Insight Focus

- Managing the turmoil of a crazy market.

- USDA monthly WASDE demonstrates the markets uncertainties.

- Putin’s war and global weather drive a nervously volatile market.

Introduction

As wheat values maintain the roller coaster ride of 2022 & 2023 it is hard to see any signs to bring about a flat and stable market in the months ahead.

As producers, traders and buyers assess what is relevant and what is not, managing your own business needs can be a scary prospect.

Market Instability

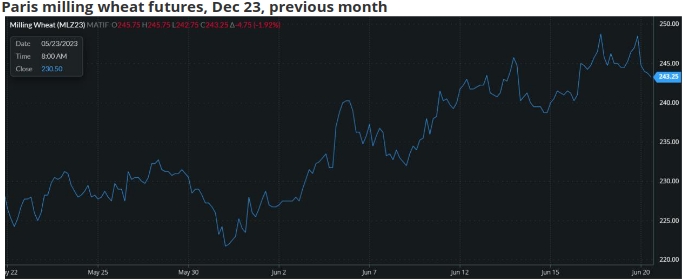

The charts below, showing wheat prices over the last month, on various global derivatives markets, demonstrate the unease for all participants.

Weather concerns have supported the rally, together with the daily updates from Russia protesting their objections to the workings of the Black Sea grain corridor agreement.

Source: Barchart Commodityview

USDA WASDE

(United States Department of Agriculture, World Agricultural Supply and Demand Estimates)

The most recent edition of the USDA monthly WASDE report, published on 9th June, provided some interesting updates from the May report for the upcoming wheat harvest and marketing year 2023/24.

Global production forecasts for 2023/24 are an impressive 800.19 mmt (million metric tonnes), up from 789.76mmt in May. This is a notable increase from the 788.50mmt for 2022/23 and 780.25mmt for 2021/22.

Worldwide ending stocks for 2023/24, forecast at 270.71mmt, up from 264.34mmt in May, should replenish much of the stock reductions being seen in the current year. These are estimated at 266.60mmt in 2022/23, while a larger 270.93mmt back in 2021/22.

Weather

Timely sunshine and rains are always on the wish-list of farmer wheat producers.

The US winter wheat crop over the last week has seen reported crop conditions at 38% good/excellent, better than last year’s 31%, although dryness has been a significant hindrance to the hard wheat plants over many months.

Europe is seeing more optimism for the upcoming harvest, as shown in France with Agrimer rating the wheat crop at 85% good/excellent. Although down from recent reports in the mid-90s, the ratings are up from 66% last year and the best for this time of year in well over a decade.

The lack of timely rain is a concern in more Eastern areas of Europe, as well as in Argentina. China has endured large amounts of rain in the Hennan province which has significantly impacted the wheat crop quality.

In India they anticipate a record wheat harvest of 113.50mmt in 2023, vs 104mmt in 2022.

Russia’s War in Ukraine.

Recent weeks have seen countless headlines reiterating Russia’s discontent with the Black Sea grain corridor agreement.

The Russian complaints centre around the West’s imposed sanctions, complicating vessel logistics as well as payments for grains and fertilisers.

The Kremlin’s displeasure is also targeted towards the significant amount of Black Sea Ukrainian exports heading to European countries. The Russian argument being that greater volumes should be destined for the world’s poorest nations in need.

There have been many reported quotes of President Putin and his advisers stating that there is no real prospect for the continuation of the agreement beyond the current expiry date of 17th July ’23.

Conclusions

The period running up to the Northern Hemisphere wheat harvest is always a time of estimates and assumptions as we are destined to await production numbers in the fullness of time.

Weather will have its annual impact as the crops ripen, as seen in China above.

Putin’s war, as in 2022, has added a huge amount of extra anxiety for market players to digest.

There are no defined answers that can steer a business to the perfect solution whenever future wheat prices are concerned.

However, there is little reason to fear an explosion of prices back to the highest levels of 2022, unless Putin’s war becomes more of a global war.

The weeks and months ahead should reveal a large 2023 wheat crop, replenishing wheat end stocks, while the Black Sea scenario will likely continue to add some volatility.