Insight Focus

- PTA futures drifted lower through the week, driven down by falling costs.

- PET resin exports similarly failed to gain upwards momentum, dropping sharply on Friday.

- Asian PET producers increasingly concerned about weak demand amid new capacity.

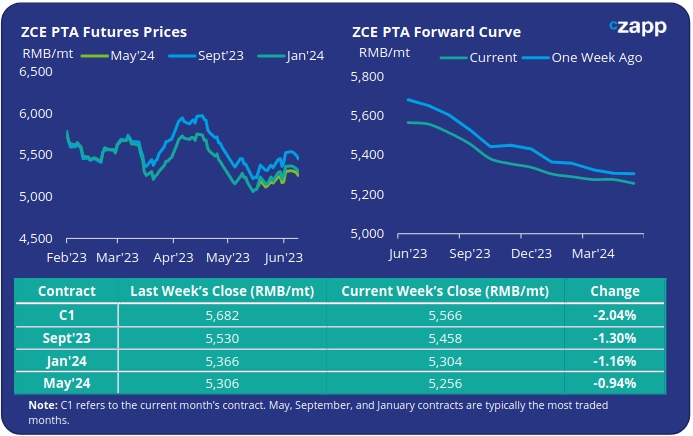

PTA Futures and Forward Curve

- Having increased following OPEC’s announced production cuts, oil prices traded lowered through the week on fresh economic concerns in Europe, China, and the US.

- PTA Futures followed upstream costs downwards, with the main Sept’23 contract dropping 1.3% on the week.

- The PTA-PX spread remained stable with supply and demand finely balanced.

- Several PTA plants are due to recommence production following turnarounds, with PTA operating rates expected to rise through June and into July.

- Whilst demand remains robust, polyester rates may also come under pressure in July due to weak macroeconomics conditions, shifting the overall supply/demand balance.

- The forward curve remains backwardated, particularly through Q3’23. By Friday, the Sept’23 contract was trading at a RMB 108/tonne discount to the current month.

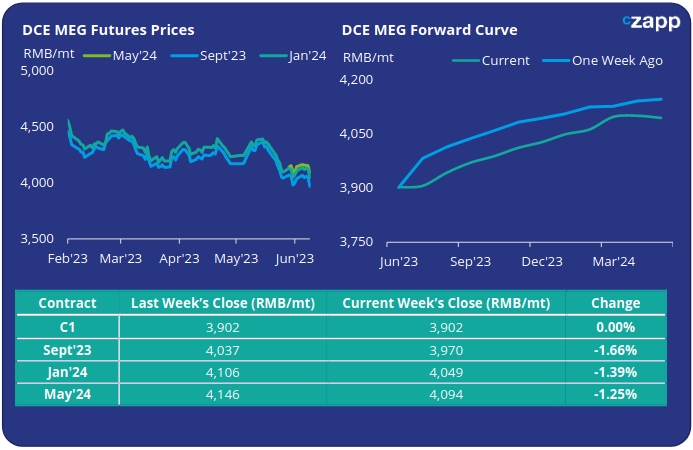

MEG Futures and Forward Curve

- MEG Futures slowed last week on following commodity markets lower, buyers cautious of lengthening supply and demand uncertainty.

- Whilst port inventory levels decreased by 0.85% last week to just over 937k tonnes, fresh cargoes from the US and Middle East are expected to arrive in China late-June and July. following turnaround season.

- On the domestic front, plant operating rates are also steadily increasing.

- Whilst polyester production remains high, rates could come under pressure in July, dampening demand, prompting oversupply concerns.

- The MEG forward curve shows a steady increase over the next 12-months. By Friday the Sept’23 contract was holding a RMB 68/tonne premium to the current month.

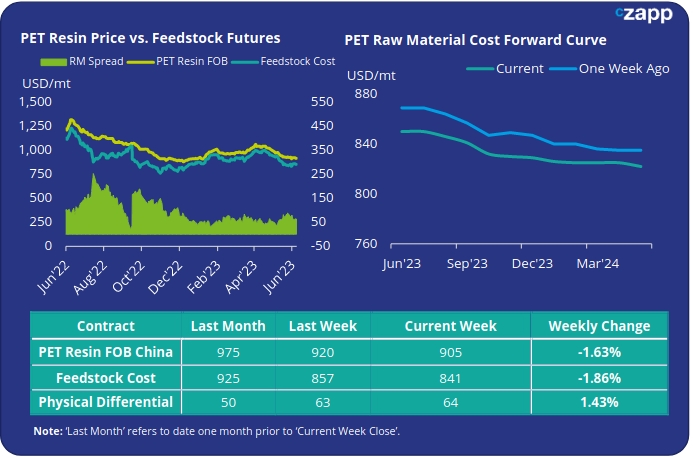

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET export prices dropped quickly towards the end of last week with prices averaging USD 905/tonne on Friday, down by USD 15/tonne on the previous week. However, deals as low as USD 880/tonne were heard.

- The weekly average PET resin physical differential to future feedstock costs decreased by USD 10/tonne to average USD 63/tonne for the week. By Friday, the daily spread was at USD 64/tonne.

- The shape of the current PET resin raw material forward curve remains backwardated with costs expected to soften through the summer before flattening out in Q4’23.

- At Friday’s close, Sept’23 raw material costs were trading with only a USD 9/tonne discount to Jun’23.

Concluding Thoughts

- PET resin export prices slumped last week, falling sharply on Friday, not only following raw material movement but also reflecting current lacklustre demand.

- As a result, margins are facing renewed pressure and Chinese producers are increasingly concerned about sales.

- Sanfame’s new capacity is anticipated to be made commercially available imminently, and other producers have additional new lines to follow in Q3’23.

- As a result, buyers are slashing target prices. Bids heard on the market are USD 40-50/tonne below the average reported prices and producers are struggling to keep pace.

- Some Chinese PET resin producers also report experiencing greater competition from other origins.

- With export margins to be heavily constrained through H2’23, crude and macroeconomic outlooks will be increasingly important on price direction.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.