Insight Focus

- Surprise drop in EU carbon greenhouse gas emissions in 2022.

- Most experts thought emissions would rise thanks to increased coal power generation.

- European industry was hit harder than expected by high energy costs.

Factories and power stations in the EU’s Emission Trading System emitted 1.2% less greenhouse gas in 2022, according to preliminary data from the European Commission released at the start of April.

The decline came as a surprise, as most expert predictions had called for CO2 emissions to have risen by around 1.4% last year, as an increase in the use of coal for power generation was expected to have outweighed a drop in industrial output due to soaring energy costs.

Analysts at ICIS said “the data show the gas crisis translated into a higher emissions profile for the EU power sector but industrial output destruction weighed down overall emissions.”

EU data showed that emissions decreased by 1.2% to 1.332 billion tonnes in 2022. According to ICIS calculations, power sector CO2 increased by 3.3% while industrial emissions dropped by 5.6%.

Earlier, Germany had published data showing that more than 1,700 German plants participating in the EU ETS generated 354 million tonnes of CO2 in 2022, in line with the previous year.

The fall in annual emissions will mean that more EU emission allowances (EUAs) remain in the market as they will not be used for 2022 compliance. Companies must surrender allowances matching their emissions before April 30.

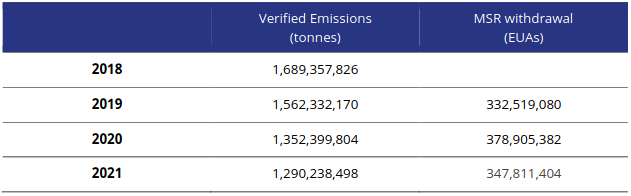

This in turn means that the market stability reserve (MSR) will withdraw more permits from the market when it is recalibrated in September. The MSR takes 24% of the calculated surplus in the market out of circulation each year by reducing the number of EUAs sold at auction.

The Commission calculated the available supply in the market at more than 1.4 billion EUAs a year ago, meaning that there are enough EUAs in the market already to meet around one year’s worth of emissions.

The MSR is configured to remove surplus allowances until market supply falls below 833 million EUAs, a level that is estimated to allow sufficient supply for power generators and industrials to ”hedge” their future demand each year.

Once the market supply falls below 400 million tonnes, the MSR would inject additional allowances into the market by increasing auction supply.

There was little reaction in the market to the 2022 data. December 2023 EUA futures rose from €91.93 on March 30 to a high of €98.50 on April 11, but have begun to drop back again as the end of the compliance season approaches.

Participants generally expect EUA prices to begin to decline once industrials have finished buying EUAs in time for the April 30 deadline.

In the medium term the market is facing additional EUA supply after the European Union voted earlier this year to auction €20 billion of extra EUAs to help fund measures to transition away from Russian fossil fuels.

The €20 billion in extra EUAs will start to come to the market in the summer, once the European Commission has updated market regulations.

The additional EUAs will be sourced from member state auction reserves for the period from 2027 to 2030, as well as by advancing some auction volumes set aside to help fund new low-carbon technologies.

The outcome of these measures is expected to make the market supply tighter in the second half of the 2020s, leading to higher prices, experts warn.