Insight Focus

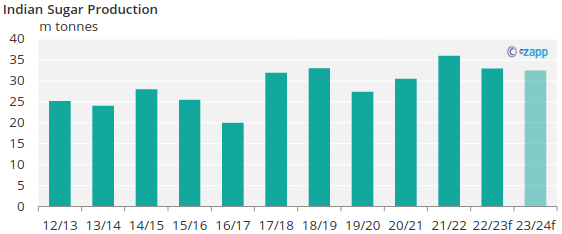

- We think India will produce 32.5m tonnes of sugar in 23/24

- This would leave room for at least 5m tonnes of exports.

- Weather and government policy have a big role to play.

“…there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns — the ones we don’t know we don’t know.”

Former U.S. Secretary of Defense Donald Rumsfeld

Source: Shutterstock

This well-known phrase sums how challenging it can be for analysts to forecast Indian sugar production. To answer the question about India’s prospects for next season we will discuss what we know and what we don’t know; we’ll have to pass on the unknown unknowns for now…

Based on what we know, we estimate that India will produce 32.5m tonnes of sugar in 2023/24, a small decrease over the previous season. This is 5.5m tonnes more than consumption, creating a surplus of sugar that could be exported.

What We Know

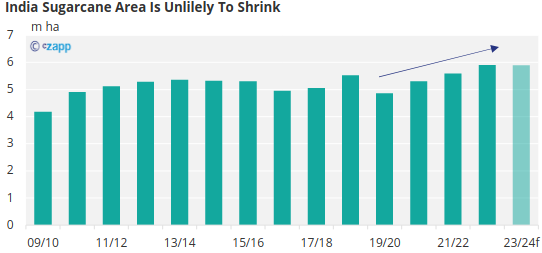

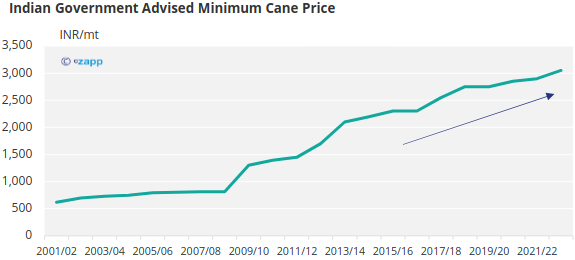

Indian cane acreage is unlikely to shrink: cane prices have been rising for over a decade and there is no reason to suggest this stops for 2023/24.

Even without an increase, sugarcane returns are very attractive to farmers as government policy is designed to support the large rural population.

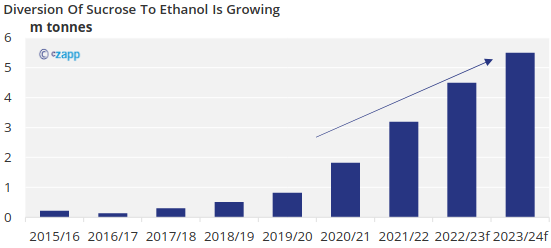

More of this cane will be diverted towards ethanol in 2023/24. Next season, we expect 1m tonnes more sucrose to be used to make ethanol, taking total sucrose diversion to 5.5m tonnes. This follows India’s plan to reach E20 fuels (gasoline blended with 20% ethanol) by 2025, with ethanol from sugar production a key feedstock.

What We Don’t Know

Cane yields and government policy.

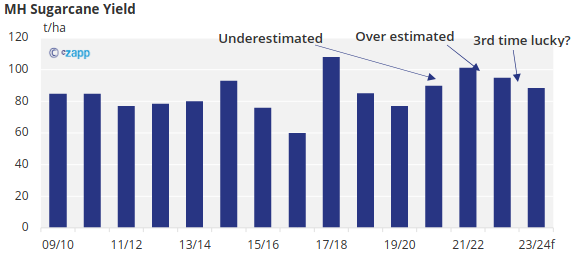

Almost everyone was surprised by yields during the past 2 seasons. In 2021/22 initial estimates underestimated sugar production quite substantially; the opposite happened this season with estimates tumbling by as much as 4m tonnes during the season.

In fact, we still don’t have finalised data for 2021/22 let seasons beyond this which makes it more challenging. But here are our estimates of yields in in Maharashtra, which generally sees the largest variance in yields and makes up about 25% of India’s cane area.

We think yields across India could drop a little further from this season back to a similar level as 2020/21. This is because cane is being grown on marginal land which is more vulnerable to poor growing conditions such as a lack of rainfall. This brings us onto the other unknown which is weather – more specifically how much rainfall the monsoon season (from June onwards) delivers to key cane growing regions.

Clearly, whatever happens with sugar production will impact how much sugar India exports to the world market. But the government and food ministry also have a significant role in how much sugar is allowed to leave the country and the timing of any exports.