Insight Focus

- Underlying demand for PET remains below typical seasonal levels.

- EU publishes ADD notice, but will it bring relief to domestic PET producers?

- Prices consolidate, warmer weather to be key demand driver into peak season.

European PET Continues to Experience Lacklustre Demand

Even as we begin to move into peak season, underlying demand for PET packaging food and beverage products is still not where it should be.

Although demand from carbonated soft drinks (CSD) is performing reasonably, still, and sparkling water segments remain weak.

Several issues have bubbled to the surface: slower supermarket sales due to inflationary pressures, investment slowdown, and the extreme dry summer last year curtailing bottled water production.

CO2 supply issues have also affected sparkling water production at certain sites over the last year.

Demand is also far from uniform across Europe. France, Central Europe, and Turkey are currently experiencing softer demand, below seasonal norms.

Whilst downstream consumer demand for packaging goods is performing better in Southern European, including Italy, Spain, and Greece.

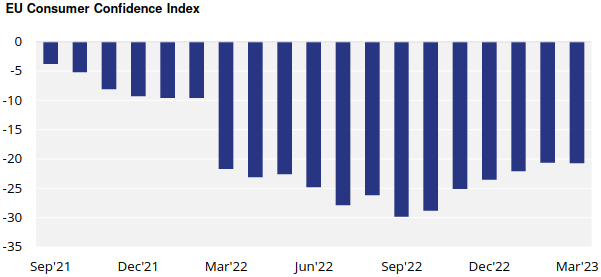

Inflation within the EU Remains a Major Concern

Despite easing from last year’s highs, inflation growth remained stubbornly high at 9.9% in February.

EU food inflation is also still increasing, up by over 19% in February, a new record high for the block.

For now, warmer weather is will be key to spurring seasonal demand going into early summer.

Although inventory levels have fallen steadily since the start of the year, with ample resin availability, buyers are expected to derisk price and demand uncertainty by keeping stocks low.

Some resin suppliers are expecting buyers to stick with smaller just-in-time deliveries, creating potential for some tightening if summer demand accelerates beyond expectations.

Some resin suppliers report recent price rises and the ADD notice against Chinese resin has already stimulated a fresh impulse to buy over the last week.

However, the recent OPEC+ crude oil production announcement is causing confusion on the future price direction; supporting the decision by most to wait-and-see.

Anti-dumping Notice of Initiation Against Chinese PET Resin

On 30 March, after months of speculation the market finally got confirmation of the EU’s notice of initiation of an anti-dumping investigation against Chinese PET resin.

The product under investigation is PET with a viscosity of 78 ml/g or higher originating in the People’s Republic of China, currently classified under HS code 39076100.

The investigation will be reviewing and assessing the injury during the period from 1 January 2022 to 31 December 2022 and examining trends back to 1 Jan 2019.

The Commission will now select certain Chinese producers for their investigation. The sampled exporters will then have to fill in a questionnaire once notified that they have been selected.

Source: European Commission

According to the Commission’s website, the investigation will be “concluded within normally 13, but not more than 14 months of the date of the publication of this Notice…provisional measures may be imposed normally not later than 7 months, but in any event not later than 8 months from the publication of this Notice”

The Commission will provide information on the planned imposition of provisional duties 4 weeks before the imposition of provisional measures, according to the notice.

Whilst not in the notice itself, European PET producers are also understood to be requesting a registration of imports, afraid of a flood of imports before the October provisional measures date.

If granted the Commission would record all importers of PET resin falling under the affected HS code.

European PET producers would then likely push for retrospective protectionism against Chinese imports, potentially causing massive disruption to the industry.

How Will Anti-Dumping Against Chinese Resin Affect Imports?

The European Commission has a strong track record of approving anti-dumping measures once initiated; the language in the Notice perhaps already indicates a bias: The Commission believes “there is sufficient evidence to justify the initiation of a proceeding”.

Whilst the focus of the investigation is on virgin PET resin, the HS code in question (39076100) is not only used for virgin PET resin, but also often for Food-Grade rPET pellet with IV ≥78 ml/g. Something that may need further consideration by suppliers.

Will the anti-dumping action cause buyers to switch to domestic resin instead?

The answer, as always, isn’t clear cut. Whilst Chinese imports will eventually subside, they may simply be replaced by other origins.

Some market participants point to the lengthy approval processes by buyers to on-board new suppliers, instead moving to domestic supply.

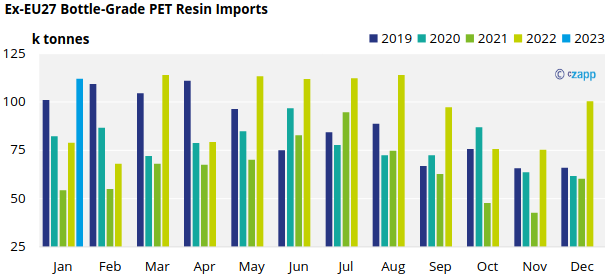

However, despite Indian resin being shut out of the European market following the EU’s withdrawal of its competitive GSP (Generalised Scheme of Preference) status at the beginning of the year, no dip in imports were noticeable; domestic PET resin producers saw little added interest.

In 2022, Indian PET resin imports average over 10k tonnes per month, by January 2023 this figure had dropped to just 223 tonnes for the month. Total EU PET resin imports, however, rose to around 112k tonnes, up 42% in January

Although many brand owners have based purchasing decisions on Chinese resin, most are actively looking to diversify origins and increase their share of imports; often quoting pricing and supply security as drivers.

Much of China’s 35-40k tonnes per month of imports are expected to be filled from Turkey, Egypt, Vietnam, and Korea. Imports from Egypt and Turkey were already increased 50% and 33% in January, compared to a year earlier.

Offers from Vietnamese producers were also noticeably more aggressive over the last month, looking to gain share in Europe.

Even with European PET prices currently at import parity, there is little doubt that a large proportion of current Chinese volume will be switched to other origins; not all European producers are able to align bids with competitive import offers.

Hypothetically, even if 50% (15-20k tonnes) moves into the domestic market this is unlikely to move the dial, in a market that continues to see average operating rates languish around 60%.

Any switching of supply to domestic production is also unlikely to be even, the imposition of anti-dumping will not be a cure-all for the European PET resin industry.

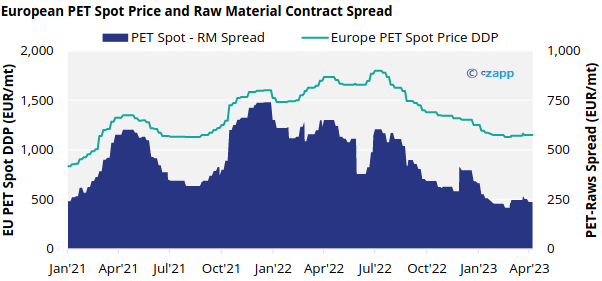

European PET Spot Prices Consolidate Ahead of Potential Rise

European producers attempted to drive prices higher towards the end of March. However, given ample availability buyers were unwilling to chase. Prices subsequently drifted lower.

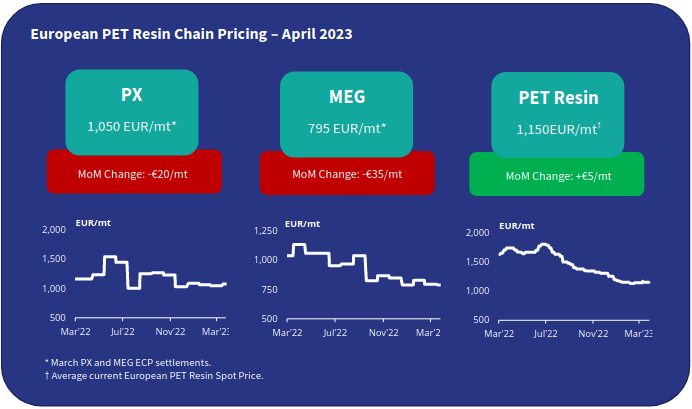

The current market price range is assessed at EUR 1130 to EUR 1170/tonne, with an average price of EUR 1150/tonne, up EUR 5/tonne versus mid-March.

As always, depending on volume and location prices varied with a full offer range from as low as EUR 1120-1230/tonne. Even for small-medium buyers EUR 1200/tonne was a distinct upper-limit.

Most major producers quoted prices ranging EUR 1120-1150/tonne for regular buyers within region.

After a bumpy start to the year, PX and MEG ECPs settled in March. Despite the decreases, PET resin margins remained relatively stable close to breakeven levels.

Although PET resin prices look to be consolidating ahead of a potential rise into the early summer, PX/PTA prices are also expected to firm, potentially giving little relief to PET producers.

Whilst the ADD investigation is gaining attention, strength of demand going into peak season will be key to returning profitability to the European industry.

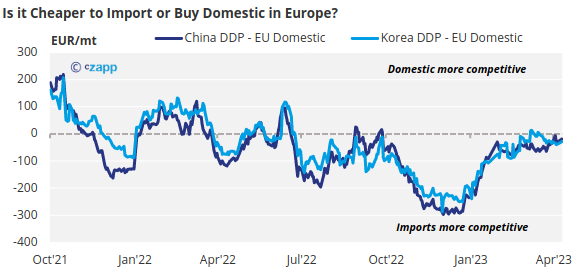

Is it cheaper to import?

The recent rise in Asian PET resin prices has enabled European producers to maintain price levels close to import parity.

Chinese PET resin export prices currently average around USD 1030/tonne, an increase of USD 60/tonne over the last month.

Import prices of around USD 1080-1100/tonne CFR, equating to EUR 1120-11230/tonne DDP, are now available based on average daily Asian export prices.

The current delta between average Chinese import and domestic European prices is just EUR 19/tonne on a delivered, duty paid basis.

Indicative prices for Korean imports show a slightly higher discount of up to EUR30/tonne over European domestic prices. Another indication that ADD may not necessarily help drive domestic prices higher.