Insight Focus

- Reasons for suspension unclear.

- Global protein demand continues to grow.

- Suspension raises risk another entity develops a plant in US Mid-South.

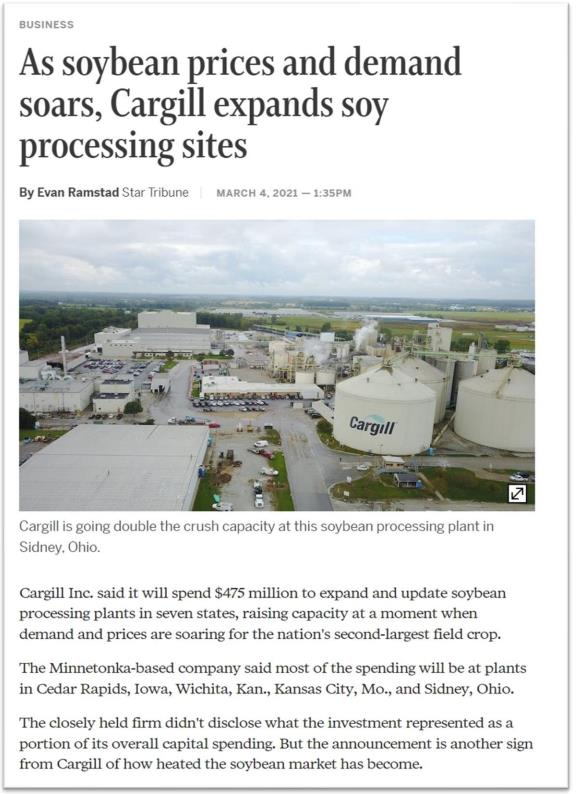

Cargill Inc announced what had been rumored since early January: the suspension of their project in the boot heel of Missouri to develop a 5,000 metric ton per day soybean processing facility. Just prior to that announcement Cargill very publicly placed a significant poundage of soybean oil in the Chicago Mercantile Exchange’s delivery window (against the May contract) for all the world to see and eventually to buy should the world want it (which Cargill was betting the world would not, at least not any time soon; see chart at end; that one did not work out so well).

Hmmm.

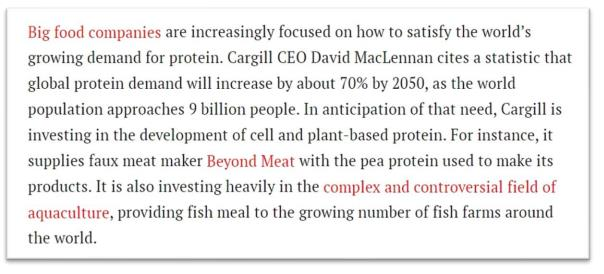

Back in the day, February of 2021, Cargill’s CEO, now chairman, said this to the commercially focused Asian Agribiz:

And he said this to Time Magazine in August of 2021:

Hmmm again.

What has changed?

Many, especially those who reside in Houston and London and who have chosen the petroleum industry as their employment sector, called me last week to say something like this: “Well, that’s it, that’s the top in all this renewable fuel nonsense; there you have it, Cargill is done with it.”

“What about global protein demand, are they done with that too?” I asked, dryly.

“What does that have to do with anything?” was the typical response.

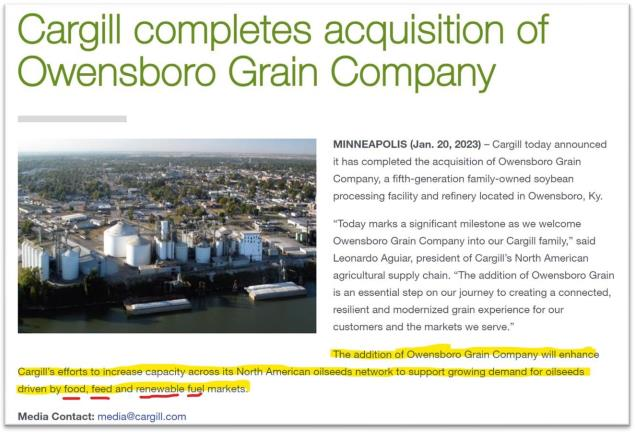

“Umm, it is why a soybean plant gets built. And the acquisition of Owensboro?” I asked, even drier.

“Oh, I see Walter, you’re going to get into that whole feed the world thing and biofuels aren’t part of all this US soybean processing expansion and Cargill is not signaling this is all too much. Is that right?”

“Yes, that’s right,” I replied in my driest tone.

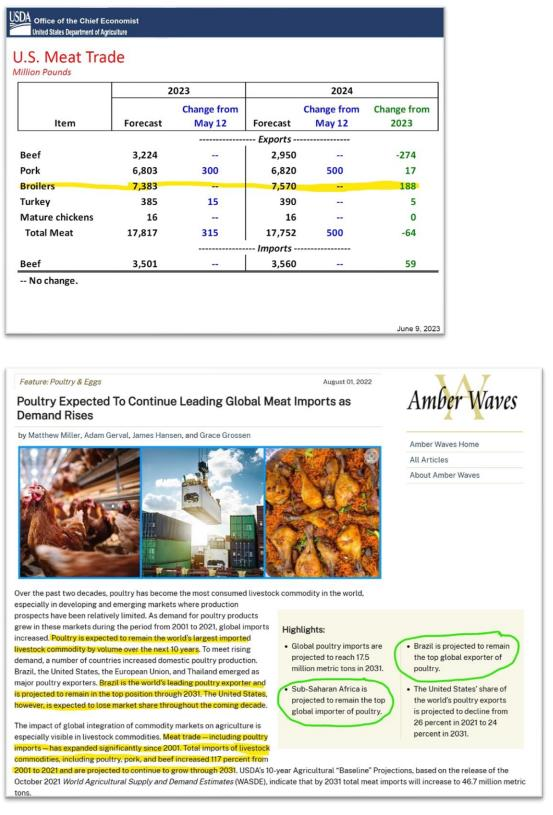

So what is up with the BIG GREEN MACHINE as we call Cargill in the trade (BIG BLUE for ADM)? One can only guess given their private status but their acquisition of Owensboro Grain, their recent acquisitions in the global aquafeed space, and the joint acquisition with Continental Grain of Sanderson Farms in the US poultry space suggest the long-term trends that David Maclennan discussed in 2021 still drive Cargill’s strategy. And the strategy is “food, feed, and renewable fuel” in THAT order (see below in red).

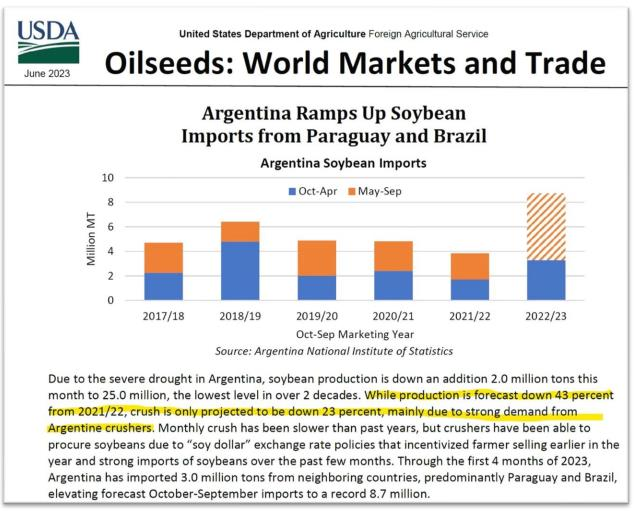

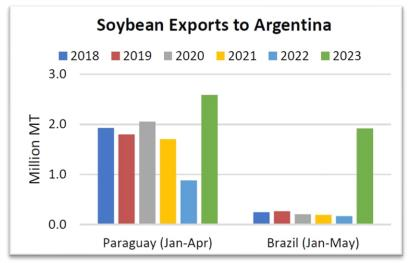

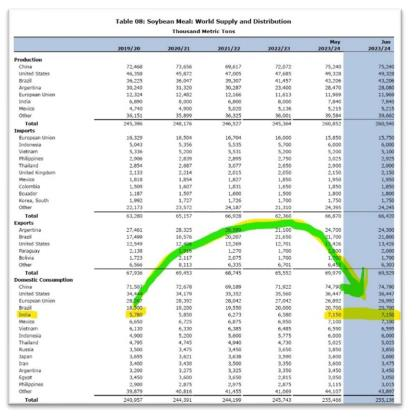

Does Cargill see Argentina pulling itself out of its current doom loop via imports, potentially tempering the immediate need for additional US export capacity (the Missouri plan was an export focus by any measurement)? USDA noted the Argentine development last week with their June WASDE:

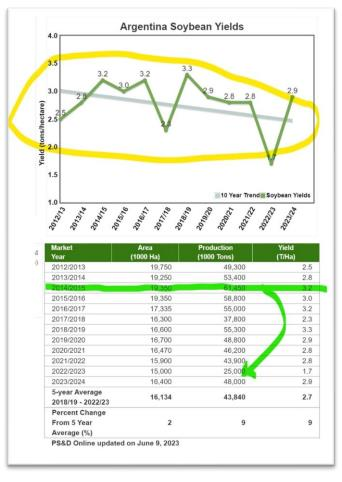

Or does Cargill agree with the USDA’s miracle Argentine recovery forecast from the current 9-year soybean production doom loop? Doom loop in yellow, peak Argentina and nadir and miracle in green.

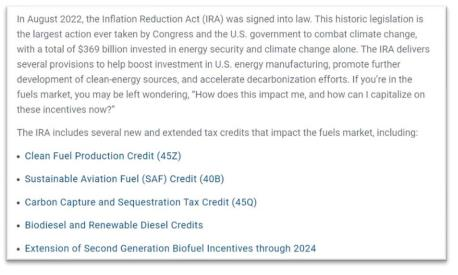

Or could it be that Cargill is in effect shorting the Biden Administration’s Deficit Expansion Inflation Reduction Act’s biofuels’ tax credit benefits? Barr Research summarized the benefits this way:

Or could it be that Cargill wants to pause and see if inflation cools? Did $475m become $575m with cost overruns and labor tightness?

Or is it (using RJ O’Brien’s Jimmy Connor’s famous words for these multiple-choice situations) a Homer Simpson, “a little bit from column A, and a little bit from column B”? Cargill called it “many shifting market dynamics.”

Does suspend mean cancel or does suspend mean suspend? Dunno.

Cargill’s risk is that another commercial another entity slips into the Mid-South area and builds a plant in a region that is agronomically ready for new investment, effectively crowding Cargill out after their project announcement pointed to the competitive value of the location.

And why might an entity make that move? In order of importance it goes like this:

- Argentina is toast and global soybean meal export capacity needs to replace the smoldering toast

- Brazil is on a multi-year (decade?) path to export surplus soybeans to the world including the US and US river locations connected to major ports, in this case New Orleans, have more intrinsic value than ever in the history of global soybean trade

- US poultry production stays on its uninterrupted 12-year growth trend (see below)

- US aquaculture production (beyond catfish to include other varieties) soars

- https://www.superiorfresh.com/

- https://atlanticsapphire.com/

- Global palm production declines requiring soybean oil replacement (YIKES!)

- China imports global soybean meal to replace lost US (and Argentine) soybean imports

- India begins a sustained, expansive soybean meal import program as massive individual gold holding wealth effect drives protein consumption

- The Ukraine/Russia war puts Black Sea vegetable protein meal exports at permanent risk

Did I forget to mention renewable diesel, sustainable aviation fuel, and the EPA RVO? I did because global protein demand is not getting suspended and that is why a soybean plant gets built.

Soybean oil futures prices: movement since Cargill delivered (in green for Big Green) and ADM prospered (in blue for Big Blue…Bunge joined them as well).