Insight Focus

- The threat of deglobalization has hung over the economy since 2020.

- The data shows that regionalisation has accelerated, and certain countries are decoupling faster than others

- But this doesn’t necessarily jeopardise maritime trade.

DHL just released its latest Global Connectedness Index, which provides some insight into the degree to which trade, capital, information and people are connected around the world. While information flows are becoming more connected, it seems flows of trade, capital and goods are faltering.

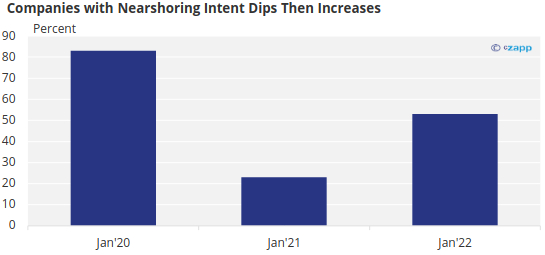

Nearshoring Intent Accelerates

After the supply chain disruptions of the past few years, it is no surprise that more and more companies are expressing the desire to take more control over their supply chains. In many cases, this takes the form of onshoring, nearshoring or friendshoring.

Source: EY FDI Attractiveness Survey

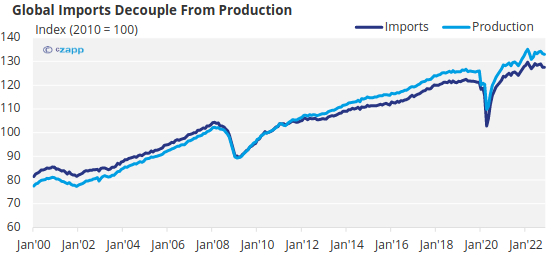

And since 2020, global import volumes have continued to diverge from production. This suggests that manufacturers are increasingly using domestic supply chains, or products are being increasingly consumed domestically rather than being exported.

Source: CPB World Trade Monitor

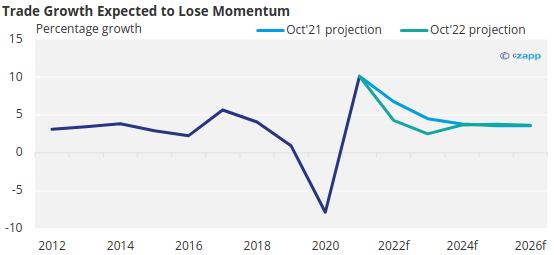

The IMF also expects a further drop the momentum of goods and services trade in the coming years. Projections show the annual growth rate will decline more sharply in 2023 than anticipated last year.

Source: IMF World Economic Outlook

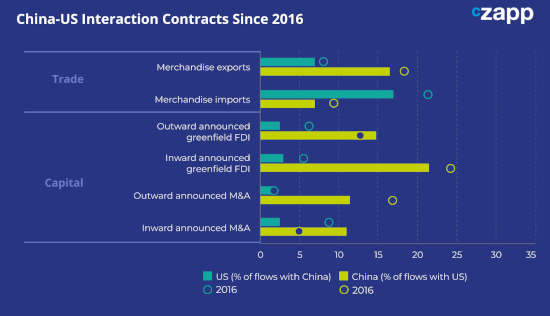

Geopolitical Tensions Fuel Investment Decline

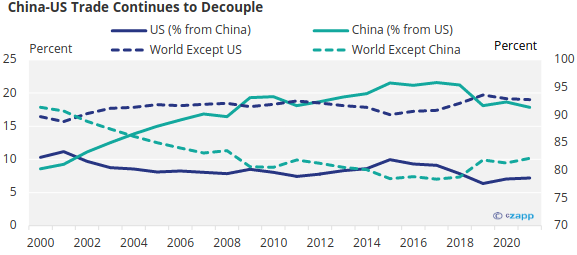

There is evidence that certain economies are detangling operations faster than others. Geopolitical tensions have peaked between China and the US in the past year, and this has become evident in their supply chains.

The DHL Global Connectedness index shows that China-US trade and capital flows have increased in very few segments since 2016.

Data Source: DHL Global Connectedness Index 2022

In fact, since 2018, there has been an abrupt decline in the percentage of US imports from China. China also took a step back as total global imports remained stable but less came from US.

Source: IMF Direction of Trade Statistics

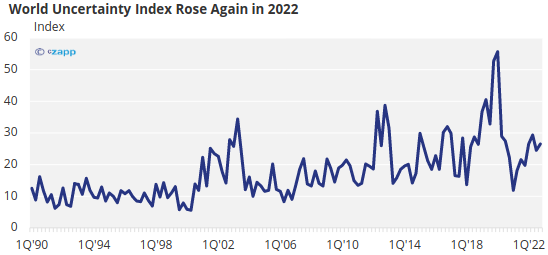

On a broader scale, there is a relatively high degree of economic and policy uncertainty surrounding global trade.

Note: The WUI is computed by counting the percent of word “uncertain” (or its variant) in the Economist Intelligence Unit country reports. A higher number means higher uncertainty and vice versa.

Source: World Uncertainty Index

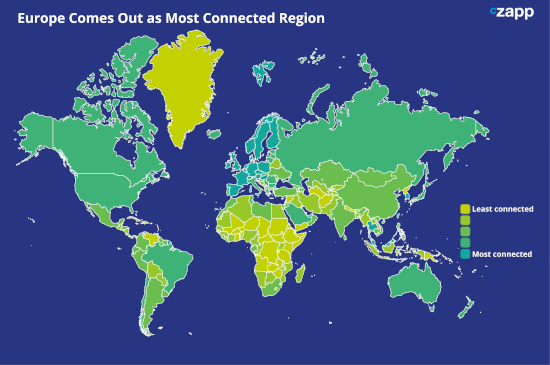

Europe Dominates in Connectedness

But some locations have remained connected. The most connected region according to DHL’s ranking is Europe. The top ranked country, the Netherlands, was commended for its “regional integration with neighbours”.

It therefore should come as no surprise that Europe is the top performer, given that its countries carry out a great deal of regional trade. This would suggest Europe is a high performer in regionalization to a greater degree than globalization.

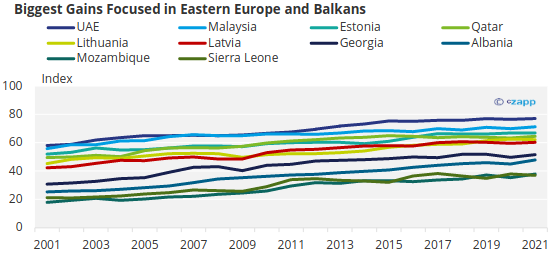

And interestingly, the largest gains over the past 20 years have been made largely by countries in the Balkans or Eastern Europe. Over this period, there has been more integration between these countries and with their Western European neighbours.

Source: DHL Global Connectedness Index 2022

Latvia, Lithuania, and Estonia all became EU members in 2004. Another Eastern European country on the list, Albania became more integrated with its neighbours when it entered the Central European Free Trade Agreement in 2007.

Again, this points more to a rise of regionalized trade than globalized trade.

Regionalisation Beats Globalization

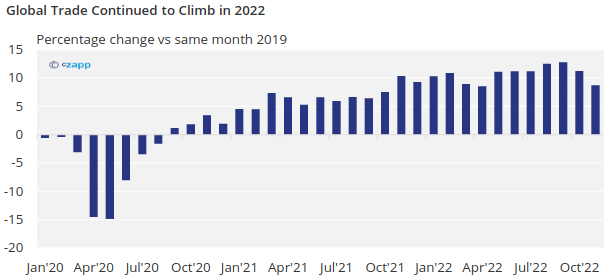

From the third quarter of 2020, trade volumes have outpaced 2019 levels. Even though performance was weaker in November 2022, trade was still 8.7% higher than November 2019 levels.

Source: CPB World Trade Monitor

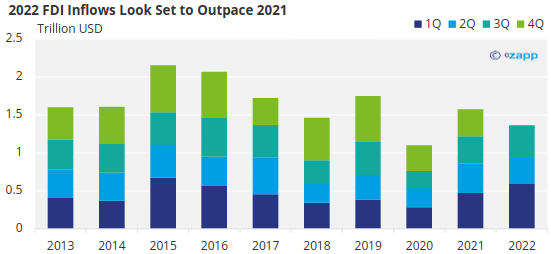

And an increase in onshoring would suggest a drop in FDI, but this is not the case. In fact, FDI inflows in 2022 looks set to outpace 2021 and may even exceed 2019 levels.

Source: OECD

According to DHL, the average distance travelled is actually increasing, which is a positive signal for maritime trade. The proportion of goods being sent within regions is stable to increasing.

All this could be an indication that supply chains are becoming more regionalised rather than nationalised. But although onshoring, nearshoring and friendshoring are taking place, they do not present a significant threat to maritime trade.