Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

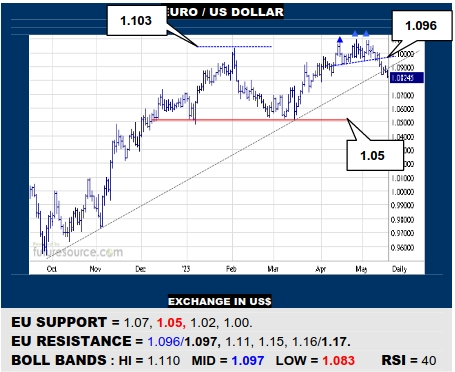

EURO / US DOLLAR

Completing the tiny H&S last week, the EU has fallen away to break the broader uptrend as well, matched by a $ Index downtrend escape. This threatens a further nearby drop to 1.07 and ultimately testing the next main ledge at 1.05. Must react back above the mini-top neckline and mid band (1.096/1.097) to make any significant repairs.

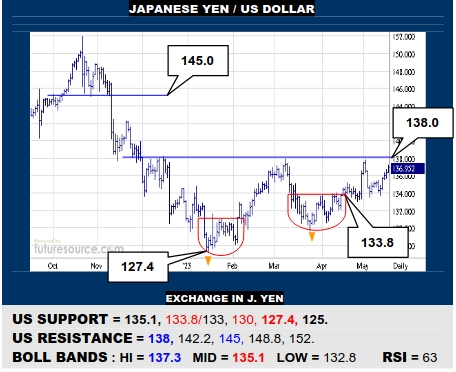

JAPANESE YEN / US DOLLAR

The US is making a third and likely pivotal run at the 138 resistance in search of a breakthrough to resolve a nearly six month base that could then act as a springboard on up to 145. Only yet a third denial at 138 and twisting back under the mid band (135.1) would infer an enduring flinch that could press back through the 133’s into the upper 120’s.

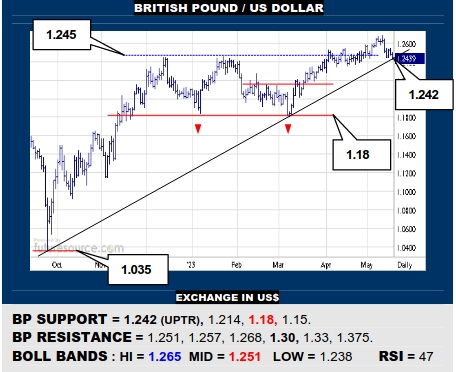

BRITISH POUND / US DOLLAR

Suspicion stemming from RSI divergence was validated as the BP fumbled its getaway higher and veered back under the mid band tonow be attacking the main uptrend (1.242). If this broke too, beware dropping back to 1.214 initially but with risk to 1.18 in due course. Must hold the trend and rebound over 1.257 to get back on the gas.

SWISS FRANC / US DOLLAR

Divergent RSI here too hinted at a turn and the US is nipping at the 0.90 resistance, seeking access to the downtrend (0.904). Piercing the trend would reassure the emerging Q2 base and suggest scope on up to the 0.94’s. The trend must block the swell and press values back under the mid band (0.892) to resuscitate the decline to try 0.875.

AUSTRALIAN DOLLAR / US DOLLAR

Yet another rebuke from 0.68 is being followed by a little bear flaggish congestion in the 0.66’s so beware the AD being poised to strike at the 0.654 border of a former late ’22 base, a break below building a large if scruffy H&S pointing on down to 0.617. Must grip clear of 0.654 again to downplay the top threat and just continue ranging.

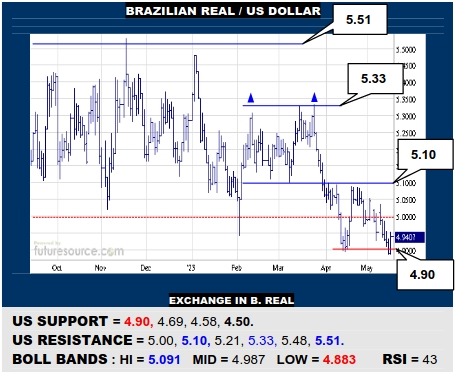

BRAZILIAN REAL / US DOLLAR

With the April bounce smothered by the 5.10 resistance, the US is back against the ropes of the 4.90 support. It must hold here and react over 5.00 to prove its resilience, in which case starting to mull the forming of a Q2 double bottom if 5.10 could later be overcome. Alas, if 4.90 gave way, beware the broader top forcing a delve to the 4.50’s.

EURO / JAPANESE YEN

The reflex back out of the 150’s was parried as the lower Bollinger band approached (146) and if the EU can boost back into the 149’s, it would imply a successful catch and a chance to try 151.6 again. Alas, if foiled in the 148’s, then beware a possible Q2 H&S top forming where breaking the 146’s could soon endanger the 144.4 base rim.

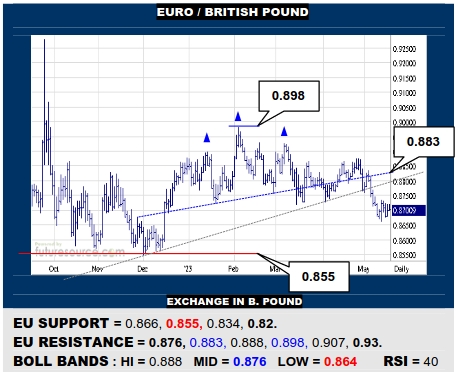

EURO / BRITISH POUND

The Q1 H&S overcame the shallow uptrend but the BP has lately allowed the EU some air amidst a spell of consolidation near 0.87. This has a bear flag vibe initially so must watch 0.866 as a tripwire on down to strike at the main 0.855 support. Needing a jolt over the mid band (0.876) to instead lunge back up to the H&S (0.883).

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.