Insight Focus

- Big progress in US corn planting.

- China cancels corn purchases again.

- Black Sea Corridor extended.

Forecast

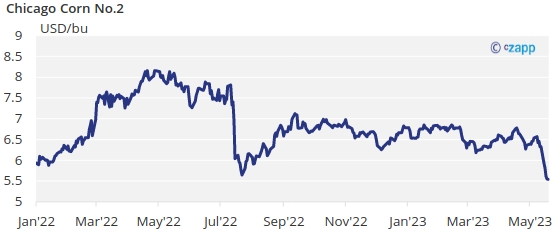

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,6 USD/bu.

Market Commentary

Big progress in US Corn planting, China cancelling purchases again, and the extension of the Black Sea corridor pressed the market down again. The sub 6 USD/bu Corn is here to stay.

There was some strength at the beginning of last week but as soon as the crop progress report was published in the US, and last Wednesday the deal for the Black Sea corridor was extended the market fell strong.

On top of the ample supply picture, Chinese buyers cancelled again purchases previously done of US origin and once again moved to buy FOB Brazil. Since April a total of 1,1 mill ton of US exports to China have been cancelled. In fact, Chinese official stats showed imports of US Corn plummeted by 54,6% year on year in April, although year to April they were just -8,4%.

US Corn planting made another big weekly progress and is now 65% planted vs. 45% last year and vs. 59% of the five year average. This continues to favor crop development with 30% of Corn already having emerged vs. 13% of last year and 25% of the five year average.

In Brazil, the first Corn crop is 72,48% harvested.

In Russia, Corn planting is 57,1% complete.

Interesting was last week the French agricultural ministry estimating a fall in Corn area to the lowest in 30 years with most of the lost area going to Sunflower. The reason appears to be farmers choosing crops that need less water during the summer. French Corn planting is 88% complete vs. 97% last year.

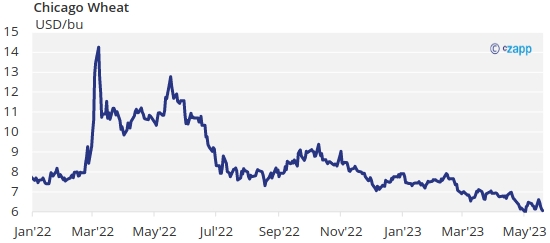

In the Wheat front, the major influence was the extension of the Black Sea corridor as a deal was finally agreed and the agreement extended for 60 days until July 18.

US Wheat condition was unchanged at 29% good or excellent vs. 27% last year. French Wheat condition fell 1 points to 93% good or excellent vs. 73% last year.

BAGE in Argentina published their first forecast for 23/24 Wheat production at 18 mill ton which is 45% higher year on year. This is vs. 19,5 mill ton of the WASDE.

In the weather front, all is looking favorable in the US for Corn planting which should see another big weekly progress with dry weather expected. Brazil should see dry weather as well benefitting safrinha Corn condition and first Corn crop harvesting. Europe continues to be too wet in the north and too dry in the south.

With the uncertainty around the extension of the Black Sea corridor now disappearing, all the focus turns to planting pace in the northern hemisphere and harvesting pace in the southern hemisphere, which means a weather market. But progress in both regions is going very well and we doubt the weakness in the market will disappear. The trend in the mid term should continue lower.

Big progress in US Corn planting, China cancelling purchases again, and the extension of the Black Sea corridor pressed the market down again. The sub 6 USD/bu Corn is here to stay. With the uncertainty around the extension of the Black Sea corridor now disappearing, all the focus turns to planting pace in the northern hemisphere and harvesting pace in the southern hemisphere, which means a weather market. But progress in both regions is going very well and we doubt the weakness in the market will disappear. The trend in the mid term should continue lower. No changes to our average price forecast for Chicago Corn for the 22/23 (Sep/Aug) crop in a range 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,6 USD/bu.