Insight Focus

- The shipping industry currently uses about 300 million tonnes of fossil fuels.

- Something must change if the industry is to meet its strict environmental targets.

- Could ammonia be the marine fuel of the future?

Ammonia Has Established Production Pathways

Ammonia is used for a range of industries, but the overwhelming majority is diverted to fertilizer production. In the US, about 88% of ammonia is used for fertilisers.

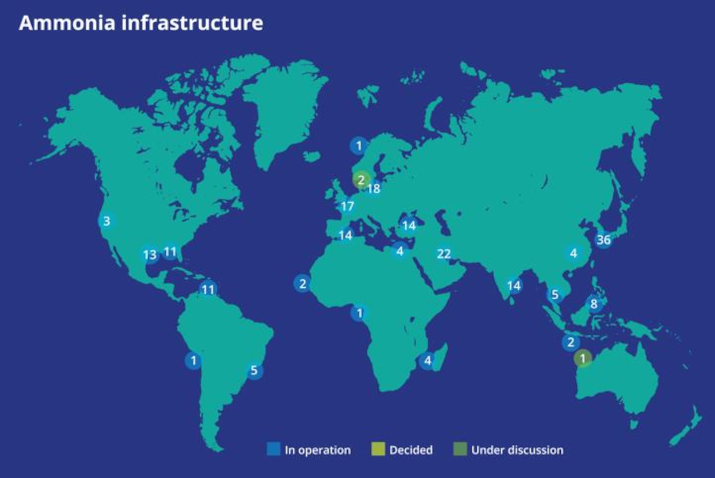

This means there is a well-established supply chain and infrastructure network for ammonia production – although there is little experience of using ammonia as a marine fuel.

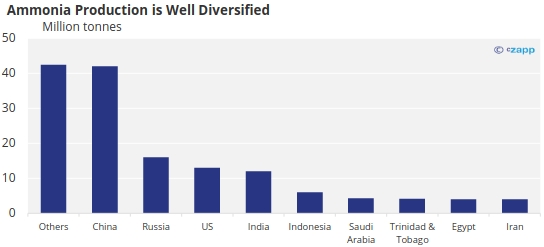

Because its main inputs are water, air and energy, ammonia can be made almost anywhere. As it stands, the biggest global producers are China, Russia and the US.

Source: USGS

According to the USDA, ammonia production will expand by 4% in the next four years, with over 30% of these expansions happening in Russia and Belarus.

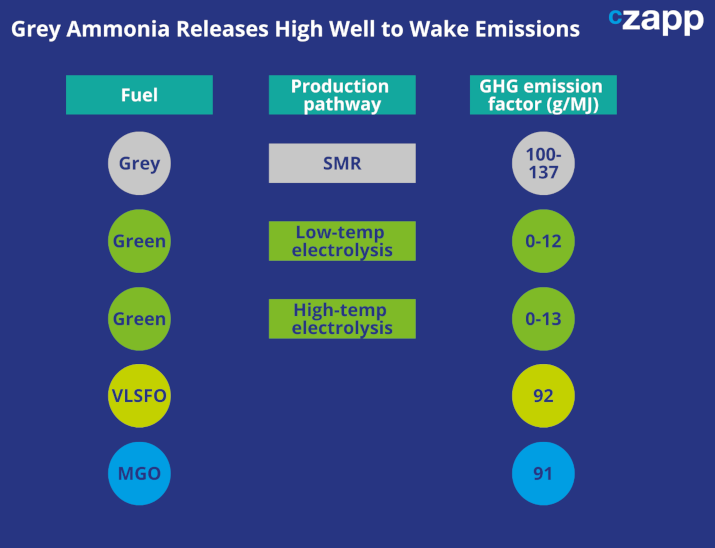

There are various ways to make ammonia, but the most common is a process called steam methane reforming (SMR). This process uses methane, water and air to produce hydrogen, but it uses a great deal of energy and, according to The Royal Society, produces 1.8% of the world’s carbon dioxide emissions.

Source: EMSA

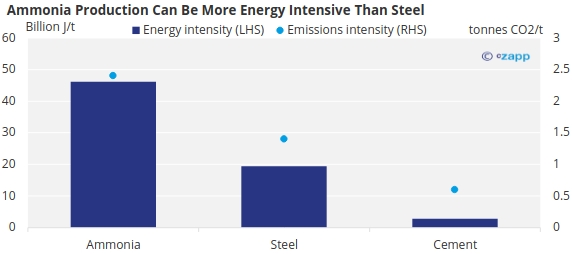

When used, traditional – or “grey ammonia” – has very minimal emissions, meaning tank to wake calculations view it very favourably in the marine industry. But as a well-to-wake fuel, emissions are high. In fact, ammonia production can sometimes be more energy intensive than the production of steel.

Source: IEA

Emissions Drop for Green Ammonia

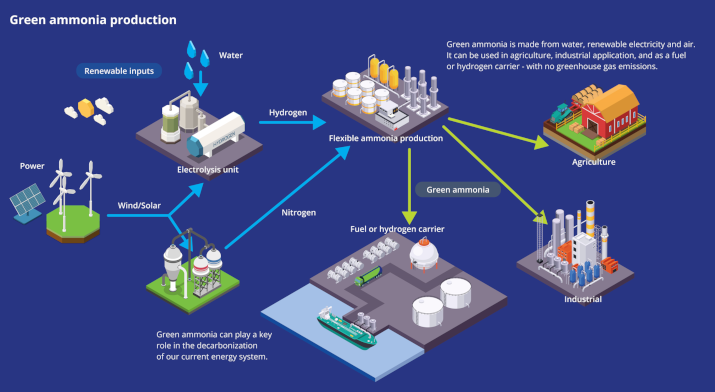

However, there is a relatively novel technique for producing “green ammonia”, which uses renewable electricity and renewable inputs to create water electrolysis. This process greatly reduces emissions but of course is not as well-established as the grey ammonia process.

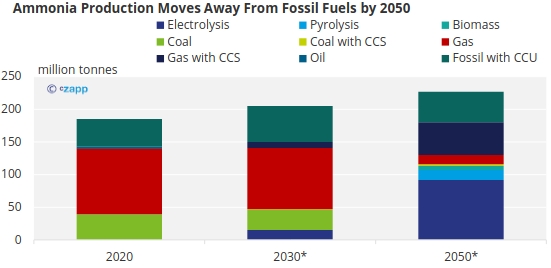

Ammonia production is moving away from grey inputs.

* Net Zero Scenario

Source: IEA

But there are still stumbling blocks related to the toxicity of the fuel. It can be toxic to humans and aquatic life in high concentrations and is highly reactive to certain materials, such as chlorine, acids, brass, copper, silver and zinc. It is also corrosive, which could lead to equipment damage or faster wear. This will require more complexity in ship designs, which would add costs.

Fuel Could Be Cost Prohibitive

Because ammonia production is well-established, a lot of infrastructure exists.

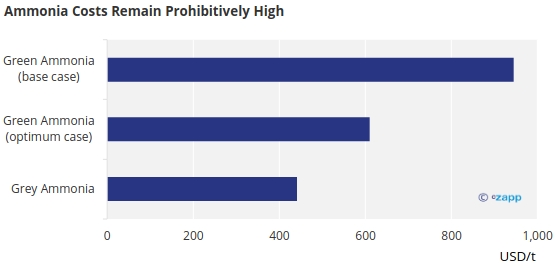

But even grey ammonia is expensive. According to CRU, the levelized cost of grey ammonia USD 441, while this cost shoots up to USD 945 for green ammonia.

Source: CRU

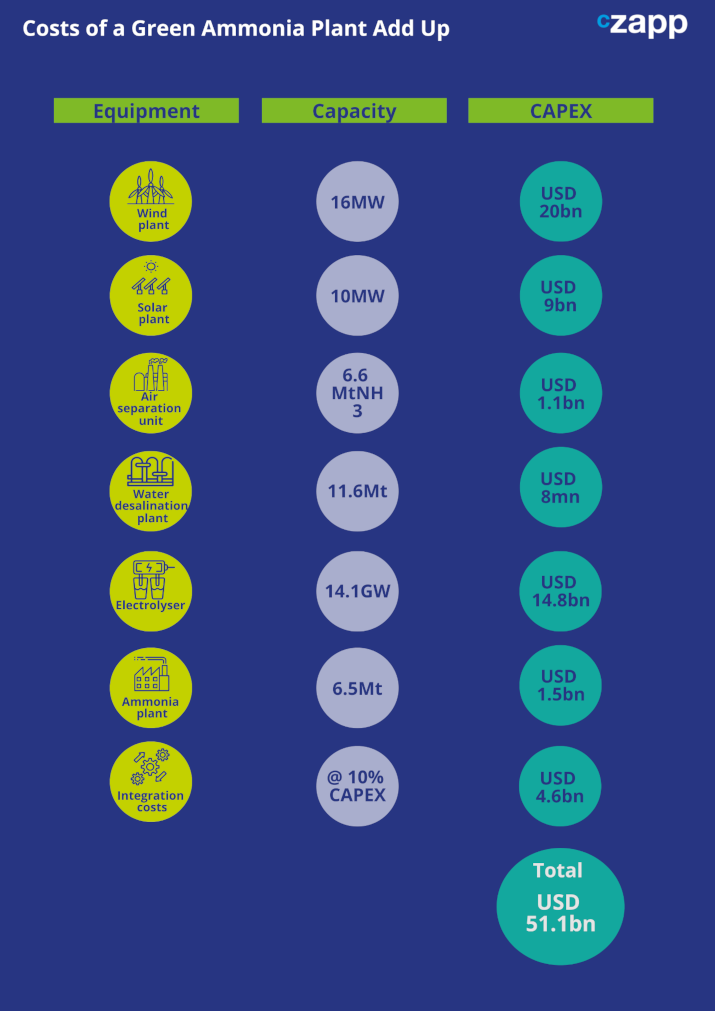

And it’s not just the fuel that is expensive – so too is the infrastructure required to produce green ammonia. CRU estimated that the total capital outlay would be USD 51.1 billion, in addition to an operating cost of USD 570 million per year.

Data source: CRU

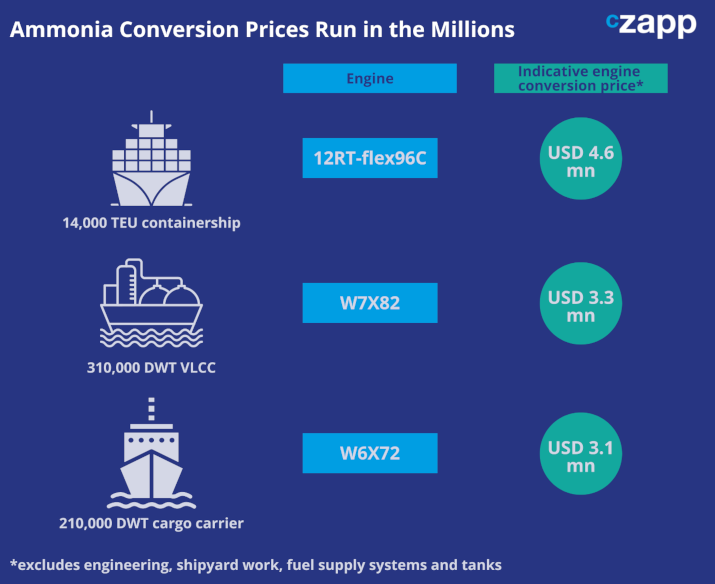

There is also the high cost of retrofitting ships to consider, with indicative engine conversion prices reaching as high as USD 4.6 million per ship.

Data source: EMSA

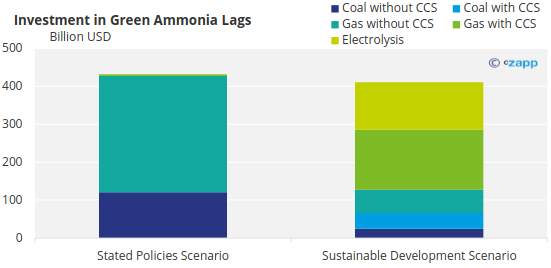

Investment is falling behind, according to the International Energy Agency. In a business as usual scenario, most investment is going to grey ammonia production rather than green ammonia or blue ammonia (grey production with carbon capture storage).

Source: IEA

Energy Conversion Issues Persist

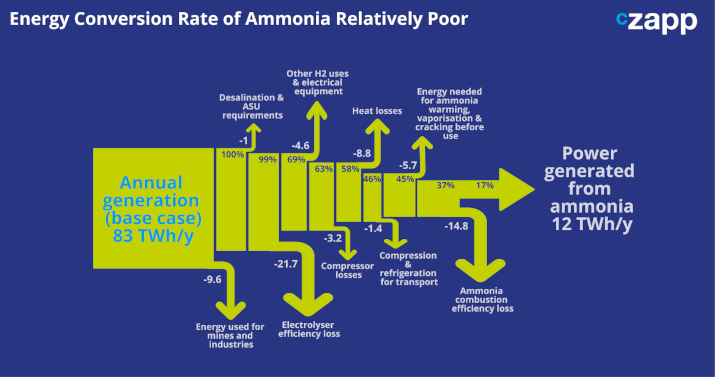

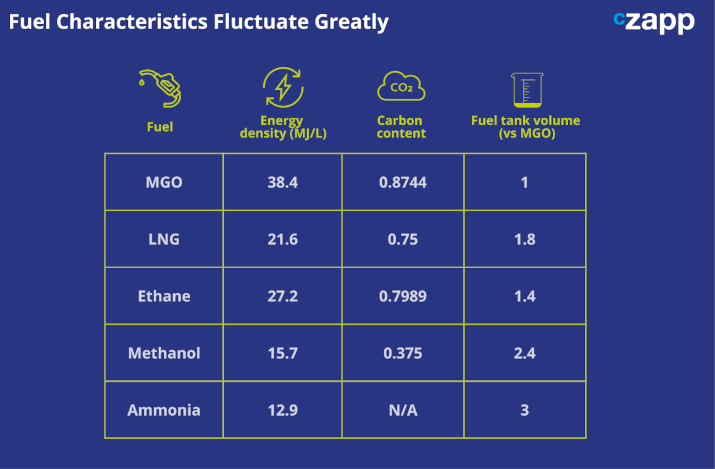

Of course, all fuels have different energy densities, and in order to replace 300 million tonnes of fossil fuels, alternative fuels need to compete on efficiency. Unfortunately, ammonia offers a particularly poor energy conversion rate.

Data source: CRU

This has bigger implications though because lower energy efficiency means higher storage requirements or more bunkering, pushing costs up.

Data source: EMSA

Concluding Thoughts

- Given that ammonia is largely used for fertilisers, it is unclear whether there would be enough capacity for marine fuels.

- This is especially pertinent given the cost associated with ammonia – it won’t be possible to scale up dramatically.

- Ammonia also offers lower fuel efficiency than comparable fuels.

- The biggest advantage of ammonia is its lack of tank to wake emissions.

- If this success can be replicated on the well to wake portion of production, ammonia could be a very promising alternative fuel to help the industry decarbonize.