Insight Focus

- The shipping industry currently uses about 300 million tonnes of fossil fuels.

- Something must change if the industry is to meet its strict environmental targets.

- Could methanol be the marine fuel of the future?

Methanol Can Reduce Emissions to Zero

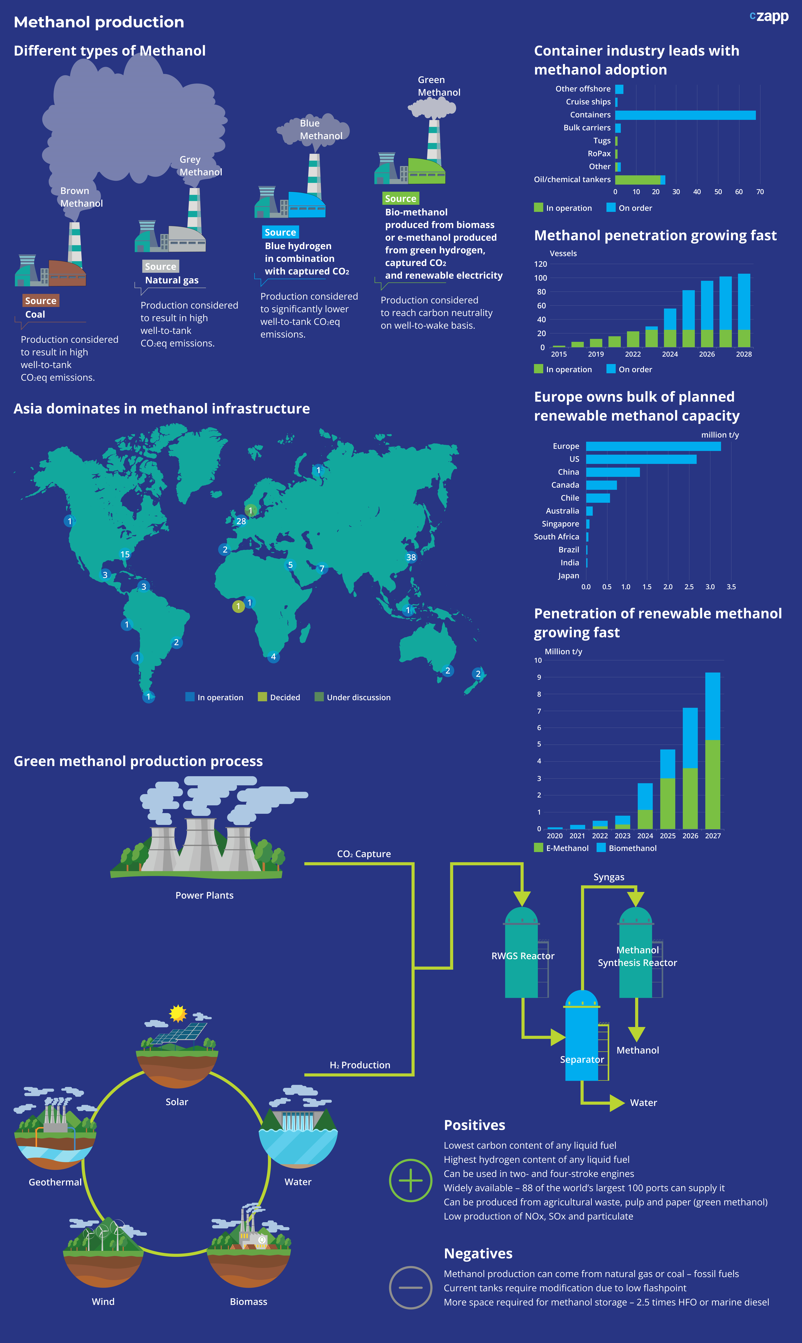

Green methanol is a clean-burning, biodegradable fuel and is known for its low levels of pollutants. It releases no soot and almost no SOx or NOx. It also releases much fewer CO2 emissions.

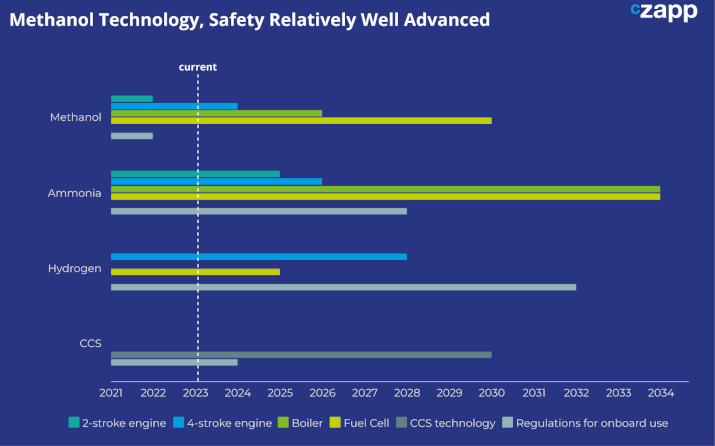

However, the fuel has come up against a challenge based on its toxicity. Like any new fuel, methanol needs to be tested to ensure it is safe for marine fuel purposes. But of all “green” fuels, methanol is the most mature and the safest.

Source: DNV Maritime Forecast to 2050

Although fuel standards still need to be expanded across some countries, the IMO approved interim guidelines for the Safety of Ships Using Methyl/Ethyl Alcohol as Fuel. This approval still needs to be agreed with the flag administration, but it gives methanol a competitive edge over alternatives such as ammonia and hydrogen.

Methanol Powered Fleet Small but Growing

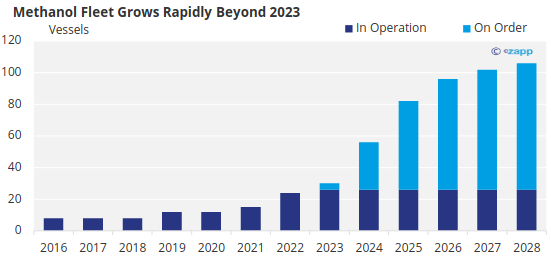

Although methanol is a relatively little-used fuel at the moment, there has been significant buy-in recently. By 2028, there are expectations that 80 methanol-capable vessels will be added to the existing fleet of around 30.

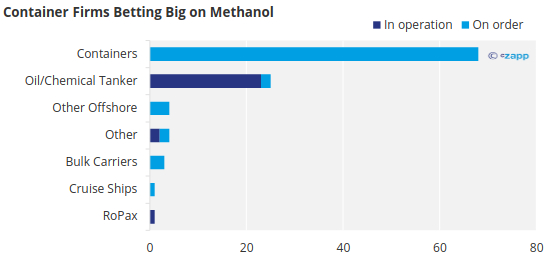

Container giant Maersk recently committed to building 20 green methanol-capable ships, up from a previous commitment of 12. In fact, container shippers seem to be the biggest advocate of the fuel.

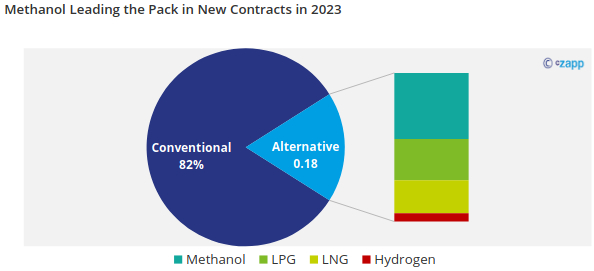

And although LNG remains the alternative fuel with the biggest foothold, new orders seem to be focusing a great deal on methanol.

Source: DNV Maritime Forecast to 2050

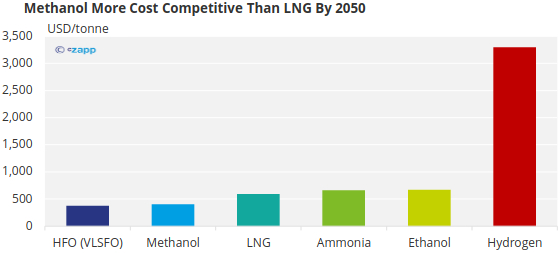

Methanol Cost Competitive with Conventional

Much of the time, the biggest barrier to alternative fuel adoption is additional cost. The bad news for methanol is that it cannot be used as a drop-in fuel and instead existing ships need costly retrofits to use it. However, this is also the case for all green fuels. The only real drop-in fuel that exists for current engines is marine gasoil or fuel oil.

The good news for methanol is that newbuild prices are relatively accessible. According to MAN Energy Solutions, installing a methanol-fuelled engine on a newbuild 54,300m3 capacity product tanker would require a price premium of about 10% compared with MGO or HFO. LNG engines, conversely, would cost about 22% more.

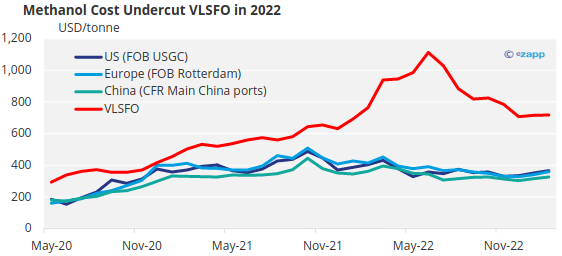

Another virtue of methanol is the relative affordability of the fuel itself. In fact, in 2022, the price of methanol was significantly lower than VLSFO, due mainly to supply and demand dynamics.

Source: Methanol Institute, Ship & Bunker

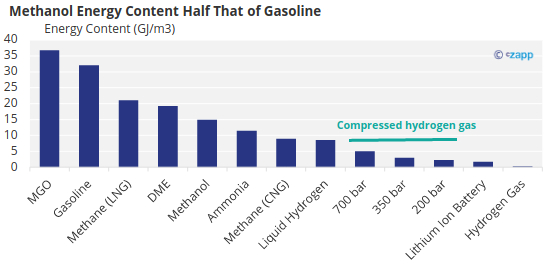

But it is important to factor fuel efficiency into this calculation. Methanol has only half the volumetric energy density of gasoline, meaning vessels need double the amount. This compresses but does not altogether remove the price advantage of methanol.

It may also create delays or congestion if more bunkering stops are needed, which would also add to the cost of moving goods, compromising the potential price advantage.

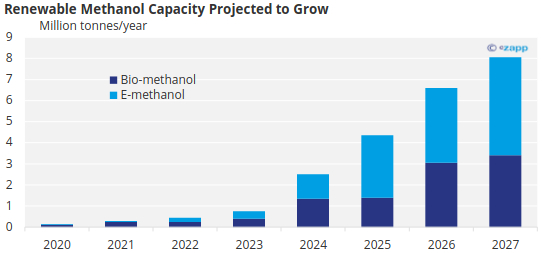

It is also worth noting that if more ships convert to methanol, demand will be higher and therefore fuel prices will rise. Of course, this might not be true if capacity and production can rise at the same rate.

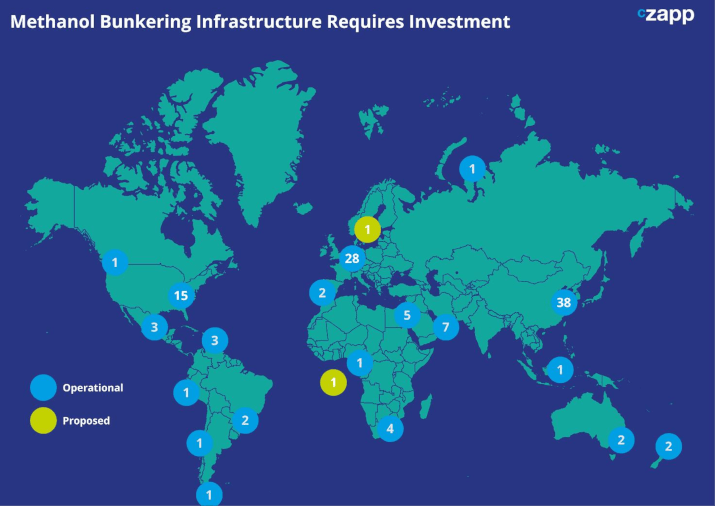

Infrastructure Expanding but More Investment Needed

Methanol bunkering infrastructure is relatively well established. In fact, 88 of the world’s largest 100 ports are able to supply the fuel.

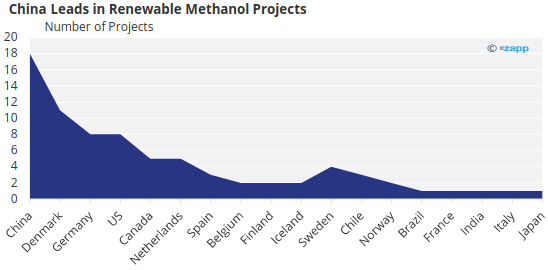

China in particular is betting big on methanol, but Europe and the US are also investing in new projects. However, it is likely that Chinese investment is more focused on production of methanol for methanol to olefins (MtO) – a key process in petrochemicals.

Source: Methanol Institute

Current Methanol Allocation Focuses on Chemicals

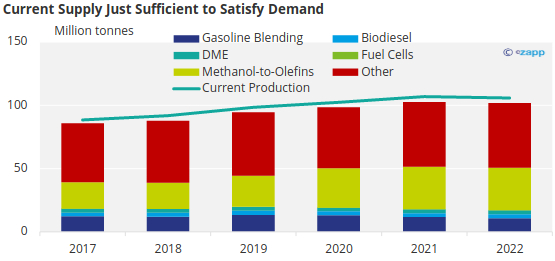

One of the benefits of methanol is that it is already widely used and infrastructure has been developed. However, the biggest use of methanol is in the production of everyday industrial chemicals and consumer products.

Source: Methanol Institute

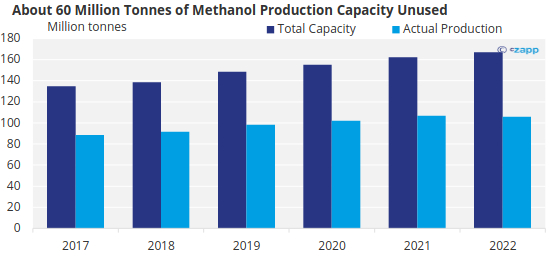

While the current supply looks just about capable of satisfying demand and no more, more capacity is available. There are no inherent technical challenges in upscaling methanol production, which creates potential for rapid methanol adoption in industries such as shipping.

Source: Methanol Institute

But as we already point out, methanol has only half the volumetric energy density of gasoline and diesel fuel. This means that to fully replace 300 million tonnes of fuel oil, the industry would need more like 600 million tonnes of methanol.

Source: Methanol Institute

The Divide Between Green and Grey Methanol

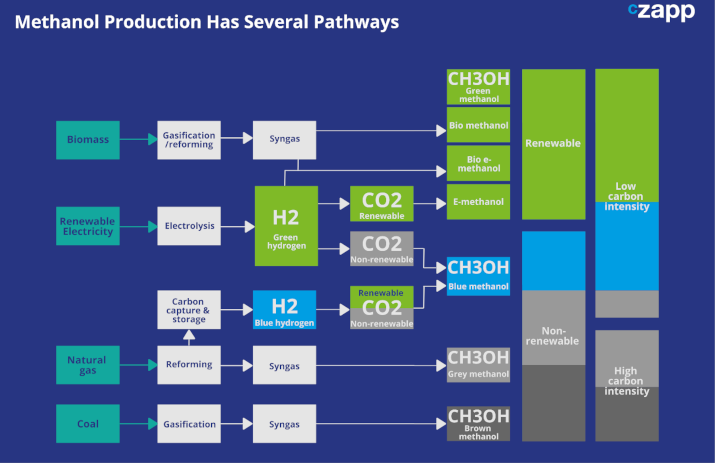

While all this looks very promising, there is a catch. There is an important distinction to be made between four methanol categories: brown, grey, blue and green.

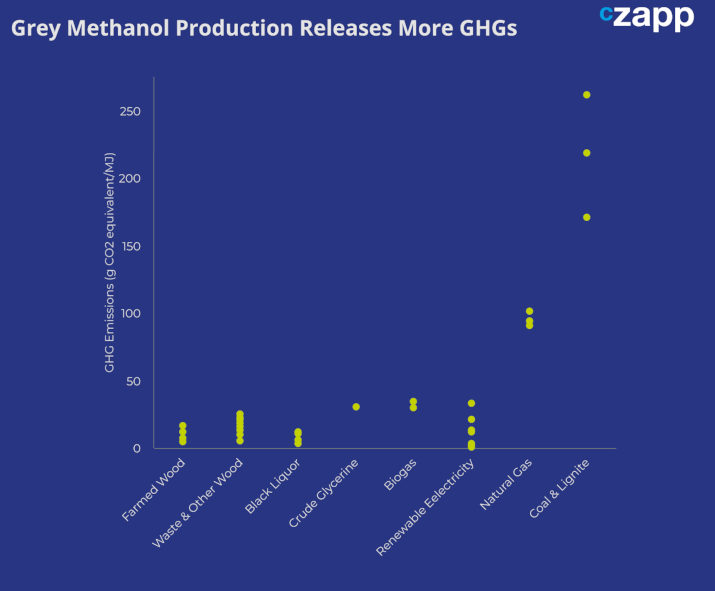

Most methanol today is produced from natural gas – known as grey methanol — although it can be produced by green sources such as biogas.

Source: Methanol Institute

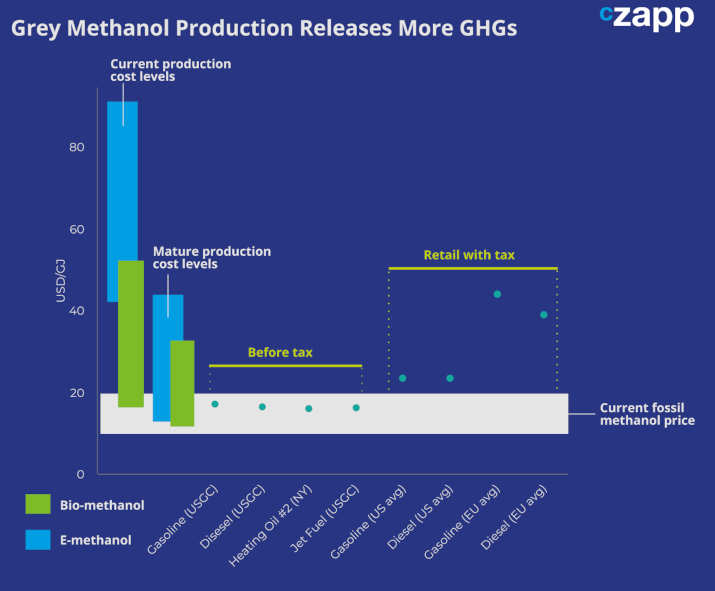

And while it seems that methanol has a key cost advantage on the surface, a lot of the benefits of methanol production come from cost advantages associated with grey methanol – using natural gas production.

Source: IMO

Methanol produced using natural gas throws up the same emissions issues as LNG production. While GHG emissions can be negligible for green methanol, the grey methanol production process still releases high levels of GHGs.

Note: Dots specify emissions range found through different studies.

Source: Methanol Institute

But for bio-methanol and e-methanol (green and blue methanol) the cost is still relatively high given the novelty of the technologies and lack of widespread investment.

Source: Methanol Institute

More projects are using renewable feedstocks such as agricultural waste, Municipal Solid Waste (MSW), sewage, renewable electricity and CO2 capture. But there is already competition for renewable feedstock such as biomass, CO2, renewable power and green hydrogen with other renewable alternatives, which could present a cost hurdle.

Source: Methanol Institute

Concluding Thoughts

- The technology to produce and store methanol is mature, and costs are competitive.

- But to reduce emissions it is important to prioritise green methanol.

- With greener options, costs rise, and technology is not as developed.

- There is also high competition for biomass feedstocks.

- Many shipping companies, particularly container firms, are willing to adopt methanol due to safety, availability and cost competitiveness.

- Methanol is a very promising option, but more investment is needed specifically in green methanol.