Opinion Focus

- Brazilian agritechs raised USD 1.3b in investment in 2022.

- Globally, investments in the sector increased 866% in the past decade.

- We look at the sector in detail.

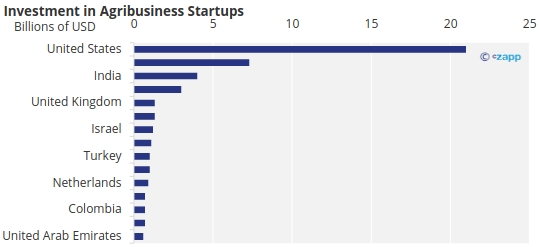

If there is something going well in Brazil, it is the agritech ecosystem. Last year, Brazilian agro startups raised USD 1.3 billion, ahead of countries like Israel (USD 1.2 billion) and France (USD 1.1 billion). The number of agritechs is also expanding: today, there are more than 1,700, 10% more than in 2021, according to data from Embrapa and SP Ventures. Even so, it is a quieter universe than that of fintechs and startups from other segments, such as health and education, which are already more consolidated.

Source: Embrapa and SP Ventures

The volume of investments has started to increase in recent years, in the face of new challenges ranging from issues related to food security, climate change, sustainability and geopolitics. The increase in productivity in Brazilian agribusiness, which should grow by around 10% this year, has also had a positive impact on the sector.

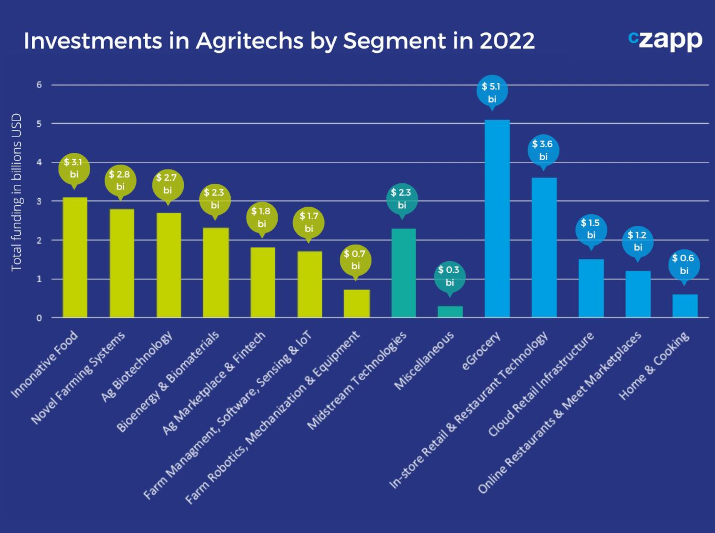

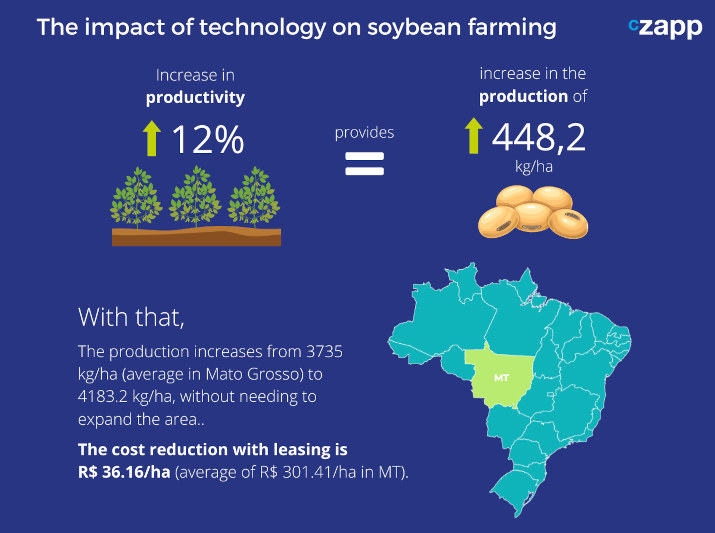

It is not surprising that businesses focused on precision agriculture, which offer tools for increasing productivity and risk management, occupy first place in the ranking of attracting resources, with 35.2% of investments, according to data from the Distrito, innovation platform, followed by robotization startups (14.2%) and biotechnology (14.2%).

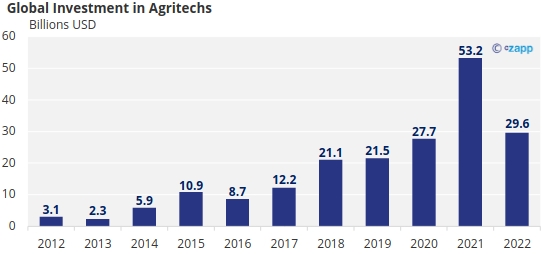

Globally, investments in agritechs peaked in 2021, when they totaled USD 53.2 billion. The boom in concerns about food safety and the impact of agriculture on the environment were one of the drivers of investment rounds in startups that developed everything from biological fertilizers to vertical farms and plant-based meats, based on vegetables.

Source: AgFunder.

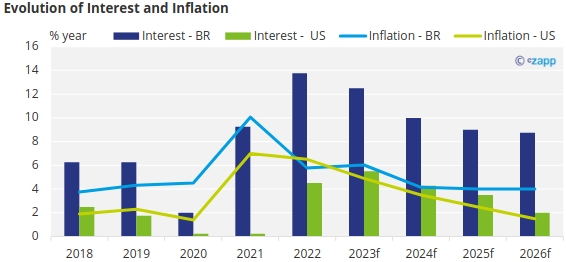

Last year, the volatility of the private market equity and the more challenging global economic scenario, with successive increases in interest rates, reduced investments in agritechs. The limitation of contributions caused the fundraising of agro startups to fall 44% in 2022, going to around USD 29.6 billion, according to AgFunder, an American investment fund focused on agritechs.

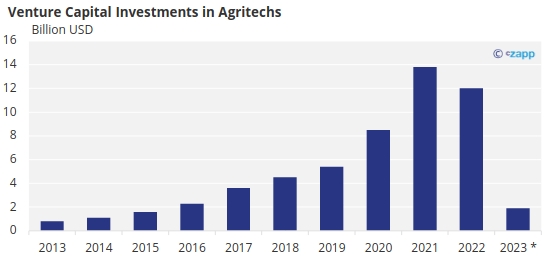

Source: AgFunder

Around the world, these challenges continued to impose themselves in the first quarter of the year, as shown by a study by PitchBook, an American market analysis company specializing in venture capital and private equity. The volume of investments fell 39% compared to the previous quarter. The global economic slowdown and the banking crisis in the United States and Europe explain much of the drop in contributions, according to the company.

Source: PitchBook. *Until March/23

Even so, important deals continued to be closed. In total, USD 1.9 billion was invested, through venture capital funds, in 172 agritechs around the world. eFishery, a startup of new technologies for aquaculture from Indonesia, raised USD 150 million, while Halter, from New Zealand, received USD 85 million to improve sensors and equipment for cows, based on artificial intelligence – the devices are used to monitor parameters such as temperature, heart rate and fertility of the animals.

At the same time, startups in robotics, irrigation and financing solutions remain on the rise. In Brazil, Solinftec raised BRL 100 million this year to boost harvest monitoring technologies, focusing on sugarcane – the company created robots that kill insects and analyze the soil to identify the need to use fertilizers or pesticides.

This type of tool, which integrates the set of precision agriculture solutions, can generate savings for the rural producer, among other benefits. For example, a sugarcane mill would normally use 300 kilograms of fertilizer per hectare – with better soil analysis, it is possible to reduce this cost by around BRL 300 per hectare.

Sugarcane plantation: new technologies to reduce costs and increase productivity. Publicity photo.

There is also room for nascent businesses. DioxD, founded in 2018, received more than BRL 1.4 million from funds such as GR8 Ventures and the accelerator AgroVen. The funds will be used to gain scale and improve a technology based on the application of CO2 in soy seed bags to speed up the plant’s germination.

In the view of Agtech Garage, one of the largest agroinnovation hubs in Latin America, the trend is that solutions aimed at optimizing production continue to gain ground, as well as the use of new technologies to monitor the crop.

“In addition to generating time savings and allowing the workforce to be allocated to other more strategic activities, technological advances allow for greater precision and intelligence in decision-making”, says José Tomé, CEO of AgTech Garage, and partner at PwC Brazil.

In general, the scenario for investments in agro startups this year is a little more optimistic than in 2022. British consultancy Oghma Partners, specialized in acquisitions and investments in the food and beverage sector, points out that the most impactful difficulties of last year should gradually be left behind, although there are still challenges for betting on new companies during a volatile business environment.

“Some of the increased costs and more complex financing environment seen in 2022 are expected to ease this year. We hope to find investors willing to offer attractive valuation levels for agritechs”, says Mark Lynch, partner at British consultancy Oghma Partners.

Source: Central Bank, World Bank and FED St. Louis