Insight Focus

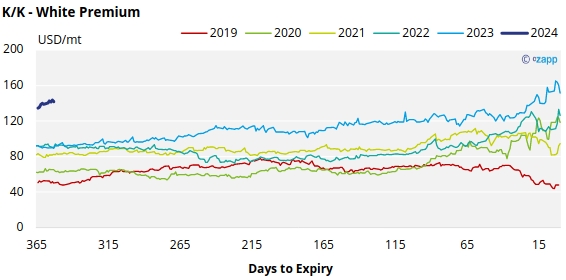

- No.11 May’23 futures contract expired at 26.99c/Ib after briefly reaching a 12-year high.

- Producers continue to hedge into the rally.

- Q/N sugar white premiums dropped to 131USD/mt.

New York No.11 Raw Sugar Futures

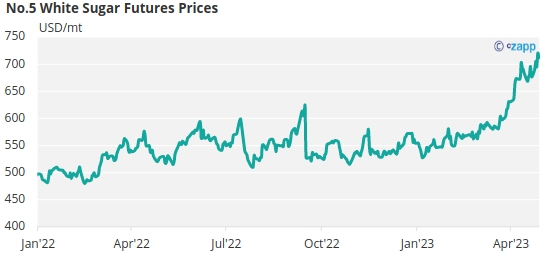

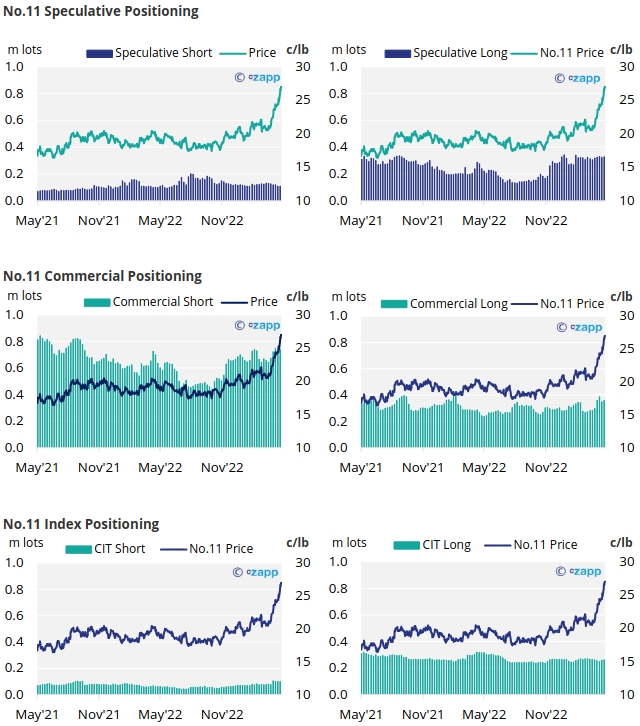

The No.11 May’23 raw sugar futures contract expired last week at 26.99c/Ib, following several weeks of bullish market activity in which the No. 11 sugar futures reached 12-year highs.

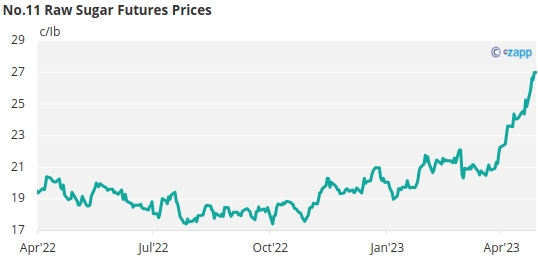

By the 25th of April (latest CoT CFTC report), both raw sugar producers and consumers had added new hedges, 17k and 11k lots respectively. Producers are likely capitalising on the price strength whilst consumers hand-to-mouth buy.

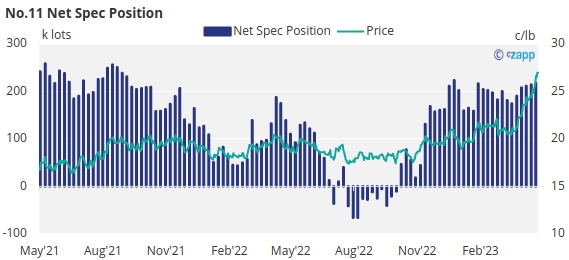

Over the same timeframe, raw sugar speculators opened approximately 4.2k lots of new long positions and 0.8k lots of new short positions, extending the net spec position by approximately 3.4k lots to 218k lots long.

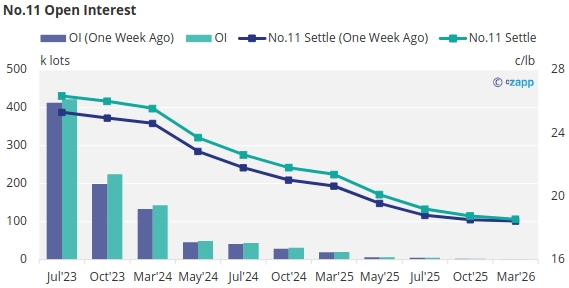

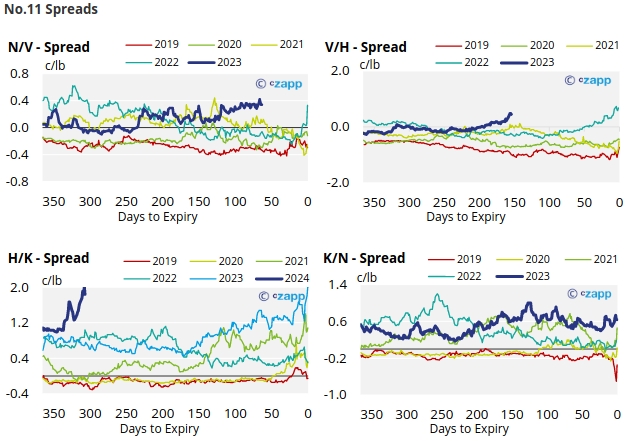

With contracts strengthening across the board, over the last week, the No.11 forward curve is now inverted.

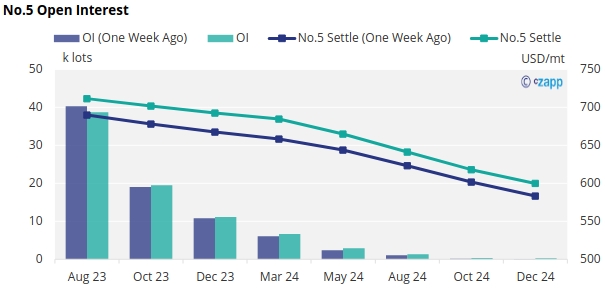

London No.5 Refined Sugar Futures

No.5 refined sugar futures strengthened to 730USD/tonne by Thursday last week before falling back toward 711USD/tonne by Friday close.

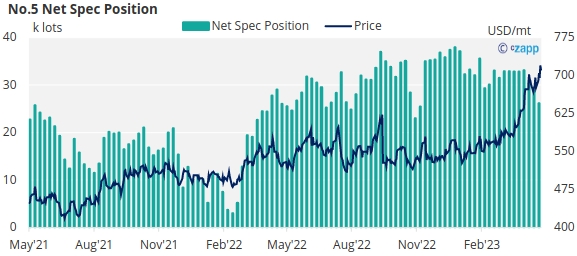

By the 25th of April (latest CoT data), refined sugar speculators reduced their net long positions by 2.5k lots; with prices already at multi-year highs, speculators may be wary of the prospects for further price increases.

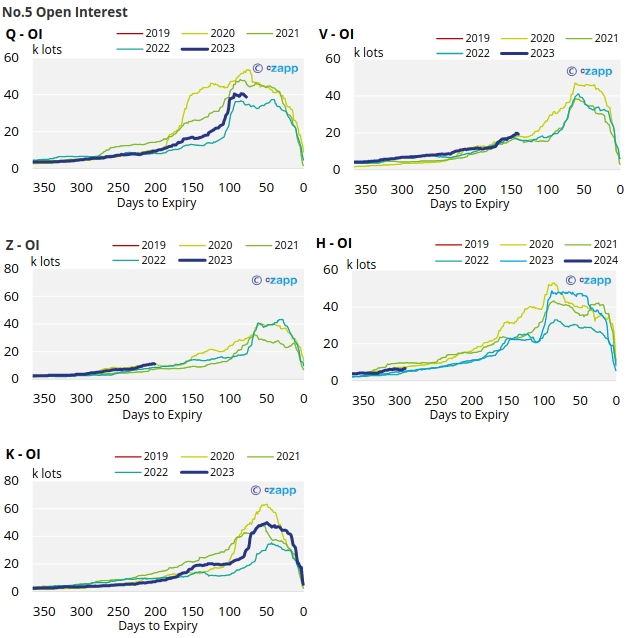

With contracts strengthening across the board, the No.5 forward curve remains inverted through to December 2024.

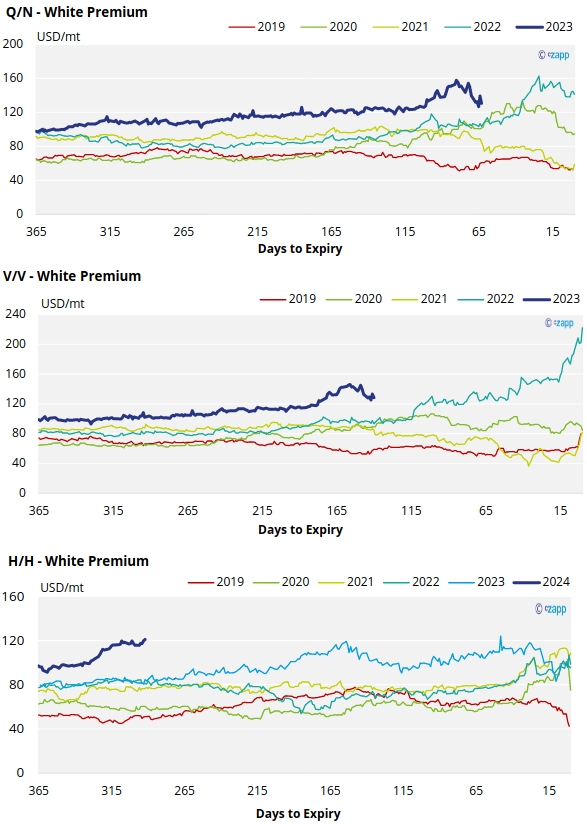

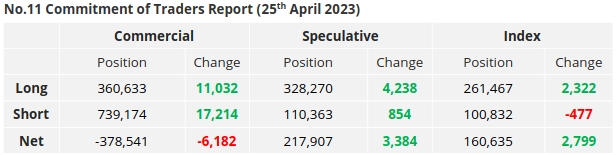

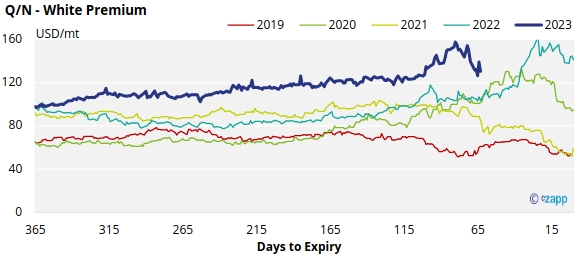

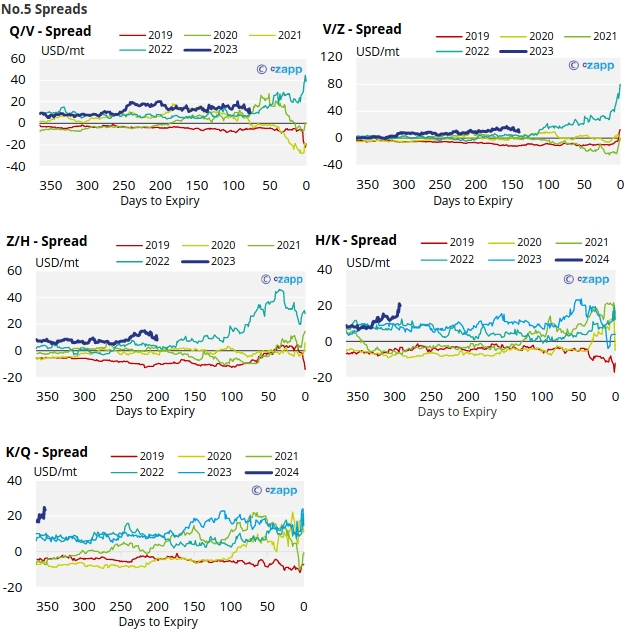

White Premium (Arbitrage)

The Q/N sugar white premium has weakened for a second week in a row, now trading at 131USD/mt.

The following V/V and H/H white premiums, however, are more stable at the moment, trading around 128USD/mt and 121USD/mt, respectively. This is unusually high this far in advance of their expiries.

With global energy prices falling, we believe re-exports refiners require around 130-145 USD/mt above the No.11 to produce refined sugar profitably.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

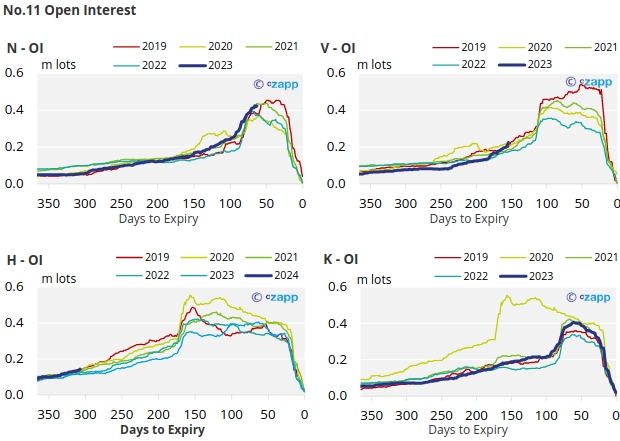

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix