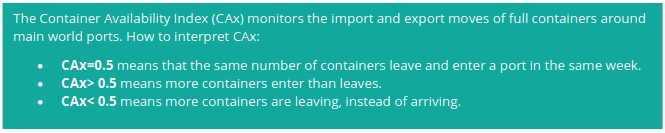

Opinion Focus

- Freight between Asia and the US has stabilized close to pre-pandemic levels.

- Market accommodation might lead to a further drop in prices.

- An increase in oil prices might be a worrying factor.

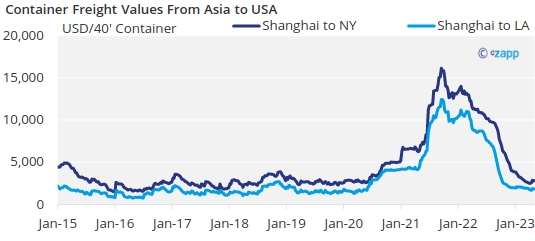

After a strong period of price increases during the pandemic, the maritime freight market started to get back on track from the middle of last year. In recent months, the price to transport a 40-foot container from Asia to the east coast of the United States has dropped to US$1,000 – at the end of 2021, freight reached US$16,000.

Source: Bloomberg

There is still room for a further drop in prices, according to market sources. “There is fat to trim in the cost of maritime transport, which is still a little higher than before the pandemic,” says Diego Viegas, sales director at MIB Shipping, a Brazilian maritime cargo handling company, in an interview with Czapp.

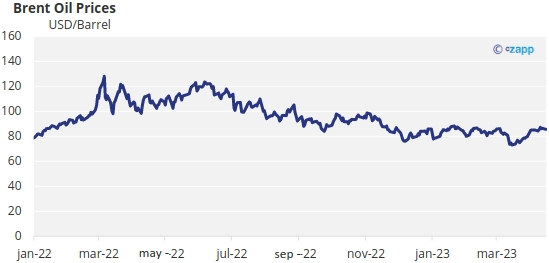

The market, however, is also attentive to issues such as rising oil prices. In early April, fuel prices rose 8% due to OPEC’s decision to cut production by 1 million barrels per day. As a result, the price of a barrel surpassed US$ 80, the highest in a year. “If oil rises again, there may be less room to further cut freight costs”, said Viegas.

See more in the interview below:

What are the prospects for freight prices this year?

Freight levels are on a downward trend mainly because of the global situation, which is experiencing some stability. The first impact of the pandemic was taking ships out of circulation, because we did not know what would happen. The memory of the 2008 financial crisis in the United States, in which ships were idle for months, has not faded. Shipping a container from China to the port of Santos costed US$ 50 in 2008. Afterwards, prices rose again.

And what happened to demand during the pandemic?

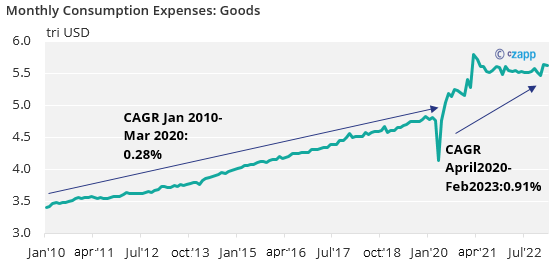

As the forecast was that demand would drop a lot, several ships were taken out of circulation. But demand hasn’t dropped that much. On the contrary, consumption in some countries has increased largely because of government fiscal stimulus packages. And then there began to be several bottlenecks in relation to freight. In 2022, shipping between South America and the United States has exploded. On the route between Asia and the American east coast, the same thing happened.

Source: FED Saint Louis

By the way, one of the most operated routes at the time of the pandemic was that of China and the west coast of the United States. There was a lot of delay in the ports of California, including due to lack of manpower. Is this one of the reasons for the increase in freights?

That was one of the reasons. Another was the US government aid package for the population. There was an increase in consumption, as I said. And the longest sea route in the world is between the United States and Asia. The biggest gateway to the United States is the west coast. There was a congestion of ships in the ports on the west coast. In Los Angeles, it took a month and a half to dock the ship. Chartering a ship costs around US$ 20,000 or US$ 30,000 a day. Imagine 30 days with the ship stopped.

How is the issue of freight and demand now?

Demand retracted. We are living in a moment of uncertainty, globally. Today, freight between China and the east coast of the United States is around US$ 1,000. It is much lower than the high prices during the pandemic, but it is still about 20% more expensive than before the coronavirus crisis.

Source: Bloomberg

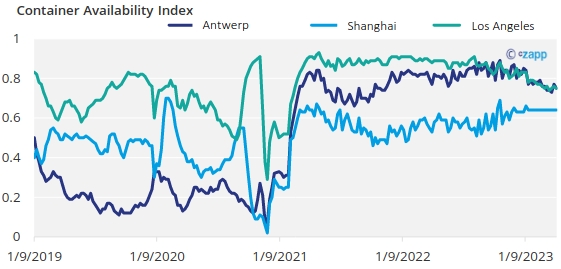

Have regular container routes been disrupted during the pandemic? And is it back to normal?

These routes were harmed. There was a scare at the beginning of the pandemic because nobody knew how the demand was going to be. Therefore, the availability of ships was reduced. This is normalizing now.

During the pandemic, the shortage of containers caused an increase in break-bulk sugar exports, of loads that are transported in boxes, bags, or barrels, right?

That’s exactly what happened. And it wasn’t just the sugar. With iron ore, the same thing happened. With lower sales, iron ore began to be shipped in bulk. This happened because of the cost of freight per ton.

Source: Bloomberg

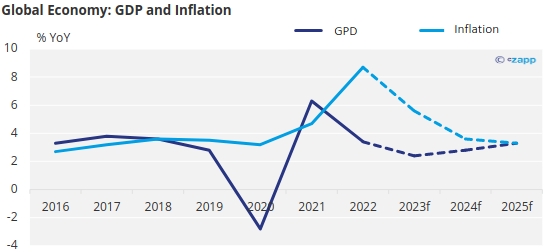

Should the prospect of lower growth in the Chinese economy impact freight prices?

It should have an impact, in the sense of a drop in price, because China is the country that handles the most cargo in the world. Everything that happens to China directly affects shipping. A drop in import demand in China greatly impacts demand and, therefore, freight costs tend to drop. The price of shipping between the United States and Shanghai has already returned to something around US$ 1,000, as I said, but it is still a little above what it cost before the pandemic.

Still have a fat to cut?

There is.

Will the increase in the oil price due to the drop in production in the OPEC countries, announced in early April, have an impact on maritime freight?

This can happen, although the effects are only noticeable after a few months because contracts are closed in advance. The shipowner hedges the cost of oil. If oil continues to rise, there should be an adjustment in freight prices. The increase in oil price, which represents 30% of the maritime transport cost, may be an indication that perhaps there is not so much room for reducing the freight cost.

Source: Bloomberg

And what about the availability of space on ships?

Some shipowners are claiming that there is already a lack of space on the ships that make the route between Asia and Brazil and that, therefore, there may be an increase in the cost of freight. All this happens due to signs of increased demand. Remember that shipping prices are very dynamic.

What is the periodicity of price adjustments?

Today, prices are usually calculated per month. But the prices are only valid for one week in the case of shipments from Asia to Brazil. The intention is to react to each market change in a very dynamic way.

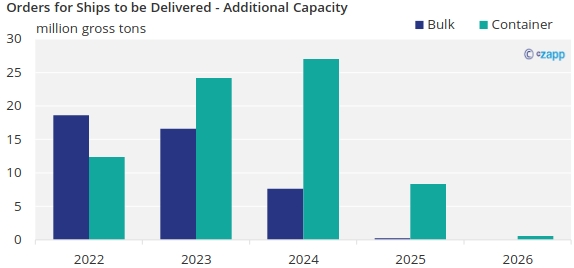

And how is the shipbuilding market, is there a prospect of delivering new ships?

Yes, there is a perspective of delivering ships, which take years to build, at the end of the year and at the beginning of 2024. This should help to balance demand.

Note: 2025 and 2026 numbers will likely increase as more orders are received in 2022 and 2023

Source: IMO GISIS

So, can we expect a more balanced market in terms of freight prices in 2024?

Exactly. Large companies in the sector are already informing that, as of the third quarter of this year, there is a prediction of a greater balance between supply and demand. But the signals are still a bit mixed, with the war in Ukraine, lower demand in China and the economic situation in the United States.

Recently, Europe defined a set of norms to limit the emission of carbon dioxide by ships. Have you been following this?

Yes. All shipowners are focused on green fuel and alternative energies. Companies are investing a lot in this. Ethanol is one of the fuels that shipowners are looking closely at. There is growing concern about ESG. And we cannot forget that oil is the cost that most impacts shipowners’ operations, so there is also an economic reason for the search for alternative sources of energy.