Insight Focus

- Raw and refined sugar prices continued to strengthen over the last week.

- Raw sugar producers have capitalised on market strength to advance their hedging.

- Sugar speculators also bought into this strength by extending their long positions.

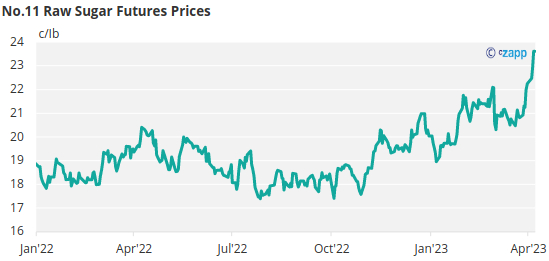

New York No.11 Raw Sugar Futures

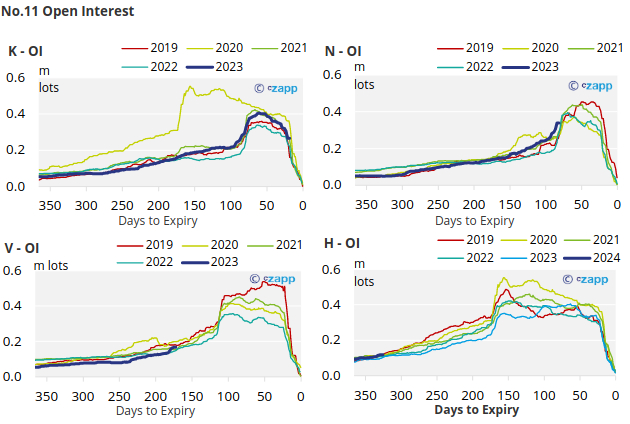

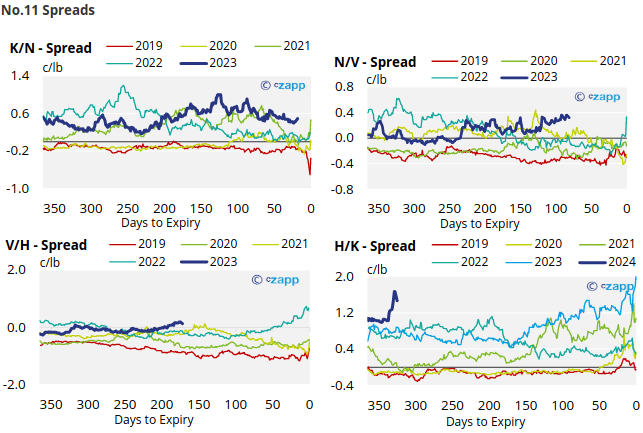

No.11 raw sugar futures have strengthened over the last week, reaching a near 2023 high of 23.56c/lb by Monday.

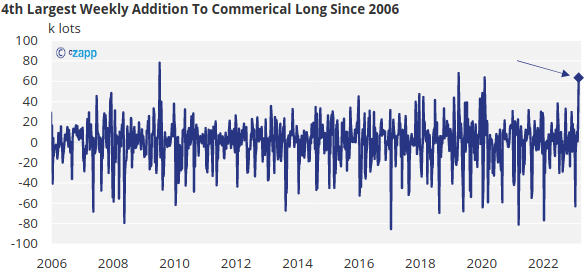

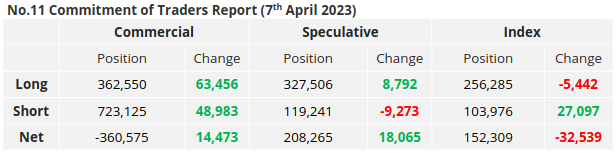

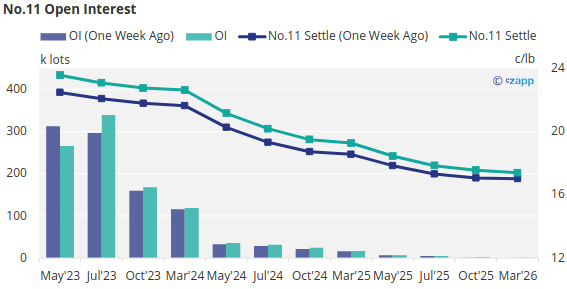

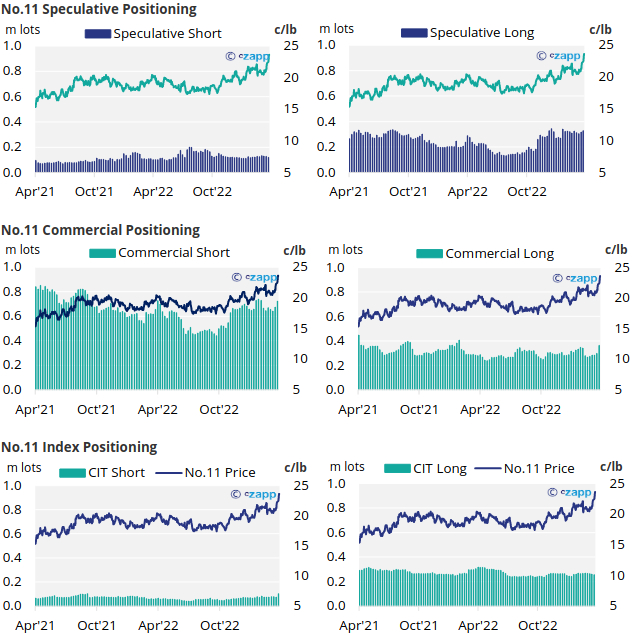

With this rally underway by the 7th of April (latest CoT CFTC report), raw sugar producers have added almost 49k lots of new hedges, selling into this recent price strength.

Consumers were probably driving the market strength, adding 63k lots of new hedges, possibly through hand-to-mouth buying in advance of the May’23 expiry.

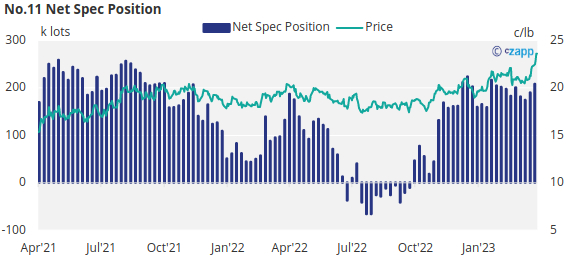

Raw sugar speculators opened approximately 9k lots of new long positions and cut a similar volume of existing short positions as raw sugar prices strengthened. As such the net spec position has extended by 18k lots to 208k lots long.

With contracts strengthening across the board, over the last week, the No.11 forward curve is still inverted.

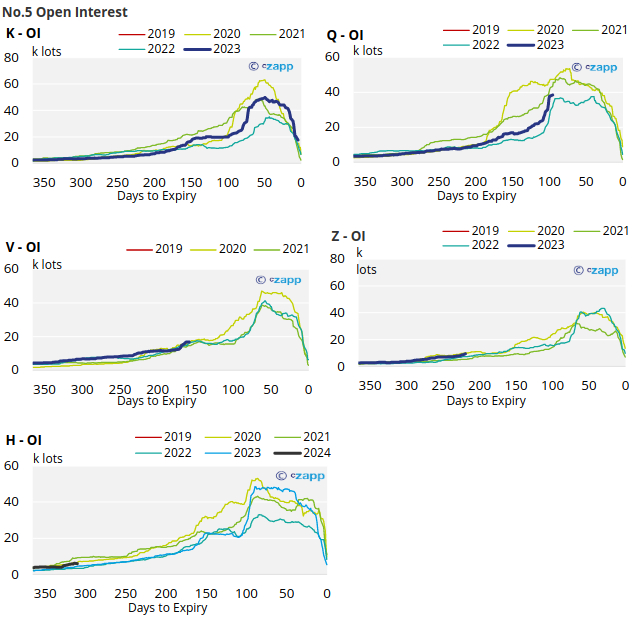

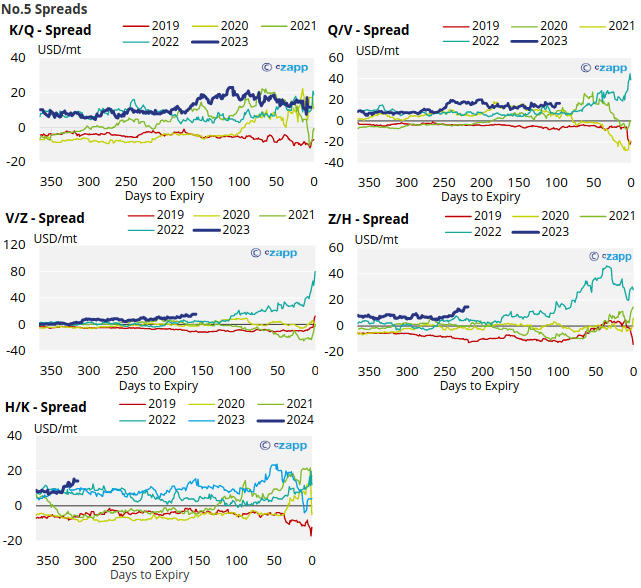

London No.5 Refined Sugar Futures

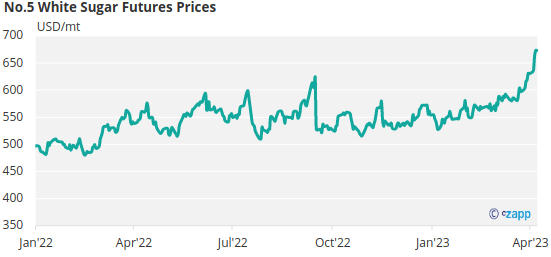

No.5 refined sugar futures have also rallied over the last two weeks, closing at USD 673/mt last Friday.

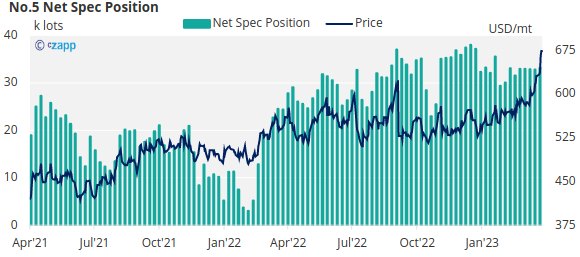

Speculators still hold a large, long position in refined sugar. Though despite rallying No.5 white sugar prices the refined sugar net spec position has continued to remain stable, around 33k lots long.

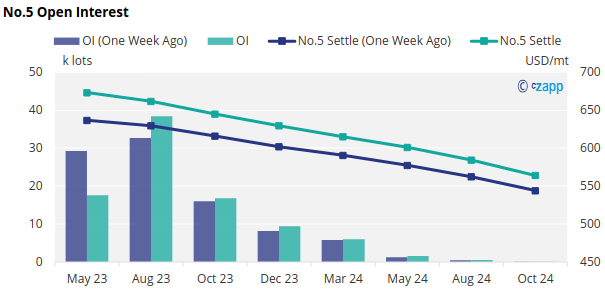

With contracts lifting across the board over the last week, the No.5 forward curve remains strongly inverted through to at least Oct 2024.

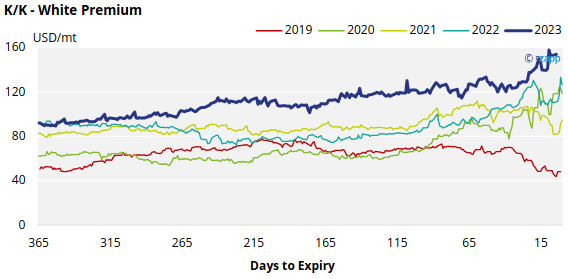

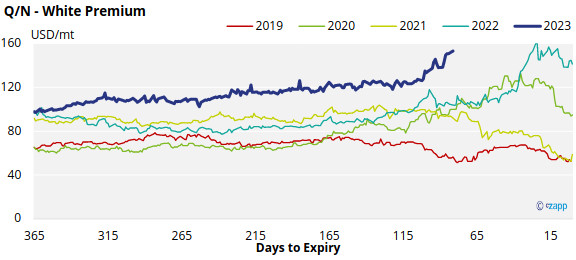

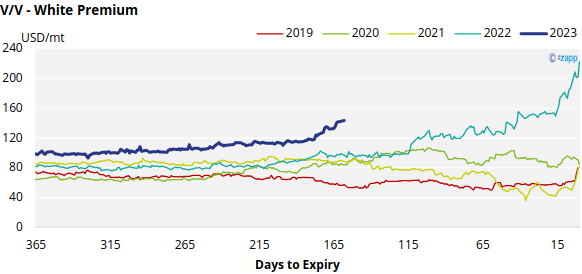

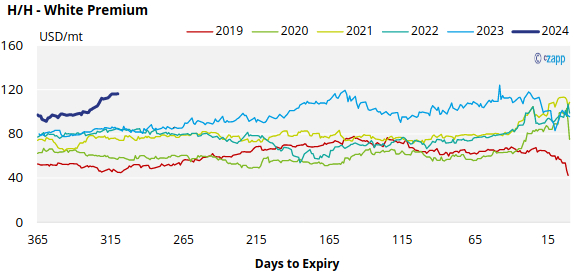

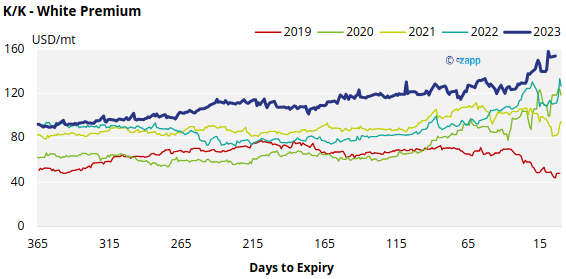

White Premium (Arbitrage)

Over the last week, the K/K sugar white premium increased by about USD 14/mt, closing at around USD 153/mt on Friday.

We think re-exports refiners need around USD 110-125/mt above the No.11 to profitably produce refined sugar without physical premiums. Currently, the white premium is above this threshold.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix