Insight Focus

- Chinese PET exports hit new highs at the start of 2023 despite Spring Festival and COVID.

- Q4’22 European imports remained at record quarterly levels as container rates plummeted.

- US PET resin imports slowed in Q4’22 as demand cooled, pressured by high inventories.

China’s Bottle-Grade PET Resin Market

Monthly Exports

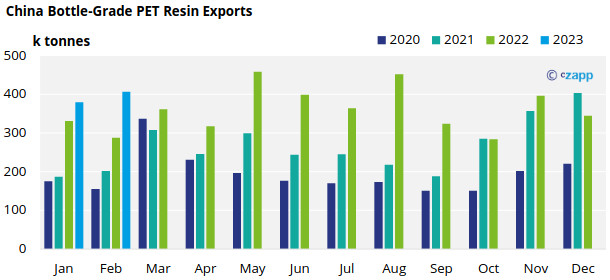

- Following the combined data release for January and February, Chinese bottle-grade PET exports (HS 39076110) totalled 379k tonnes for January and 407k tonnes in February.

- Exports for the two-month period increased by over 27% versus a year earlier, setting a record high for the period.

- Despite the timing of Chinese Spring Festival, and rise in COVID infections in January, monthly exports increased 10% from December levels, exceeding expectations.

- Whilst order intake has since softened, availability for prompt shipment is limited and exports are expected to range between 400-450k tonnes in March and April.

- Russia was once again the largest destination for Chinese PET resin exports in January/February with around 61.8k tonnes and looks to remain a key sink for Chinese resin in 2023.

- Exports to Russia continued to rise into February, increasing 38% from the January, up 56% versus February 2022.

Latin American destinations including Mexico, Colombia, Peru also remained key markets absorbing a combined 77.6k tonnes of Chinese PET resin exports over the two-month period.

- Exports to the Philippines also saw monthly gains, with volumes increasing 6% in February to around 23k tonnes. In 2022, total exports to the Philippines increased 14.1% to over 320k tonnes.

- Other important markets for Chinese PET resin exports at the start of 2023 included the UAE and Nigeria.

EU Bottle-Grade PET Resin Market

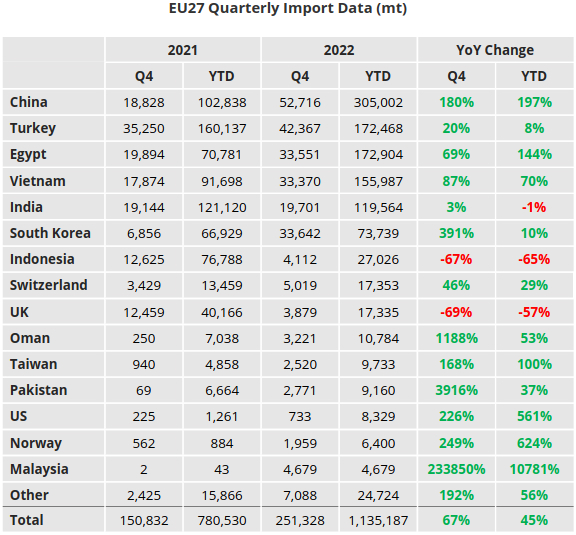

Quarterly Imports

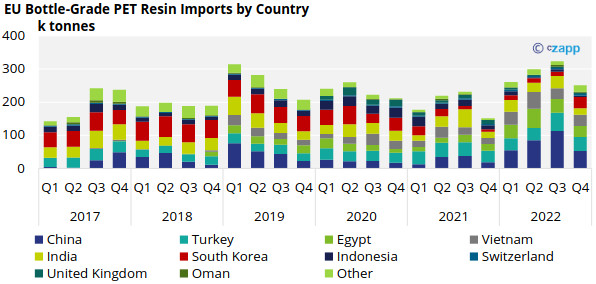

- EU-27 bottle-grade PET imports (HS Code 390761) totalled 251k tonnes in Q4’22; although dropping over 22% from the previous quarter, still registered a staggering 67% increase compared to Q4’21.

- Despite energy costs declining sharply, the collapse in ocean freight rates and highly competitive Asian resin prices meant buyers continued to stock up on imports.

- Top 5 origins in Q4’22 were China, Turkey, South Korea, Egypt, and Vietnam, equating to around 78% of total EU imports from outside of the block.

- China remained the largest source of imports, although volumes dropped sharply, down over 53% to 53k tonnes in Q4’22, representing 21% of total EU-27 imports in the quarter; a 180% increase on Q4’21.

Imports from other major origins also lost ground in Q4’22 as the region moved into off-season, with volumes from Turkey and Egypt declining 24% and 19% respectively.

- However, imports from South Korea and Vietnam, duty-free origins, experienced a bounce, increasing 168% and 4%.

- Full-year EU-27 imports totalled 1.14 million tonnes, an annual increase of 45%. Of which 305k tonnes originated from China, increasing nearly 200% compared to 2021 levels.

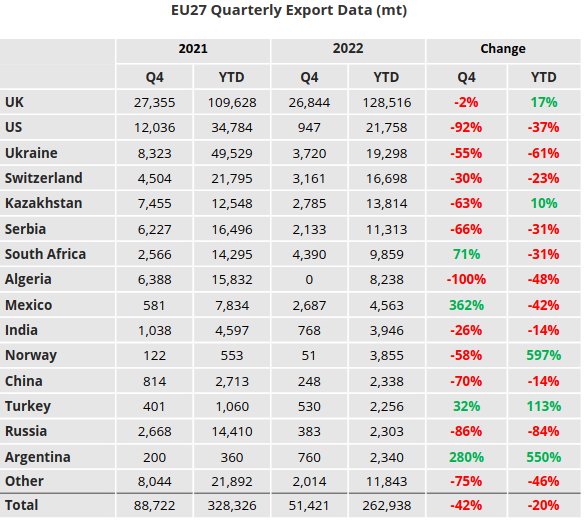

Quarterly Exports

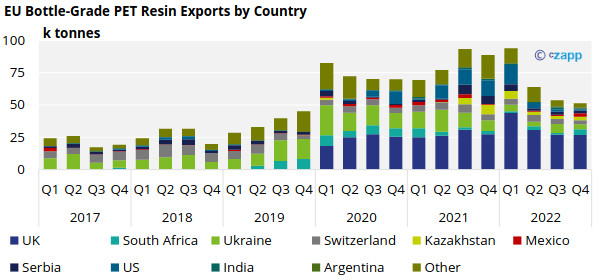

- Extra-regional EU-27 PET resin exports continued to decline in Q4’22 as domestic European producers slashed operating rates, down a further 4% versus the previous quarter to around 51k tonne.

- The UK remained the largest destinations for PET resin out of the EU block, followed by smaller volumes to South Africa, Ukraine, Switzerland, and Kazakhstan.

- Whilst exports to the UK softened slightly falling 1% to 26.8 tonnes, volumes to South Africa increased by around 234% to 4.4k tonnes.

- Export volumes for the full 2022-year totalled 263k tonnes, an annual decrease of around 20%.

US Bottle-Grade PET Resin Market

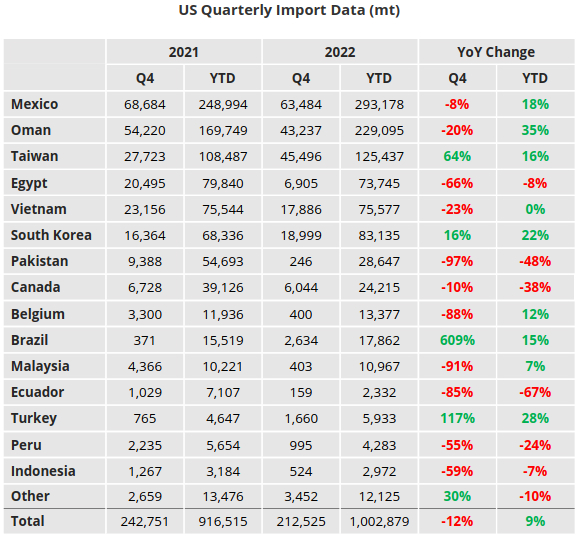

Quarterly Imports

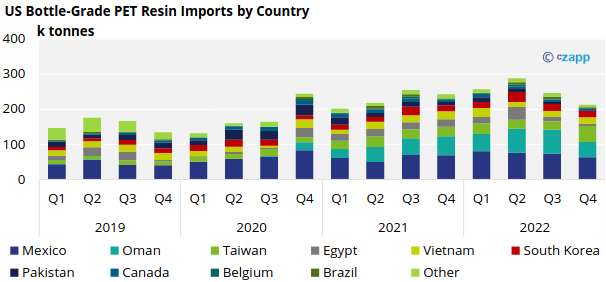

- US bottle-grade PET imports totalled 212.5k tonnes in Q4’22, down a further 14% on the previous quarter and 12.5% year-on-year.

- Despite the dip in the second half of the year, US PET resin imports reached over 1 million tonnes for the full year 2023, an increase of around 9% from 2022 levels.

- Moving into 2023, higher inventory has lent to slower demand in January, whilst producers report demand improving through March, Q1’23 import levels are expected to be dampened.

- However, the announced closure of Alpek’s PET resin manufacturing operations at their smaller Cooper River site near Charleston, SC (170kta), may support growth in imports during the upcoming peak season.

- Origins with the greatest volumes in Q3’22, include Mexico, Taiwan, Oman, South Korea, and Vietnam.

- Volumes from Mexico and Oman continued to decline in Q4 from the previous quarter, down 14% and 36% respectively.

- However, volumes from Taiwan leapt 91% quarter-on-quarter, to around 45.5k tonnes.

- Looking at the full 12-month period, imports from the top 4 destination all experienced sizable increases, with the largest annual percentage gains from Oman and South Korea.

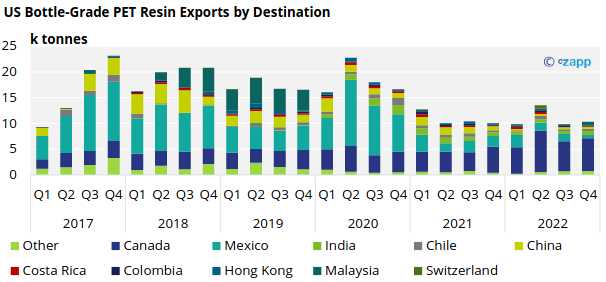

Quarterly Exports

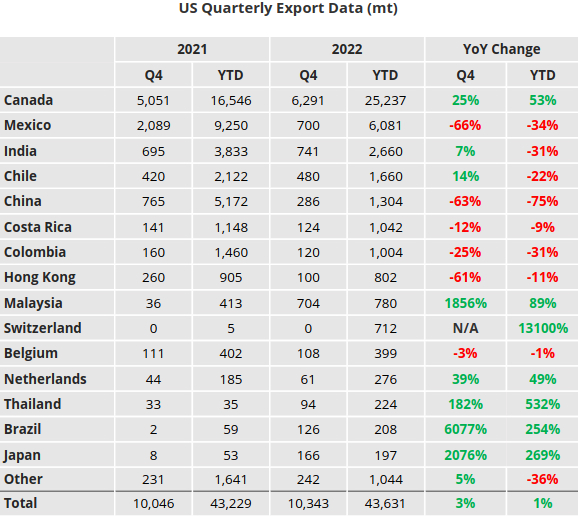

- US bottle-grade PET exports totalled just 10.3k tonnes in Q4’22, although increasing 4.5% on the previous quarter and 3% year-on-year.

- For full-year 2023, US PET resin exports totalled 43.6k tonnes, relatively flat, up less than 1% on versus 2022 levels.

- Around 68% of the total export volume in Q4’22 remained within North America, with Canada the largest destination.

- Around 6.3k tonnes was exported to Canada in Q4’22, whilst a much smaller 700 tonnes went to Mexico.

- For the full-year 2022 over 88% of total US PET resin exports went to Canada and Mexico, equivalent to 38.5k tonnes.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com.