Insight Focus

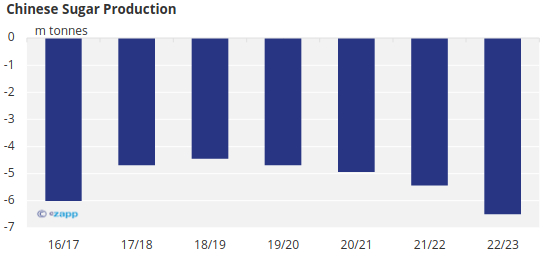

- China could produce 9m tonnes of sugar in 22/23, lowest in 7 years.

- This leads to a domestic deficit up to 6.5m tonnes, second highest in history.

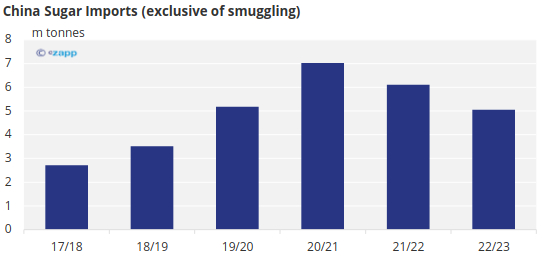

- We think China could import 5.4m tonnes of sugar in 22/23 before import margin improves.

We’ve discussed in a previous report about China’s efforts to boost sugar security. However, we also warned you to lower expectations of the outcome. Now we are heading for the worst crop in 8 years.

What does it mean for the world sugar market?

22/23 Sugar Production: Worse Than Bad

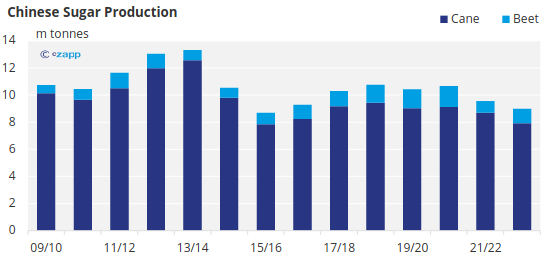

After the February production data came out, we were already expecting poor sugarcane performance this year. We lowered the sugar outlook to 9.2m tonnes, versus 9.56m tonnes in 21/22 season. But now, it looks even worse, with 22/23 sugar production likely to eke out 9m tonnes, the lowest level since the 15/16 season.

What Went Wrong?

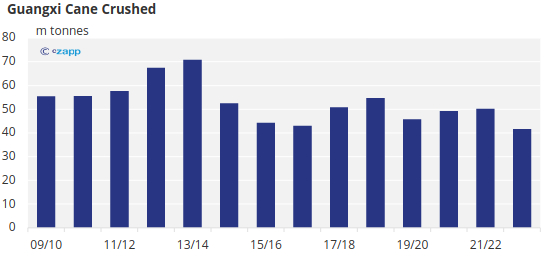

From the chart above, we can easily blame sugarcane for the loss, especially Guangxi.

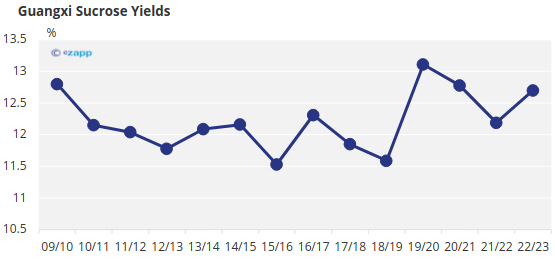

Guangxi is the largest sugar production region in China, accounting for 60%. It saw a considerable reduction in sugarcane output, although a higher sucrose yield made up for some of the loss, but ultimately to no avail.

That’s why our farmer’s diary is highly recommended. A major sugarcane grower in Guangxi has been comp laining about the dry weather all year long, and even in the early harvest informed of the drastic reduction in his sugarcane fields.

March is the spring planting season. This March brought drought fears back to farmers. According to the service center of the Guangxi Meteorological Bureau, the rainfall in Guangxi from Feb 11 to March 21 was 84.4% less than normal, the lowest in history.

What if 9m tonnes sugar production becomes the ‘new normal’?

Halting the decline may require sugar mills to raise cane prices or otherwise invest more in the industry. This could be a lucrative year for sugar mills, which would be a good start.

Although there is less cane availability, higher sucrose yields mean less canes are consumed per tonne of sugar, which means lower costs for sugar mills. The large deficit drives sugar prices higher. Guangxi sugar price is now at 6300 yuan/mt, 15% higher than the mill cost of sugar production.

How Much Imports Needed in 2023?

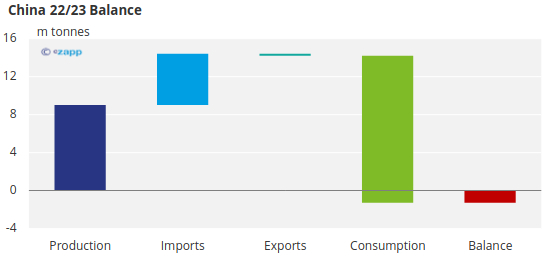

Anyway, we need to solve the problem at hand first. Sugar consumption this year will recover after China lifted COVID restrictions. That means the gap between sugar production and consumption could reach 6.5 million tons, second largest in history.

But the domestic market has not yet been hit by supply shortages. This was helped by large imports over the past three seasons. During this period, China has imported 18.3m tonnes of sugar. The deficits for that period were 15 million tonnes.

For 22/23, we are now expecting 5.4m tonnes of sugar imports including a return of smuggling. This includes a lower raws import due to the negative import margins since 2022. We also expect a higher ratio of liquid sugar and premix powder imports because they are cheaper.