Insight Focus

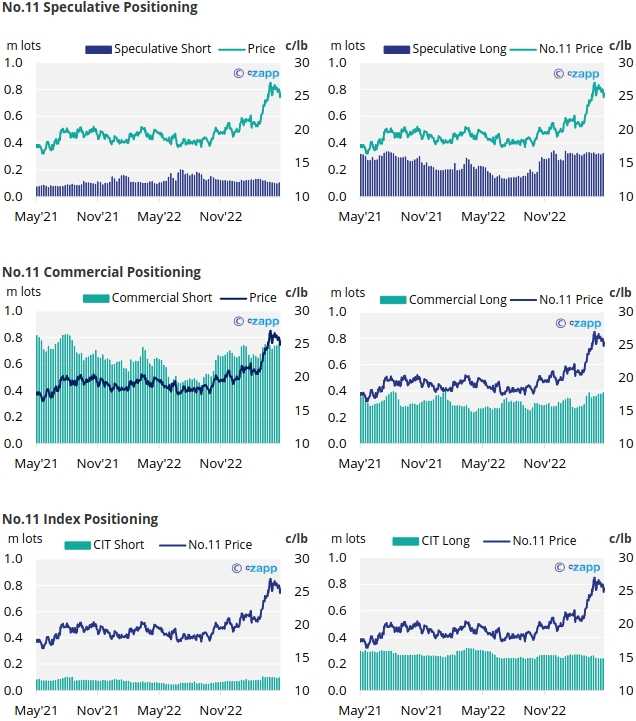

- The No.11 has weakened slightly over the past week.

- As a result, both consumer and speculator net positions have remained nearly unchanged.

- Q/N sugar white premiums have strengthened, standing at 149USD/mt.

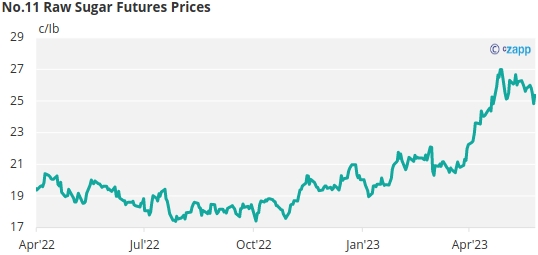

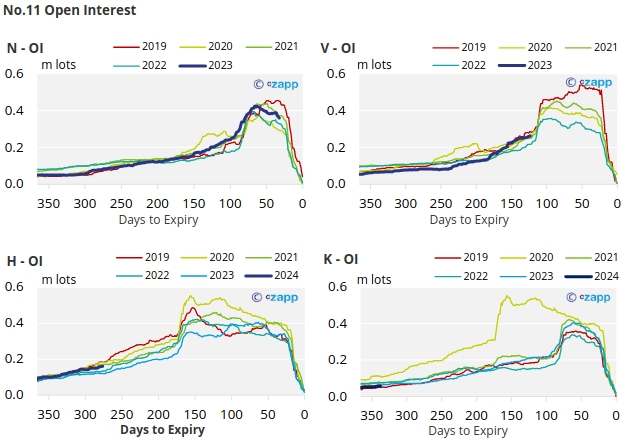

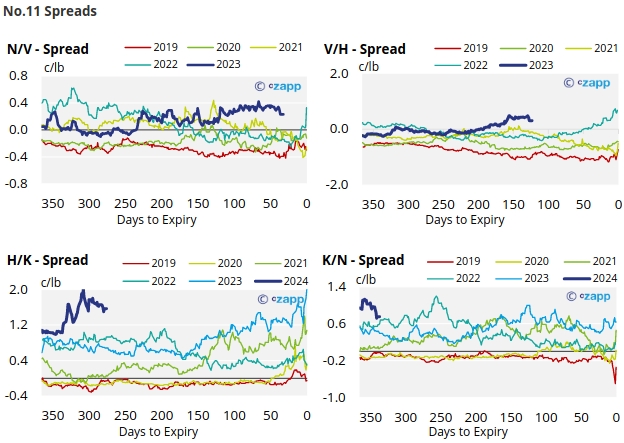

New York No.11 Raw Sugar Futures

The No.11 sugar futures contract has weakened slightly in the last week, closing at 25.4c/Ib last Friday.

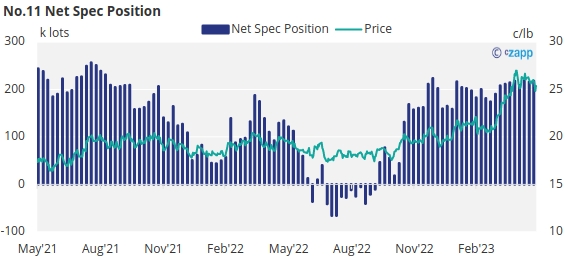

By the 23rd of May (latest CoT CFTC report), raw sugar speculators had opened approximately 10.4k lots of new long positions and 8k lots of new short positions.

As a result, the net spec position has grown by around 2.3k lots to 218k lots long.

Similarly, on the commercial side, both raw sugar producers and consumers increased their hedges by around 9k lots and 11k lots, respectively.

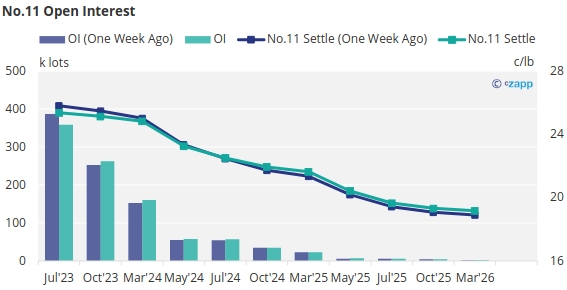

With prices down the board weakening over the last week, the No.11 forward curve remains backwardated towards the middle of 2026.

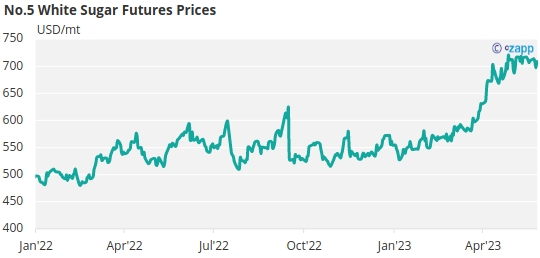

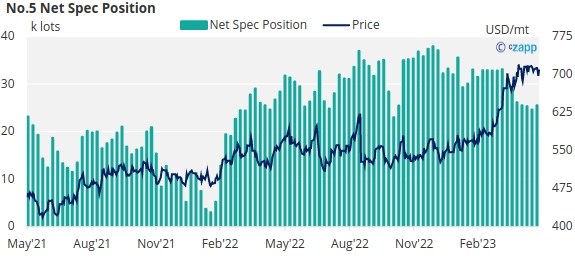

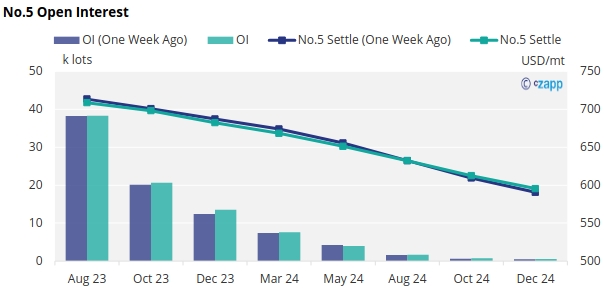

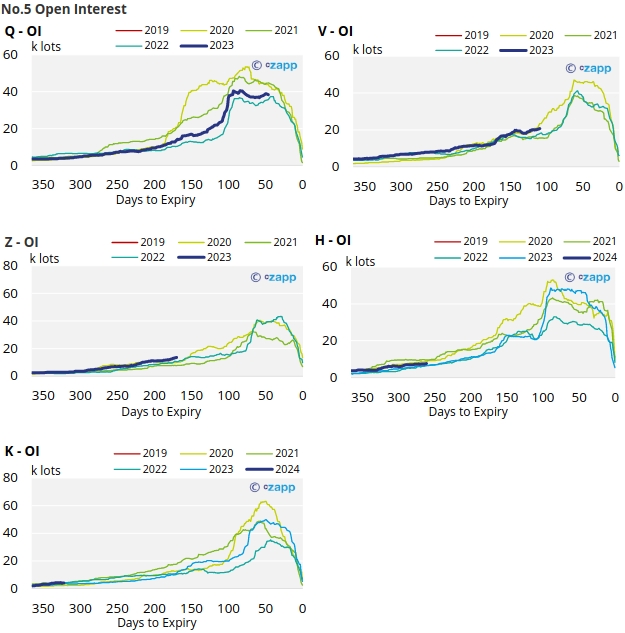

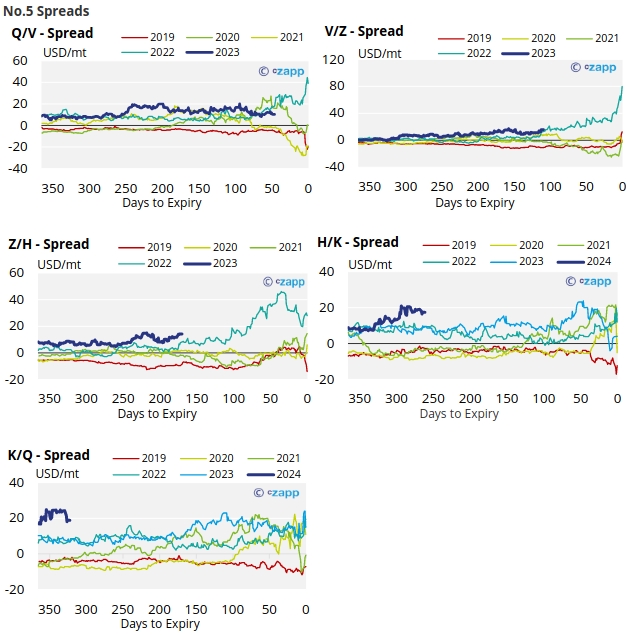

London No.5 Refined Sugar Futures

Similarly, refined sugar prices have continued to fall over the last week, falling to 697 USD/mt by the end of trading on Friday.

By the 23rd of May with prices in decline, the refined sugar speculators continued to increase their net long positions by 0.9k lots, now standing at 25.5k lots.

The No.5 forward curve remains inverted through to December 2024.

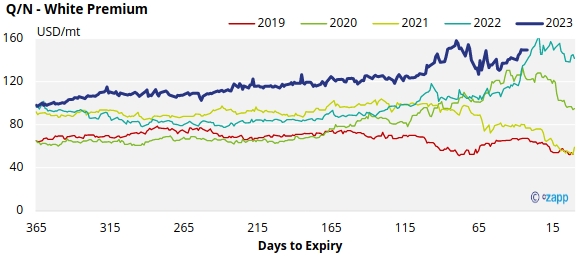

White Premium (Arbitrage)

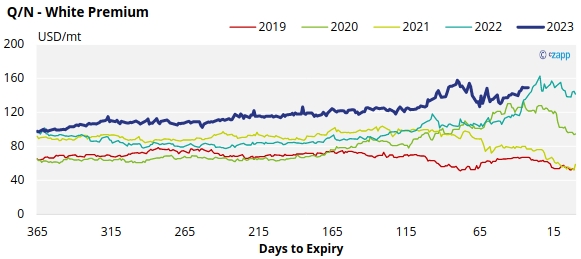

The Q/N sugar white premium has strengthened slightly over the past week, now trading at 149.2USD/mt.

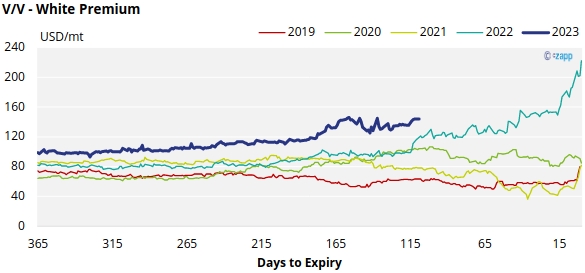

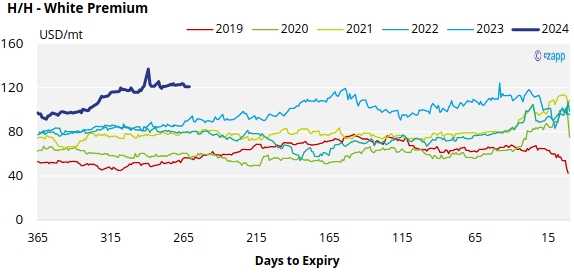

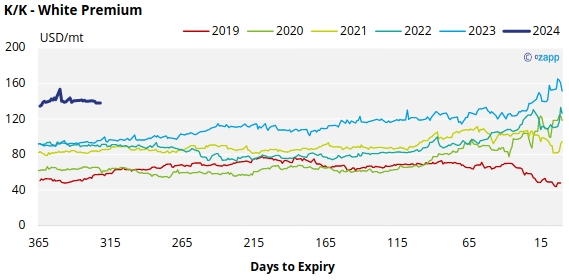

The refined sugar market is likely to be slightly undersupplied for the majority of 2023, and this is reflected in comparatively strong V/V and H/H white premiums, which have also been rising and now approach 144USD/mt and 121USD/mt, respectively.

With global energy prices falling, we believe re-exports refiners require around 120-135 USD/mt above the No.11 to produce refined sugar profitably.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix