% progress of last year. In Argentina, BAGE reduced their Corn production forecast again by 2 mill ton now to 34 mil ton which is to compared with last year’s production of 52 mill ton. Corn is 43,6% harvested and just 7% is in good or excellent condition.

In Russia, Corn planting is 89,1% complete. In France Corn condition fell 1 point and is now 85% good or excellent.

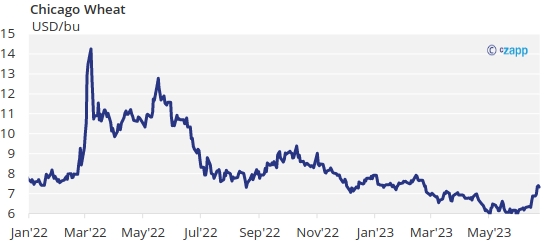

In the Wheat front European and US markets rallied as well with US harvesting running very slow as just 15% has been harvested vs. 23% last year, but condition was flat at 38% good or excellent. French Wheat condition fell again to 83% good or excellent 2 pts lower week on week. Harvesting is 2% complete similar to last year and ahead of the five year average.

European Wheat saw small changes in the June MARS report with Wheat yields now 2% lower at 5,7 ton/ha still +2% vs. the five year average. But Germany’s farmer’s cooperative lowered their production forecast of total grains by 1,2 mill ton due to dry weather.

The flow out of the Black Sea continues to be very slow with just between one and three vessels per day being inspected.

In the weather front, rains are expected in the US Corn Belt but not much which in any case will help to alleviate the lack of moisture in the soil. Dry conditions are now expected in Brazil except for some rains in the south. Europe is also expected to have dry conditions in the coming days.

We have the US quarterly stocks report this week June 30 with stocks as of June 1 and we don’t rule out lower than expected stocks given the very high basis we see in the market.

Ending stocks for the new Corn crop are very sensible as a yield just 5% lower than USDA’s projection takes away 765 mill bu of production and would be a yield below last year. Production would still be higher year on year thanks to higher acreage, but prices would have to do the work to destroy some demand and exports. As a reference, key state Illinois which had a record yield last year is showing this year condition of 36% good or excellent when last year at the same time it was 71%.

We should expect weather volatility to continue and guesses around the real size of the US crop to emerge. The July WASDE during the first days of July might be too early for the USDA to reduce their yield forecast as they usually prefer to make changes after July weather has passed. But we think the lower Corn yield is a reality. Too early to guess how much lower.

We continue to think it will be difficult to see prices sustained below 6 USD/bu.

Negative week after an initial drought related rally but a rain related sell off by the end of the week for Corn in Chicago. Wheat closed the week positive in all geographies. US Corn yield should be lower than USDA’s forecast. We should expect weather volatility to continue. We think the lower Corn yield is a reality, but too early to guess how much lower. We continue to think it will be difficult to see prices sustained below 6 USD/bu. No changes to our average price forecast for Chicago Corn for the 22/23 (Sep/Aug) crop in a range 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,55 USD/bu.