Insight Focus

- Maintenance shutdowns lend near-term support to PTA and MEG futures.

- Forward curve for raw material costs moves increasingly into backwardation.

- Schedule and ramp-up of new capacity additions key to price outlook over the coming months.

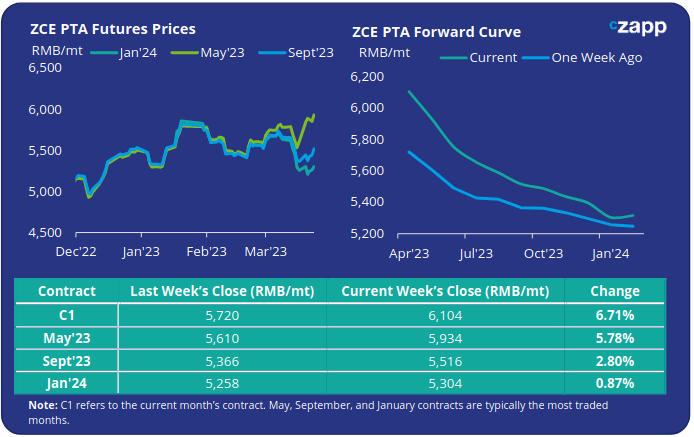

PTA Futures and Forward Curve

- PTA futures rallied last week on tighter PX and PTA availability, diverging from the recent fall in crude oil prices.

- PX and PTA has entered turnaround season, with a string of major producers scheduling maintenance shutdowns between now and mid-May. Start-up of CNOOC Daxie’s new 1.6Mt PX plant has also been delayed by 1-2 weeks.

- Coupled with improving downstream polyester demand, PTA inventories at bonded futures warehouses have also ebbed lower.

- Near-term PTA market tightness is being reflected in the forward curve, which is heavily backwardated over the next few months as PX and PTA flows normalise from May onwards.

- By Friday the May’23 contract was at a RMB 70/tonne discount to the current month’s contract; Sept’23 RMB increasing markedly to a 588/tonne discount.

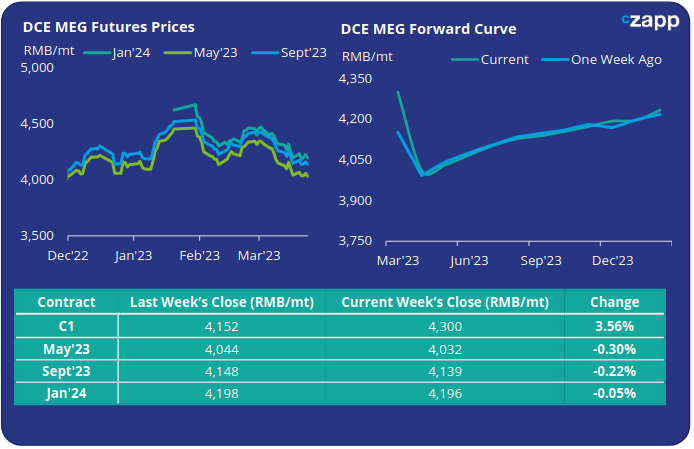

MEG Futures and Forward Curve

- MEG futures drifted marginally higher with crude recovering some ground early Friday, before crude gave up much of its weekly gains later in on Friday’s session.

- Again, start-ups and upcoming plant turnarounds are lending near-term price support, with several plants in China, South Korea, and Taiwan shutting units for maintenance.

- However, having moved lower in recent weeks, East China main port inventories rebounded 4.6% last week to around 1.06Mt.

- Beyond the current maintenance period, further recovery in downstream demand is needed to eat into the current oversupply.

- Near-turn supply constraints created by turnarounds mean MEG futures are heavily backwardated over the next month, before rising slowly through the rest of the year.

- On Friday, the May’23 contract was at a RMB 268/tonne discount to the current month’s contract.

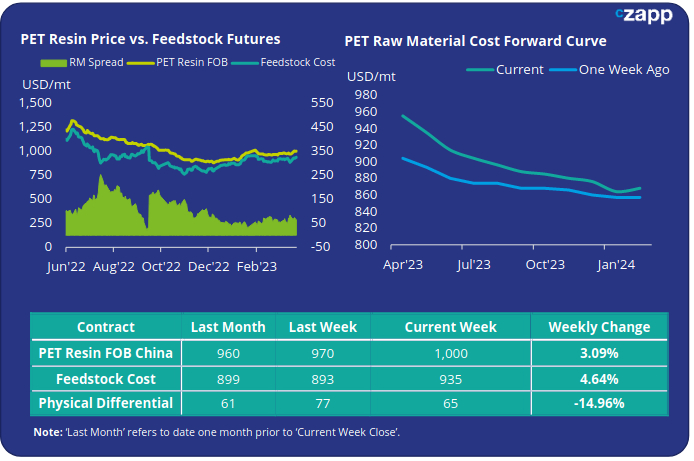

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices moved higher in the early part of last week with producers attempting to follow raw materials, with prices averaging USD 1000/tonne last Friday, up USD 30/tonne on the previous week.

- The weekly average PET resin physical differential to feedstock costs fell slightly by around USD 3/tonne to average USD 69/tonne for the week. By Friday, the daily spread had decreased to USD 65/tonne.

- The PET resin raw material forward curve increased steeply in backwardation last week. At Friday’s close, the May’23 contract trading at a USD 20/tonne discount to the current month’s contract, whilst Sept’23 was running at a USD 67/tonne discount.

Concluding Thoughts

- Latest trade data for January and February 2023 shows that total PET resin exports for this period had increased 27.3% to over 786.4k tonnes versus the previous year.

- Existing backlog and good intake levels in Q1 meant PET resin producers are increasingly sold-out for April, although shipment is still widely availability for May.

- Tighter availability, coupled with higher raw material prices, enabled producers to follow raw materials higher last week.

- However, many export markets are reporting high stock levels, meaning buyers with adequate coverage may be resistant to higher offers, instead moving to the side-lines.

- Whilst buyers needing immediate supply are likely to turn to small ‘hand-to-mouth’ orders.

- With the forward curve moving into greater backwardation, much will now be determined by the schedule and ramp-up of new capacity additions over the coming months.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.