Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

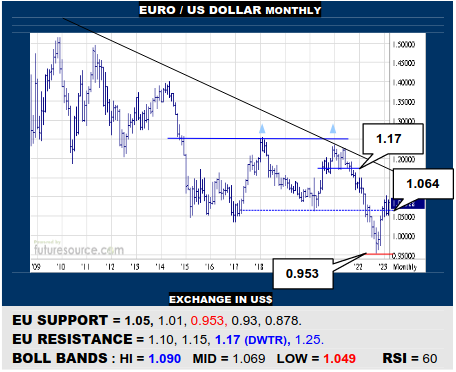

EURO / US DOLLAR MONTHLY

The 0.95’s trough looks like a cyclical low but the EU must secure the lunge back into the dual top above 1.064 to really prove it. Success would then point on to 1.17 where the downtrend from the ’08 peak (1.60) now lies. However, a swat back under 1.05 would instead warn of the top reasserting control to suggest another delve towards 0.953.

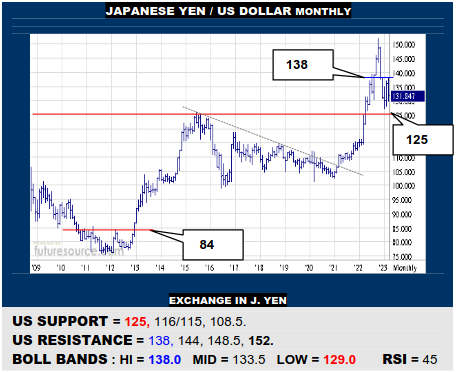

JAPANESE YEN / US DOLLAR MONTHLY

The rebuke from the 150’s pulled back close to the next main support at 125 before the US has been allowed some relief. Even so, a jolt back over 138 is now needed to energize the turn, otherwise Q1 meantime has a rather bear flaggish vibe that could still pose a threat to 125, a break below warning of a further substantial step down to the 115’s.

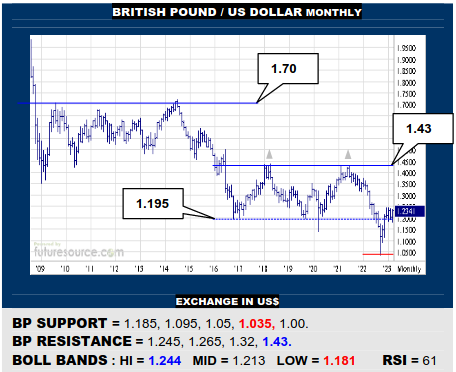

BRITISH POUND / US DOLLAR MONTHLY

The BP reflex from 1.035 also implies a cyclical low but must still be validated by sustaining the return to the 1.20’s and soon piercing 1.245 to merge the past four months into a monthly chart bull flag to open passage on up towards the low 1.40’s. Be wary of any 1.185 break meantime dispelling the flag to instead return to 1.05/1.035.

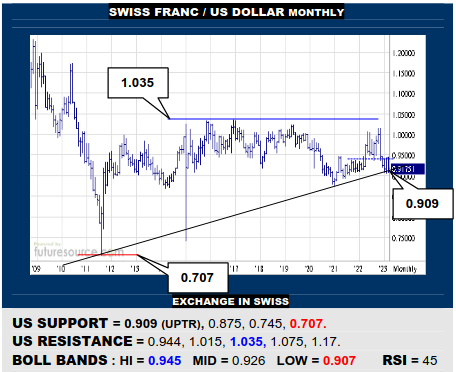

SWISS FRANC / US DOLLAR MONTHLY

Delving back through 0.937 to build a ’22 dual top is now stressing a decade long shallow uptrend at 0.909 so the nearby struggle here looks key if the US is to have any chance to pick up again. If 0.909 cracked to cut the trend, beware a swift drop to 0.875, all bets off with any further break then as there is little underneath until the low 0.70’s.

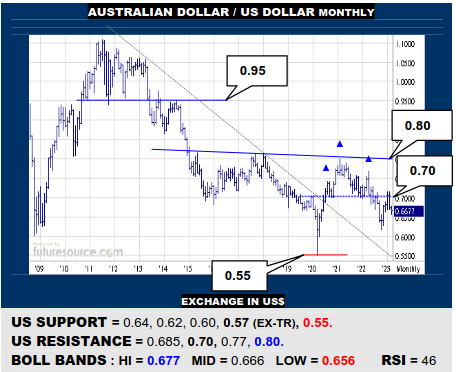

AUSTRALIAN DOLLAR / US DOLLAR MONTHLY

The AD must still score a definitive return to the 0.70’s to really disperse the early ‘20’s H&S top. Success would then tilt the context of the whole past 8 years by creating the chance for a far larger inverse H&S at 0.80. A dubious footing while shy of 0.70 however so watch 0.655 as a tripwire for harsher fallout back into the 0.50’s.

BRAZILIAN REAL / US DOLLAR MONTHLY

A Q1 basing chance has fizzled and so the 5.00 to 5.50 ranging just goes on. A clean snap out of the 5’s could phrase the ranging into a top, threatening to bring a test of the decade long uptrend, now at 4.50. Otherwise needing a decisive punch into the 5.30’s to expose the range ceiling and any new hopes for forming a flag instead.

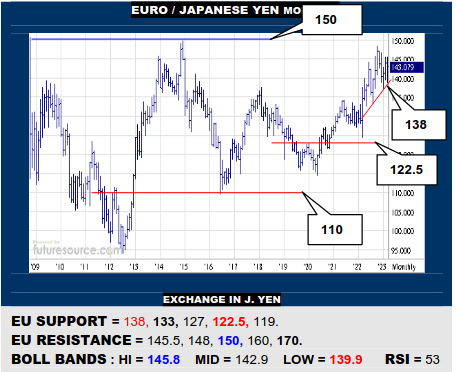

EURO / JAPANESE YEN MONTHLY

Bumpier action since early ’22 warns to at least be wary of a broader H&S if 138 support were breached, wherein the EU would be at risk of falling back into the 120’s. Meantime must decisively hurdle 145.5 to diffuse the topping threat and bolster prospects to dispatch the 148’s and try the 14-year high at 150, seeking an escape towards 170.

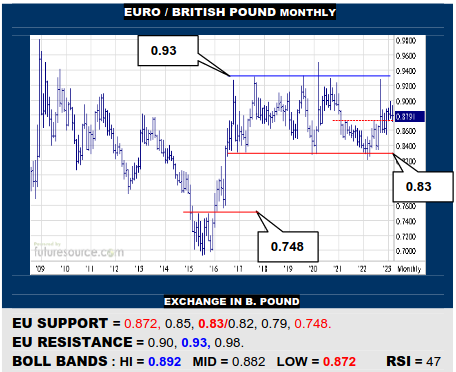

EURO / BRITISH POUND MONTHLY

The EU must maintain balance on 0.872 to prevent eroding away a former ‘21/’22 base that would tip the balance back towards the 0.83 underside of the overall range. Must otherwise actually reach and get a bona fide grip in the 0.90’s to really step up with conviction and so have a realistic shot at the range ceiling of 0.93.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.