Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

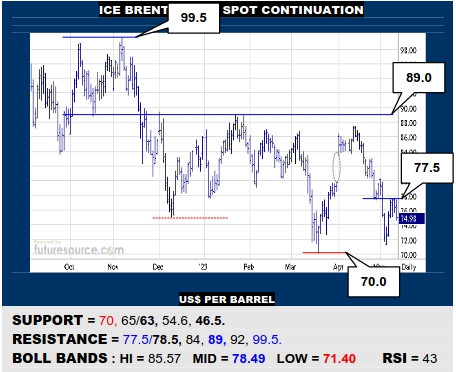

ICE BRENT CRUDE OIL SPOT

Brents’ April dive has been fended off clear of the 70 trough but it will soon need to punch free of 77.5 as the mid band intersects there in order to give a more persuasive sense of retrieval to maybe mull the Dec, Mch and May lows for a possible overall inverse H&S. Still minding 70 meantime as the spoiler tripwire on down to a 63 Fib retracement.

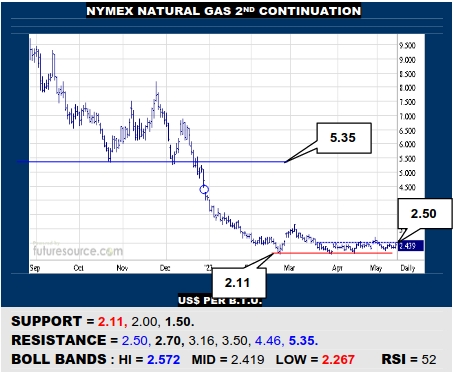

NYMEX NATURAL GAS 2ND CONTINUATION

Nat Gas has flattened out in ’23 but an initial lunge over 2.50 failed to gel so the sense of a saucer shaped base evolving has yet to be validated and 2.70 is technically now the trigger out of trouble for a first step to 3.16 and maybe then eying the 4.40’s gap. Stable meanwhile but having to watch 2.11 all the same as a trapdoor on down to 1.50.

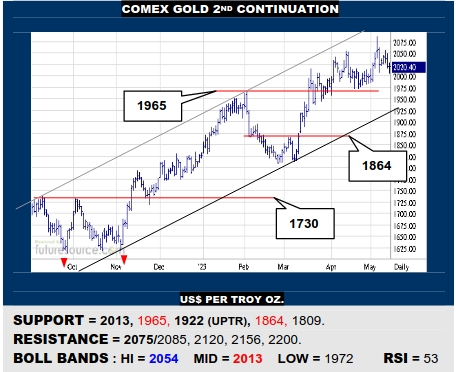

COMEX GOLD 2ND CONTINUATION

Gold quickly undid a glimpse at a new 2085 high and the mid band is under fire again (2013) as the Dollar provisionally sheds it downtrend. If that mid band gave way and the Dollar trend exit endured, beware shifting macro sands putting the 1965 shelf in peril to reveal the uptrend (1922). Must hold the mid band to revive chances to rally again.

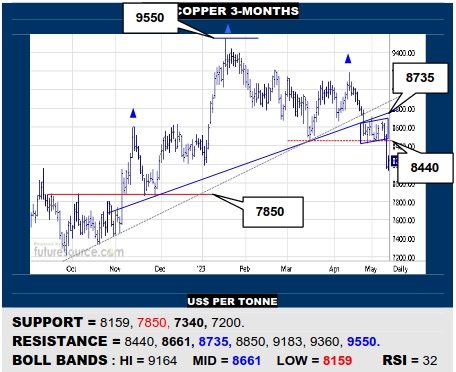

LME COPPER 3-MONTHS

A recent spell of 8500’s ranging gave way this week to post a bear flag and give greater emphasis to Coppers’ large six-month H&S top. The Dollar now breaking its downtrend seems to endorse the ongoing decay here and so further steps lower to 7850 and even 7340 threaten. Only a sudden rebound over 8440 would be reason to doubt the breakdown.

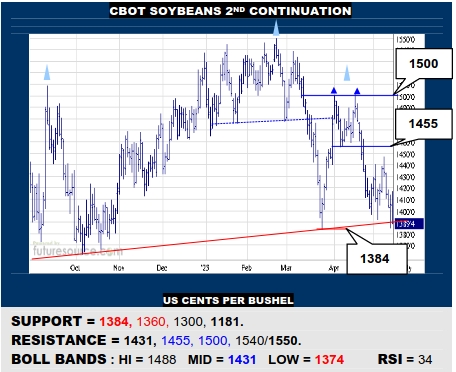

CBOT SOYBEANS 2ND CONTINUATION

Both a broad daily H&S apparent here and a far larger weekly chart version are hanging on the fate of the 1384 support. Beans duly look to be teetering on the precipice where a breakdown would suggest a next step to 1300 and quite possibly 1181 in due course. Must somehow hang tough at 1384 and defeat the mid band (1431) to lift the pressure.

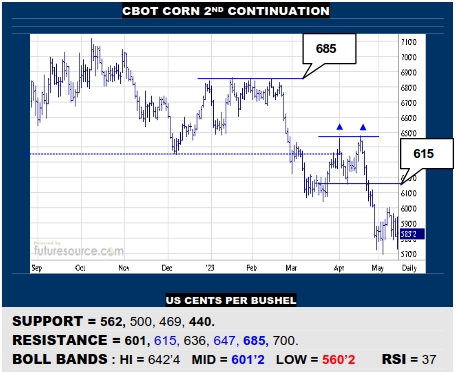

CBOT CORN 2ND CONTINUATION

Corn doesn’t have much leeway to a pivotal 562 trough where a vast H&S already dominating the weekly landscape would receive further endorsement for a next drop to 500 with ultimate prospects of chewing on down to the 440’s. Must at least pop the mid band (601) for initial relief and a chance to make a better turn by piercing 615 thereafter.

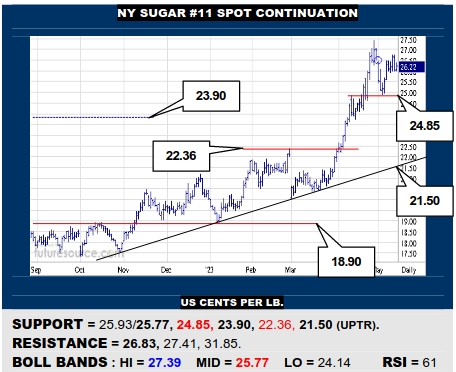

NY SUGAR #11 SPOT CONTINUATION

A stable week but Sugar could only stab higher to fill a mid 26’s gap before slipping back again. This marks a dubious initiation for Jly as the spot month and warns to mind the approaching mid band (25.77). A break below could soon endanger 24.85 with risk of a double top. Must hold the high 25’s and close over 26.83 to get back on the pedals.

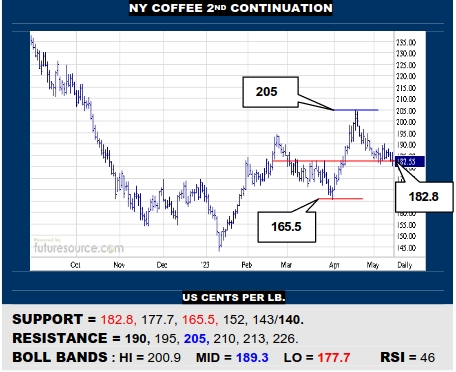

NY COFFEE 2ND CONTINUATION

An ongoing struggle in the lower 180’s has generally still maintained the 182’s Mch base rim but Coffee must soon react back over 190 to shed its mid band and so curtail a correction. If so, look for a new fifth wave (Elliot wave) higher that could pop 205 and reach the 220’s. Slim margin for error though and ouster from the 180’s would point on down to 165.

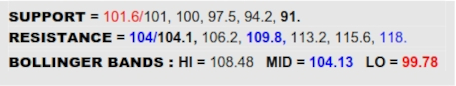

BLOOMBERG COMMODITY INDEX

Fraught conditions for the B-Berg as it probes below prior Mch lows at 101.6 while meantime the Dollar has pulled free of its downtrend. If the greenback can secure that getaway, prospects of keeping the fingertips on the cliff edge here would fade and a new April top shape would demand recognition, projecting down to the 94’s, thus much of the way to the next major monthly support in the 91’s. Otherwise there feels like a dire need for the Dollar to quickly fumble its trend exit and veer back through 100.8 to bring the cavalry to town here, subsequently having to react back over 104 where the mid band is now intersecting to give any first real suggestion of turning the tide.

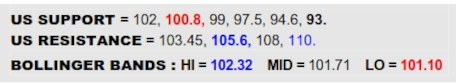

US DOLLAR INDEX

After repeated defenses by the 100.8 support in Q2, the Dollar has finally staged a rebound over its downtrend Friday that had prevailed these past eight months. Under the circumstances of the Fed’s busy in-tray, this must still be substantiated with some ongoing balancing on 102 next week to then offer passage up to the 105’s where a broader six month base could be in the offing to score more enduring macro change to really hurt commodities. Meanwhile though, only if quick to stumble and pressed back out of the 102’s would it be premature to dismiss the downtrend, then keeping 100.8 in the viewfinder as the breakpoint to reshuffle the macro cards again.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.